investment viewpoints

Alphorum: think fallen angels for attractive high-yield convexity

In the sixth and final insight for the Q4 2021 issue of Alphorum, we share findings from our research on the performance characteristics of companies that have descended from investment-grade status – the so-called fallen angels of high yield – in different market environments.

Our research report follows earlier commentaries from this issue of Alphorum:

- Lead commentary: our CIO responds to the diverse financial, macro and sustainability risks and opportunities coursing through markets

- Developed market and inflation-linked bonds: from the US to Europe to Asia, narratives for hiking interest rates are solidifying or actually playing out

- Sustainable fixed income: real efforts to accurately capture the effects of environmental risks on credit performance should withstand accusations of greenwashing in a year of record sustainability-bond issuance

- Corporate credit: as markets acknowledge the imperfections of this recovery, spreads are widening in certain sectors

- Emerging markets: responses to the risk of inflation vary across the universe, while slowing but stable global growth supports sovereigns as the tailwind of healthy current accounts eases

For now, let’s return to our research programme, where our analysis of the performance patterns of fallen angels in different market environments shows how these issuers can provide investors with a source of high-yield convexity – an attractive characteristic for credit portfolios.

Fallen angels: a source of asymmetric beta

So-called ‘fallen angels’ are borrowers who have been downgraded from investment grade to high yield (usually from BBB to BB). Although the boundary between investment grade and high yield is somewhat artificial, the two universes tend to appeal to different classes of investors. More risk-averse and benchmarked investors often sell out of downgraded bonds, a tendency which has been fueled by the rise of passive indexation benchmarked to bond indices. This results in dislocations which are a potential source of outperformance.

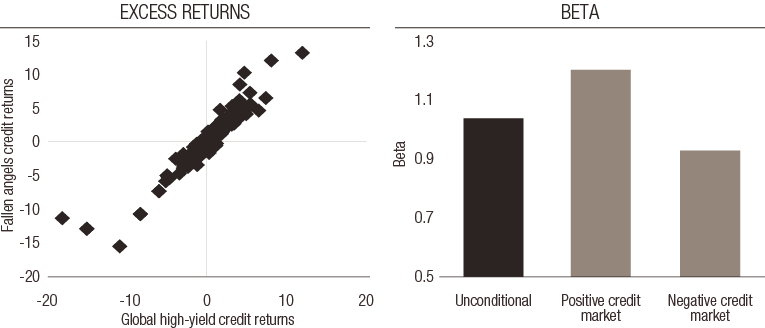

A number of structural elements in the way that the fallen angels universe is formed, which we explore later in this piece, gear the asset class towards a greater exposure to credit market returns in recovery periods. One way to test exposure to different market regimes is to calculate conditional betas of the universe of fallen angels to the broader high yield universe. Panel B of Figure 1 shows the excess returns of the fallen angel universe when compared to the global high-yield credit universe, both unconditionally and conditional on up and down moves. As you can see, the unconditional beta is close to 1, indicating similar market exposures as the high-yield index over the full cycle. However, on the downside (during negative market returns) the conditional beta is 10% lower, while on the upside (during positive market returns) it is over 20% higher. Therefore, fallen angels provide a convex high-yield exposure – that is, they outperform in a recovery (while falling less in a selloff). This net positive convexity, also known as ‘asymmetric beta’, comes both from a reversal of price overreaction and from the increased exposure to recovering sectors which fallen angels provide.

FIG 1: Outperformance of fallen angels compared to global high-yield credit

|

A: Excess returns of fallen angels vs global high-yield credit |

B: Beta of fallen angels compared to global high-yield credit |

Source: Bloomberg indices, LOIM calculations as at September 2021. For illustrative purposes only.

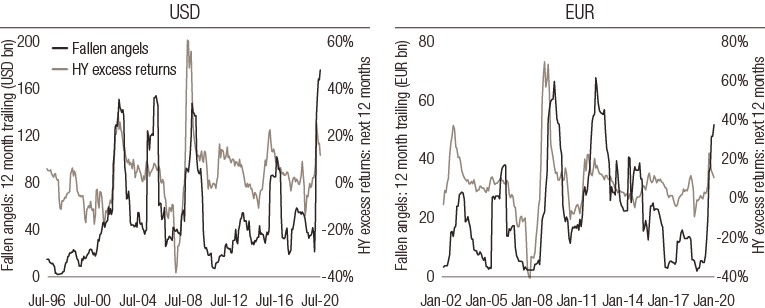

Supply dynamics of fallen angels

Historically, the supply of new fallen angels is highly correlated with economic cycles. By definition, supply will peak in the downgrade cycle as credit-rating agencies react to stressed economic and market environments, a process that tends to lead the bottom of credit selloffs. As an example, the COVID-19 crisis generated a 12-month rolling supply of fallen angels in the US dollar market of USD 195bn, which, in absolute terms, is the largest ever recorded. European market supply was just shy of all-time highs at EUR 55bn. Largely as a result, the fallen angels universe currently stands at around USD 400bn in size.

