investment viewpoints

Pandemic impact on credit: sector opportunities

The COVID-19 pandemic has not affected all sectors of the economy equally. Indeed, it has made a highly differentiated impact on the various sectors of the corporate bond markets.

Over the space of a few weeks, the pandemic created a harsh reality for a number of companies: near-zero revenues for the foreseeable future. While confinement measures are being eased, social distancing appears set to persist, perpetuating the revenue drought for some.

Other sectors, however, stand to be far less affected.

We expect unprecedented central bank intervention to ease systemic risks arising from the pandemic. Extraordinary monetary accommodation is already strongly supporting credit spreads and more fluid credit market conditions, and will likely continue do so until the COVID-19 economic shock has eased. With systemic risks under control, we expect a significant amount of dispersion in both economies and markets, however, beginning with sectoral impact.

Sectoral risks arising from the pandemic matter because they will impact companies’ longer-term economic future. Relatively often, however, we find that market valuations are disconnected from this sectoral dispersion and thus create investment opportunities.

High impact vs low impact sectors

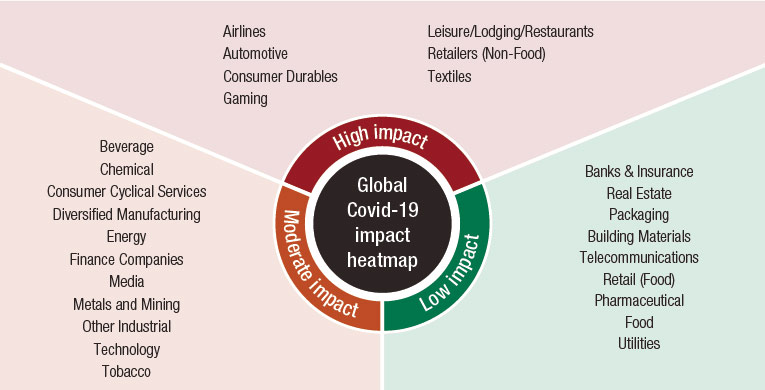

Generally speaking, we expect sectors closest to the consumer that offer discretionary and deferrable goods and services to suffer a high, negative impact. Sectors that supply or support high impact sectors are likely to be moderately impacted.

This heatmap summarises our view (Figure 1). High impact sectors refer to areas with the most negative consequences from the pandemic, whereas other sectors are less affected or not affected.

Figure 1. COVID-19 sectoral heatmap

2020 is different than 2008

Historical crises each have their own winners and losers: the characteristics of the crisis determine which sectors fall into which category, and, consequently, what percentage of the market is highly exposed. Increasingly, the 2008 global financial crisis is used as a lens to evaluate the fallout of the current pandemic. We believe the roots of the two crises are very different, however, and as such will generate a different sectoral outcome.

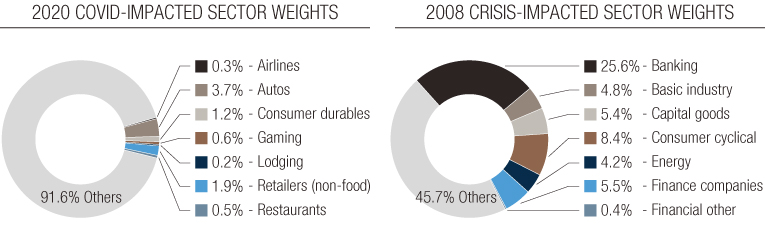

In Figure 2, we evaluate the global corporate bond universe as of September 2008 and March 2020, weighting the respective high impact sectors versus other sectors.

Figure 2. Global corporate bond sector impact: 2020 vs 2008

We find the 2020 pandemic made a more limited sectoral impact than the 2008 crisis in terms of the overall universe. Indeed, 2020 high impact sectors make up about 8-9% of the universe, while in the 2008 crisis, roughly 54% of the universe fell under sectors we deem highly impacted.

Little valuation differential in indiscriminate selloff

Fundamentals suggest that the Spring 2020 corporate bond selloff should be well differentiated because the pandemic will not impact all sectors equally. It stands to reason that the high impact sectors should suffer the most valuation shock. This did not occur, however, and credit markets sold off across the board.

Part of the selloff stemmed from a flight-to-liquidity (or dash-for-cash) and exacerbated this trend. Such an indiscriminate selloff creates opportunities for actively managed portfolios, in our opinion, and brings higher yields back into play after the past decade of low-for-long.

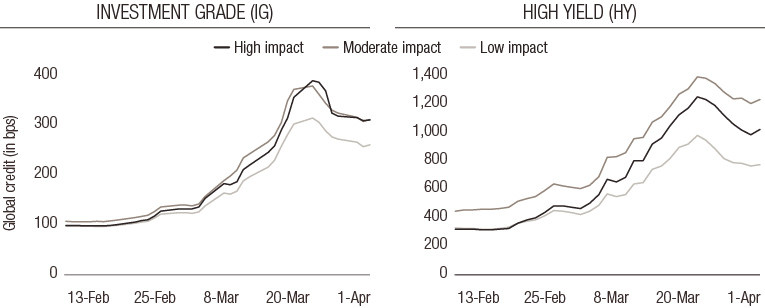

In Figure 3, we plot average credit spreads of high, medium and low impact sectors, as defined in our heatmap. The graph shows very little differentiation, with many low impact sectors also hit in the broad-based, market-wide selloff.

Figure 3. Global credit split by impact of COVID-19 on business activity (Feb-April 2020)

Source: Bloomberg, LOIM calculations. Yields are subject to change and can vary over time. Past performance is not indicative of future results.

Sector spreads have also become disjointed relative to their long-term averages. We find that many low impact sectors are trading at levels well above long term averages, and in some cases at levels greater than high impact sectors (on a normalised basis). These wider spread levels on low impact names fail to reflect the expected influence of the virus.

We orient our corporate bond portfolios to maximise such opportunities. For instance, in the bottom-up part of the selection process for our crossover strategy, we would seek to harvest additional credit spread from sectors we deem to be low impact. Currently, this would include banks, residential property, food and internet-based retailers, though the markets are constantly in flux, and therefore require a team of experts to actively capture the best prospects.

We believe that such relative mispricing represents a substantial alpha opportunity for active managers to harvest additional credit spreads in low impact sectors.

Please click here to download the full white paper entitled ‘Credit where credit is due.’