Overview of the Fixed Income Market

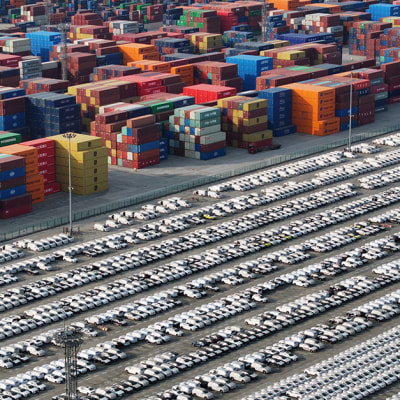

The bull run continued for fixed income in September with the fifth straight month of positive performance, as a continued cutting-cycle-fueled rally in rates lifted all fixed income assets. Investment grade benefitted most thanks to the balance of rates and credit markets, which continued to exhibit a return of diversifying properties. At a sector level there was quite some dispersion, with pessimistic outlooks from notable autos manufacturers seeing the sectors substantially underperform, while yet again HY real estate saw substantial outperformance, being highlighted by markets as the big winner from cutting cycles amidst still cheap valuations. September was ultimately a month of central bank cuts and broadly dovish signaling. Led by the Fed, the focus firmly shifted away from inflation concerns towards concerns around a weakening labour market. US non-farm payrolls for August was on the soft side , which clearly didn't sit well with Fed officials on the back of having 800k jobs removed from the prior year's employment statistics following August's revisions. The result was the Fed starting their cutting cycle with a 50bp cut to interest rates, surprising dovishly versus economist expectations of 25bps, but actually in line with market pricing by the time the meeting arrived. Nevertheless, the move clearly underscored the Fed's desire to get things moving at pace, and perhaps an admission that cuts should have begun at their July meeting. That said, growth metrics point to little chance of an imminent slowdown in activity, with growth for the quarter continuing to track at healthy levels.Less urgency was shown across the Atlantic in Europe, where economies are seemingly in much more pressing need of monetary support. The ECB and UK both held rates despite flatlining growth. While the latter does indeed have a stickier inflation problem to contend deal with, Eurozone inflation is now well below target in many nations. After the Fed's more dovish delivery, President Lagarde did seem to confirm that more easing would be coming in November, although the lack of initiative places the block at a much greater risk of falling well behind the curve.Elsewhere, a new round of stimulus was launched by Chinese authorities in an attempt to reboot faltering activity. Indeed, the package was much larger and targeted than prior attempts and looks to directly address major structural damage caused by the misjudged deleveraging of 2021/22. Markets approved and responded with a violent rally in both onshore and offshore risk assets. Time will tell if the programme will be sufficient, but it will certainly need to be followed with fiscal measures more direct to the consumer's pocket, which has been severely depleted since the onset of the pandemic in 2020. Geopolitical risks increased in prominence in the middle East through the month, as Israel's conflict turned to further focus on neighbouring Lebanon with targeted attacks on Hezobollah members and infrastructure. This marked quite a severe escalation in the breadth of the conflict in the region, and increase the probability of a direct confrontation with Iran. We still believe this to be against the interest of all parties, but acknowledge that these developments make the chance of an accident in the region higher and worth monitoring.

Portfolio activity

We did not make any material changes to the portfolio in September.

Performance and characteristics

The fund out-performed its benchmark once again in September driven primarily by our over-weight to BBB rated issuers. Our Real Estate holdings continued to tighten with German residential property group Grand City and Swedish property company Heimstaden Bostad once again the strongest performers. This portfolio remains well ahead of benchmark year-to-date due in particular to the strong contribution from our overweight to BBB rated issuers but also supported by a strong performance from the over-weight in the BB space. From a sector perspective much of the out-performance has come from our long term investments in the Real Estate and Banking sectors, particularly in subordinated debt.

Outlook

We continue to favour duration, although our conviction has dropped somewhat with a lot of cuts priced into markets already and still robust growth dynamics in the US. That said ongoing cutting cycles should continue to support the asset class. We hold our preference for high quality high yield to access spread and carry with robust fundamentals as we don't consider a slowdown to be imminent.

Sustainability

Draghi's Report on EU competitiveness - Sustainability reporting framework. Mario Draghi, former ECB President, delivered his Report on the future of European competitiveness to the President of the European Commission. Ursula von der Leyen confirmed her support of the fundamental principles of the report, first of which ensuring the long-term competitiveness shifting away from fossil fuels and towards a clean, competitive, and circular economy.. The Report argued that EU's sustainability reporting and due diligence framework could be "a major source of regulatory burden, magnified by a lack of guidance to facilitate the application of complex rules", which entailed a "major compliance cost for companies in the EU". . The EU should simplify its sustainability reporting and due diligence framework as part of efforts to rescue the bloc from economic underperformance and promote its competitiveness internationally, according to Draghi's Report.ECB and European Commission focus on nature. In a statement by the European Central Bank (published by Elderson, vice-chair of the ECB's supervisory body), central banks should consider as part of their mandate how to manage nature-related risks which could represent material financial risks. Central banks should "deepen [their] understanding of how nature-related financial risk affects the economy and the financial system", including legal implications with the rise in nature-related litigation. Elderson concludes saying that "the economy and the financial sector are vulnerable to nature-related risks.". Speaking at a Nature Conference in Munich, European Commission president Ursula von der Leyen has called for a nature credit market, a market-based system to encourage farmers and industry to conserve nature and restore lost biodiversity by putting a price on ecosystems.