This countercyclical uptick in supply increases the weight of ‘new’ fallen angels within the overall fallen angels universe just before credit market rallies, as shown in Figure 2. This is a very favourable dynamic, which can be exploited further through a relative-value approach.

FIG. 2: Fallen angels supply vs market returns

Source: Bloomberg indices, LOIM calculations as at September 2021. For illustrative purposes only

It is interesting to note that the ratings distribution of fallen angels has been relatively stable over time and has actually improved, with a greater proportion of BBs. What’s more, in contrast to high-yield, we expect the quality of the fallen angels universe to be counter-cyclical as a credit selloff should result in more BBs entering this segment.

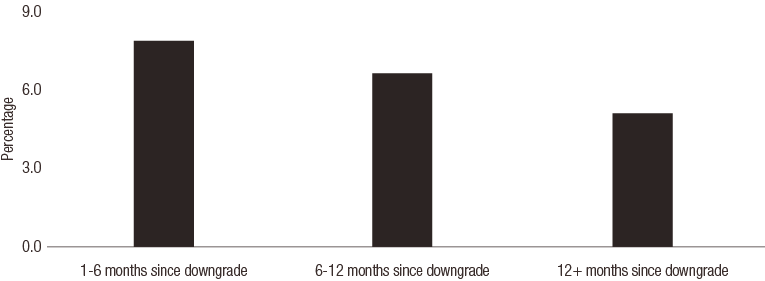

The age of fallen angels as a factor in outperformance

Our analysis shows that a large part of the reversion in fallen angels is realised in the first year after being downgraded. This raises the possibility of overweighting newer fallen angels while being underweight aged ones. Figure 3 shows the average credit excess returns for fallen angels split by the length of time from downgrade. The one-to-six-months cohort outperforms but is also much more volatile. The six-to-12 months cohort also performs strongly but demonstrates lower volatility and a marginally higher Sharpe ratio. Finally, the 12-plus months cohort significantly underperforms the broad index.

The asymmetric beta angle is also more pronounced for newer fallen angels. The one-to-six months cohort exhibits a beta of 1.45 to market rallies, while their lower participation in selloffs is reflected in a downside conditional beta of 0.87. However, beyond a year from downgrade the effect fades, with fallen angels behaving broadly in line with their high-yield peers.

FIG 3: Average credit excess returns of fallen angels sorted by months from downgrade

Source: LOIM Calculations as at September 2021. Return and volatility figures are annualised. Conditional Betas calculated against excess returns of Global HY index. Past performance is not a guarantee of future results.

|

Summary statistics by time since downgrade

|

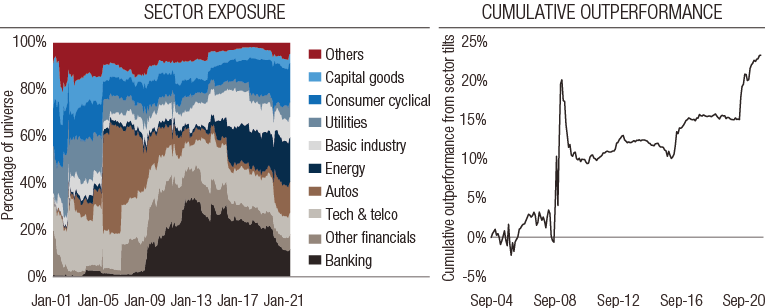

Playing the recovering sectors

While market overreaction and subsequent reversion in terms of individual borrowers is an important factor in outperformance, fallen angels tend to be just as much a sector-recovery play. Whole sectors that are under the greatest pressure tend to overreact, with that overreaction exacerbated for the fallen angels within that sector.

As shown in figure 4A, the largest sectors for fallen angels have shifted over time, reflecting sector-specific leverage cycles. The early 2000s saw a resurgence in technology and telecom fallen angels, while in 2005 the major downgrades of Ford and GM meant the auto industry dominated1. In 2008-09, the global financial crisis led to banking becoming the largest fallen angels sector, a position it held for over a decade until the Covid-19 crisis saw the auto and energy sectors come to the fore.

