Review

The average yield of the JP Morgan Global EM Diversified index declined slightly in March, ending the month at 6.30%. The 10-year UST yield was on balance unchanged at 4.20%.

In the FX market, the USD was weaker again and many EMD currencies strengthened against the USD in March.

Most emerging bond markets posted positive returns, with the exception of Turkey and Colombia.

Turkish assets were under intense pressure due to the arrest of Istanbul Mayor Ekrem Imamoglu, President Erdogan's main political rival. The TRY fell more than 10% as a result of the political unrest.

Colombia was negatively impacted by political unrest after the resignation of Finance Minister Diego Guevara. Fitch Ratings also lowered its credit outlook from stable to negative while maintaining a BB+ rating.

Performance

Emerging bond yields in local currency were almost unchanged on balance in March, resulting in a slightly positive return in local terms. The return of the JP Morgan Global EM Diversified index was also higher in USD terms as most EMD currencies strengthened against a weaker USD.

Romania (4.37%), India (4.18%) and Brazil (3.84%) were the best performers in the Fund, while Turkey (-16.09%) and Colombia (-4.01%) fared worst.

Our overweights in India and Brazil and underweight in Turkey had a positive impact on relative returns, while the overweights in Colombia and Peru detracted.

Outlook

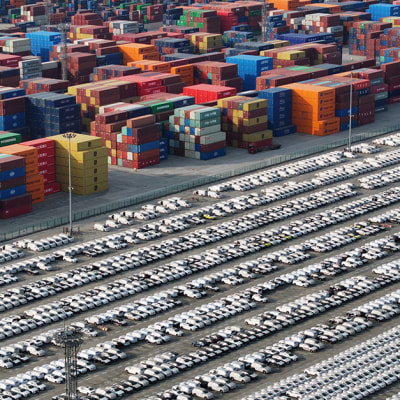

While control of both Congress and the White House gives the new US administration a clear mandate, the extent and timing of the rollout of Trump’s flagship policies, including import tariffs, remain unclear. Given the uncertainties, the risk of non-linear outcomes is higher than usual.

The impact of the higher-than-anticipated import tariffs announced on 2 April might lead to a large growth shock, hurting export and commodity prices, if they are indeed implemented as announced, and could result in a trade war.