investment viewpoints

Credit and sustainability: ignorance is risk

The need for companies to adapt to long-term structural trends is not new. They have been doing it for centuries. However, today the challenges created by sustainability are more urgent than ever. In particular, sustainability-driven change is unparalleled in scale and speed.

Amid this sustainability revolution, we believe it is vital to adapt the way we invest in fixed income. In corporate bonds specifically, we believe sustainability must be taken into account as a key factor to mitigate risk without compromising potential returns1. As such, we have developed a bespoke method to assess which companies are well-positioned to benefit from sustainability-driven change.

Since return in corporate bonds hinges on creditworthiness, we evaluate the robustness of borrowers through the prism of sustainability. We have developed a proprietary approach designed to identify companies with sustainable financial models, business practices and business models.

Our core principles to integrate sustainability into corporate credit portfolios

Target performance/risk represents a portfolio construction goal. It does not represent past performance/risk and may not be representative of actual future performance/risk.

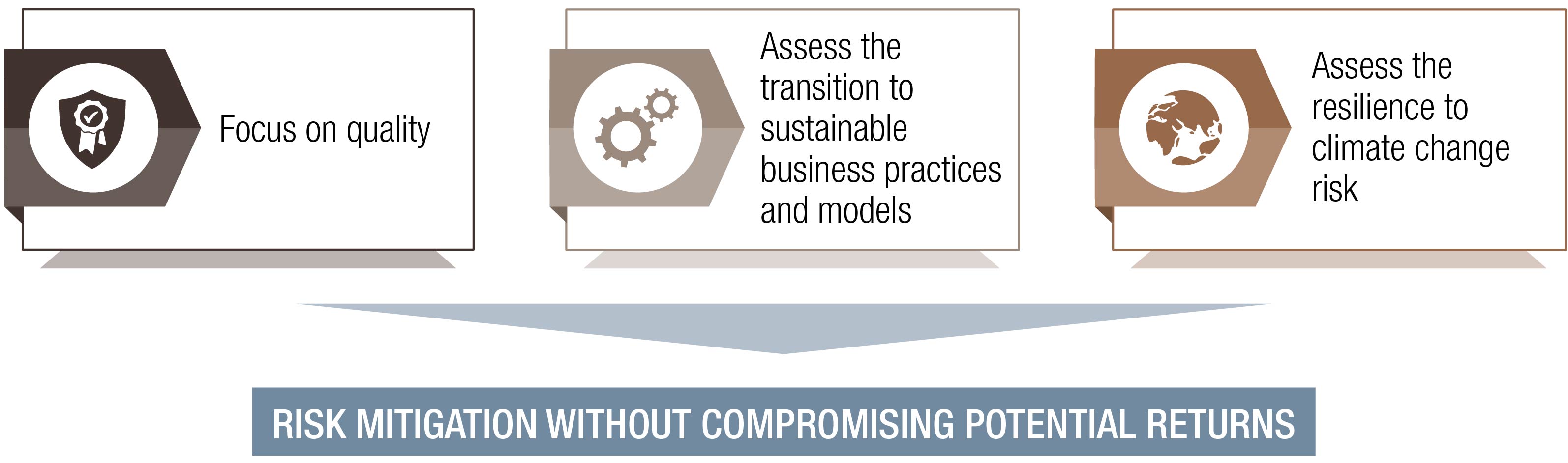

Our approach is based on these core principles:

- Focusing on credit quality to embed a greater degree of safety - this allows us to improve diversification and better protect portfolios during periods of volatility.

- Further mitigating risk by assessing extra-financial factors including environmental, social and governance (ESG) criteria and beyond - this means we favour companies with better business practices, and those we believe are evolving towards more sustainable business practices and models.

- Considering the resilience of the portfolio to the physical and transition risks associated with climate change - this leads us to prioritise companies with a lower carbon intensity to reduce the carbon exposure of the portfolio, and add exposure to climate-aligned bonds.

In our view, issuers with better business practices, lower carbon intensity and a willingness to issue climate-aligned bonds are also more likely to transition to a low-carbon economy in an orderly fashion.

Stewardship and creditworthiness

We place great importance on being active stewards with debt issuers, and believe the characteristics of corporate credit lend themselves especially well to stewardship. In particular, engaging in dialogue with companies is critical to assessing creditworthiness because it improves our understanding of the issuer’s risk profile.

Traditionally, as owners of companies, equity investors have taken the lead on stewardship since they are directly impacted by the failure to manage or mitigate corporate governance risks. Bond holders engage with companies on different issues, however, because, as credit providers, they are more focused on preserving capital while earning interest. Because of this focus, key areas of bondholder interest might include leverage, liquidity and tail risks - such concerns become exponentially more significant for lower-rated issuers.

In our view, bond investors can influence companies towards more sustainable behaviour because of their role as providers of finance.

In our view, bond investors can influence companies towards more sustainable behaviour because of their role as providers of finance. This is particularly the case when new issues are brought to the primary market, and for smaller companies. Furthermore, non-investment grade issuers tend to have less balance sheet flexibility to absorb unexpected deterioration in their businesses due to material ESG risks.

A number of studies2 have demonstrated that, on average, companies with a clear management focus on sustainability have been able to reduce financing costs compared with companies where this is less of a priority. Typically, the credit premium required by investors will be lower for companies that boast a strong sustainability profile. This would suggest a nascent trend for risk and return to be correlated with sustainability.

A 2018 report by Japan’s Government Investment Pension Fund (GPIF) and the World Bank3 argues bondholders may actually be more powerful than equity holders in encouraging companies to transition to more sustainable models. Because they can decide not to reinvest at maturity or to reinvest only at a higher rate, bondholders can directly affect the cost of debt.

Sustainability is upending the investment landscape. It can no longer be ignored as a key variable in any considered analysis.