The Fund recorded a gain of +2.76% (USD N Accum share class) for 1Q 2025, vs the benchmark JP Morgan Asia Credit Index (USD) which returned +2.29% for the same period. The Fund closed 2024 strongly at +12.22%, which comes on the back of a reasonably good 2023 at +8.46%.

The events of April thanks to Trump’s aggressive tariff impositions and escalating threats, led to a major liquidity gap and sell-off in Asia-EM credit over a concentrated 2-3 day period. This was exacerbated by de-grossing by leveraged accounts (hedge funds) and investment banks and broker dealers who rushed to square off their trading books. We also heard of various margin calls, including within wealth industry owing to the cross-asset sell-off which led to clients derisking by selling bonds.

Unlike all other severe credit sell-offs that we have witnessed as a desk here over the past 13 years (2013 Fed taper tantrum / EM FX sell-off; 2015 Commodity price collapse, Covid-induced growth lapses in Asia-EM, the Fed’s 550 bps rapid rate hikes, and China’s real estate crisis/defaults), this credit sell-off was extremely sharp but more importantly is not matched at all by any credit fundamental deterioration. In each of the previous sell-offs or bear markets, there were legitimate concerns of credit weakness, credit downcycle and/or default cycle picking up. This time, our markets and portfolios are largely domestic focused (in terms of underlying credit exposures), resilient in macro as well as individual credit fundamentals. We share our full view of potential hypothetical Asia country macro impact and our portfolio construction (and its resilience away from US import tariffs or economic slowdown there), in the attached comprehensive note.

Now that Trump has walked back on much of this tariff threats (less than 24 hours after they were enacted on 9th April) and imposed a 90-day pause with 10% tariffs on all countries except for China, we expect US to go through an economic slowdown induced by weaker confidence by businesses and consumer, as well as less private sector investment. To that effect, our central scenario is a calibrated and gradual resumption of Fed’s rate cutting cycle. We expect 2-3 rate cuts from the current median Fed rate of 4.35% towards 3.5% by early 2026. These rate cuts will eventually be good for Asia-EM fixed income markets especially at current yields which are elevated after the sell-off. Moreover, the majority of the IG and HY universe is domestic in nature with little business and credit fundamental correlation to a slowing US corporate sector or economy.

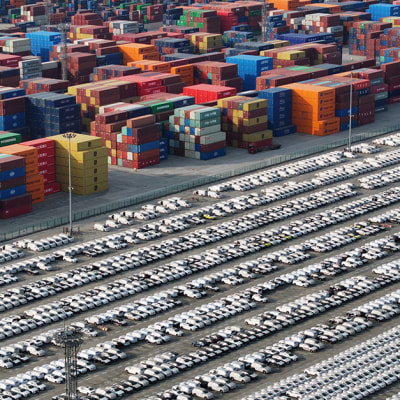

With regards to US’ imposition of a 145% tariff on Chinese exports, we think that Trump has strategically cornered himself with China. For China, trade with the US is tiny at ~2% of its own GDP especially after it has managed to successfully transition its own economy from an investment led one (pre-2018) to a high-value add (tech, advanced manufacturing and consumption going forward). We believe it is the US that needs China, and not China that needs US. We believe a resolution towards a more normalised trade relationship will start from a US approach, as China feels significantly disrespected by the ongoing treats and ‘bullying’ by Trump’s administration. We believe US will find ways to alleviate itself from this conundrum, and a truce or resolution will be reached in short order. This is based on our view that it is onerous for US to have 145% import tariffs on Chinese goods, for which it doesn’t have much of a replacement source anyway.

The key credit we added in March was Greenko Energy’s new 7.25% 2028 (USD 1b tranche; Ba2/BB Moody's/Fitch). Greenko is one of India’s largest renewable energy generating firm, which is 60% owned by Singapore’s Sovereign Wealth Fund (GIC) for several years now. Whilst we have invested in various Greenko’s bonds since 2015, this new bond is secured by a new large-scale project which is a pump hydro energy storage plant. This plant has taken four years to build, is very large scale, and simply provides energy storage utilising pump hydro systems. It effectively stores energy during a 12-hour cycle during the day (by buying excess renewable energy during low electricity demand period, utilising it to create kinetic energy via pump hydro mechanism, and release the energy as electricity during daily peak demand slots). This is a well-established technology, and Greenko has signed supply contracts for up to 25 years for this bond. This is an example of a very defensive underlying credit situation, which is secured in nature, short dated (2028) and with an attractive yield. We bought 21m in the fund at par (new issue) and unfortunately during the market panic of 7th April it gapped down towards 90c. It is still at sub 95c, and representative of the attractive pricings and bonds within the fund at the moment.

At the time of writing (10th April EOD Asia), the Fund was positioned with a YTW of 8.8% (USD terms), duration of 5.4 years and average ratings of BBB-. India continues to be the core country allocation at 20%, followed by China 13% (increased from lows of 7-8% in 2023) and HK at 10%. There have been no significant changes in the fund at all, and all that has occurred is cheapening of the bonds leading to higher yields whereby the Fund’s YTW has gone from 7.5% last month to 8.8% now owing to the US macro issues. Given valuations, we think the path of least resistance will be solid gains from here within a year’s time post this recent sell-off.

Thank you for your continued support.

DHIRAJ BAJAJ

On behalf of LOIM Asia Fixed Income team