Consequently, the recovery of cyclically affected sectors contributes significantly to fallen angels. By reweighting sectors in the fallen angels index to be in line with sector weighting in the wider investment-grade and high-yield universes, we can see how the recovery of cyclically affected sectors contributes to the outperformance of fallen angels. In Figure 4B you can see the outperformance of the standard index versus the sector-matched index, indicating that sector composition in recovery periods contributes significantly to the strong performance of fallen angels.

FIG 4: Fallen angels: sector composition

Source: Bloomberg indices, LOIM Calculations at September 2021. Past performance is not a guarantee of future results.

Conclusion

A corporate bond universe bluntly split into distinct investment-grade and high-yield markets at the BBB/BB boundary has resulted in the unique outperformance potential of the fallen angels segment. As we have shown, fallen angels provide a convex high-yield exposure, demonstrating higher returns compared to high yield in a recovery and lower drawdowns in a selloff. This outperformance is achieved through ‘valuation reversal’ rather than improved fundamentals and occurs both at an issuer-specific and sector levels, via channels that we expect to remain persistent through future cycles.

To read the full Q4 2021 issue of Alphorum, please use the download button provided.

Sources

1 Any reference to a specific company or security does not constitute a recommendation to buy, sell, hold or directly invest in the company or securities. It should not be assumed that the recommendations made in the future will be profitable or will equal the performance of the securities discussed in this document.

Informazioni importanti.

Il presente documento è pubblicato da Lombard Odier Asset Management (Europe) Limited, una società autorizzata e regolamentata dalla Financial Conduct Authority (“FCA”), iscritta nel registro FCA con il numero 515393.

Lombard Odier Investment Managers (“LOIM”) è un marchio commerciale.

Questo documento è fornito esclusivamente a scopo informativo e non costituisce un’offerta o una raccomandazione di acquisto o vendita di titoli o servizi. Il presente documento non è destinato a essere distribuito, pubblicato o utilizzato in qualunque giurisdizione in cui tale distribuzione, pubblicazione o utilizzo fossero illeciti. Il presente documento non contiene raccomandazioni o consigli personalizzati e non intende sostituire un'assistenza professionale in materia di investimenti in prodotti finanziari Prima di effettuare una transazione qualsiasi, l’investitore dovrebbe valutare attentamente se l’operazione è idonea alla propria situazione personale e, ove necessario, richiedere una consulenza professionale indipendente riguardo ai rischi e a eventuali conseguenze legali, normative, creditizie, fiscali e contabili. Il presente documento è proprietà di LOIM ed è rivolto al destinatario esclusivamente per uso personale. Il presente documento non può essere riprodotto (in tutto o in parte), trasmesso, modificato o utilizzato per altri fini senza la previa autorizzazione scritta di LOIM. Questo documento riporta le opinioni di LOIM alla data di pubblicazione.

Né il presente documento né copie di esso possono essere inviati, portati o distribuiti negli Stati Uniti d’America, nei loro territori e domini o in aree soggette alla loro giurisdizione, oppure a o a favore di US Person. A tale proposito, con l’espressione “US Person” s’intende un soggetto avente cittadinanza, nazionalità o residenza negli Stati Uniti d’America, una società di persone costituita o esistente in uno qualsiasi degli stati, dei territori, o dei domini degli Stati Uniti d’America, o una società di capitali disciplinata dalle leggi degli Stati Uniti o di un qualsiasi loro stato, territorio o dominio, o ogni patrimonio o trust il cui reddito sia soggetto alle imposte federali statunitensi, indipendentemente dal luogo di provenienza.

Fonte dei dati: se non indicato diversamente, i dati sono elaborati da LOIM.

Alcune informazioni sono state ottenute da fonti pubbliche ritenute attendibili, ma in assenza di una verifica indipendente non possiamo garantire la loro correttezza e completezza.

I giudizi e le opinioni qui espresse hanno esclusivamente scopo informativo e non costituiscono una raccomandazione di LOIM a comprare, vendere o conservare un titolo. I giudizi e le opinioni sono validi alla data della presentazione, possono essere soggetti a modifiche e non devono essere intesi come una consulenza di investimento.

Il presente documento non può essere (i) riprodotto, fotocopiato o duplicato, in alcuna forma o maniera, né (ii) distribuito a persone che non siano dipendenti, funzionari, amministratori o agenti autorizzati del destinatario, senza il previo consenso di Lombard Odier Asset Management (Europe) Limited . Nel Regno Unito, questo documento rappresenta materiale di marketing ed è stato approvato da Lombard Odier Asset Management (Europe) Limited, che è autorizzata e regolamentata dalla FCA. ©2021 Lombard Odier IM. Tutti i diritti riservati.