MARKET UPDATE

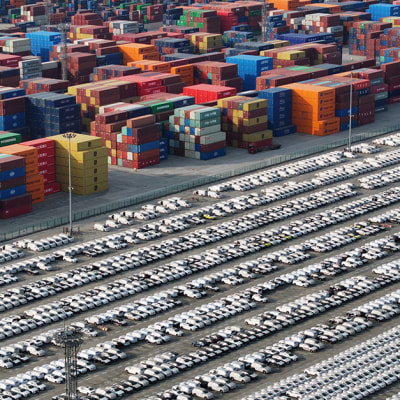

Issuance in the impact bond market slowed down significantly in April after markets digested the impact of new US tariffs. The bond market as a whole was similarly affected. Chinese issuance proved to be the most resilient, as multiple issuers decided to tap investor demand, including Liangshan Development, Huzhou Wuzing Talent, and the Chinese sovereign themselves, who issued a CNY 6bn green bond that was heavily oversubscribed. Towards the end of the month some confidence returned, in particular after the 90 day tariff pause, with some US and European issuers opting to issue green and sustainability linked bonds, including Alliander, Aeroporti di Roma, Achmea, and Omniyat. If markets remain relatively stable we would expect to see a uptick in delayed issuance in the coming months.

Global markets were challenged in March as market participants weighed risks from an escalating trade war, economic slowdown, and persistent inflation. The new administration’s rapidly changing tariff narrative and concerns of the health of the US economy triggered rate volatility and injected turbulence into global markets. Government bond yields fell over the month, and credit spreads widened as an escalation of the Trump administration’s trade war fueled global growth fears. While the bulk of the tariffs were paused for 90 days, concerns remain around the ability of the administration to negotiate a significant number of deals, particularly with their largest trading partners, including China.

Portfolio Positioning

The fund slightly underperformed the benchmark over the month (2.86% vs. 2.94%), predominantly due to individual security selection in euro and sterling denominated bonds, as spreads widened. This brings the since inception return of the portfolio to 0.97% vs. 0.92% for the benchmark. This was offset slightly by some positive active FX positions, including small overweight positions in yen and Australian dollars, as well as positioning along the curve in US dollar denominated bonds.

In bond market terms, we are slightly overweight the dollar bloc, underweight Asia, and slightly overweight Europe. The fund’s overall duration position is now largely neutral. In China we have a small underweight duration position, given the low level of yields in a global context and recent growth supportive economic measures. The fund now is close to a neutral duration position in the US, as the fears have increased of weaker growth going forward due to tariffs and other isolationist policies, although uncertainty remains.

Within Europe, we hold small overweight positions in the Norwegian krone, Swedish krona and UK Sterling denominated bond markets.

During the course of the month we adjusted portfolio positioning in light of the rapidly changing economic environment. We reduced some exposure to spread product early in the month both in euros and US dollar bonds. We purchased some long dated Japanese yen bonds to take advantage of the recent steepening of that curve. We also added a small amount of duration in the US. We purchased very small amounts of lower rated paper that we perceived to both be cheap, and also relatively immune to tariff disturbances.

Given the volatility in markets throughout the month, the primary market was very quiet. As such, we only participated in one new green issue from Enexis, the Dutch utility company. It is focused on improving energy efficiency and the share of renewable energy within its electricity supply.

Contributors

• Overweight positions in Japanese yen and Australian dollars

• Curve positioning in US dollar denominated bonds

• Small overweight duration position in euro, sterling and Australian dollar denominated bonds

Detractors

• Security selection in euro denominated bonds

• Security selection in sterling denominated bonds

• Underweight position in Swiss franc