Market Review

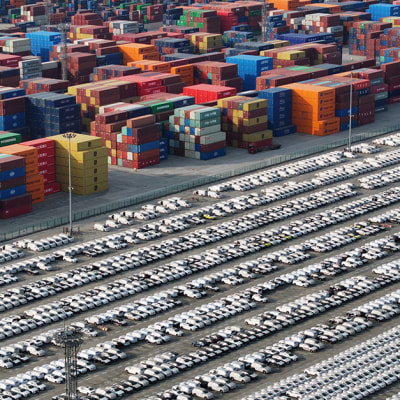

March brought heightened geopolitical turmoil with landmark developments in both the US and Europe seeing Fixed Income post its first negative month of the year (and already the third month in a row for Switzerland), culminating in the unveiling of an enormous tariff program in early April which sent vast risk off waves across markets. Focusing just on March moves, prior to the April announcements, European and Swiss treasuries were the sizable underperformer, whilst spreads in high yield also suffered. US Treasuries were the only positive for the month, also supporting US IG corporate total returns to near flat for the month. Sectoral spread moves were broadly in line, with the only notable underperformance coming in the final week of the month from Autos as the crosshairs of tariff action fell upon them.The month began with a sharp U-turn on fiscal spending rules in Europe, as the new German administration drew up plans to remove fiscal spending limits and push through an unprecedented fiscal package of infrastructure and defense spending. The market reaction was equally unprecedented, with bunds delivering the largest 1 day move in over 30 years, rising ~30bps on the day. The move comes to compensate for the loss of reliance upon US military support under the new Trump administration, with their shift in stance on the Russia-Ukraine situation causing a sudden shock to international allegiances. In a quite remarkable move, the plan was passed through the incumbent Bundestag, before the first sitting of the newly elected government, to ensure its passing, underlining the urgency deemed necessary by European powers to get it over the line. Not to be outdone, the political action on the other side of the Atlantic was equally as drastic. The Trump administration ramped up tariff talk and action, with targeted measures on several close trading allies, ranging from Canadian Lumber to European wines. The largest of which came towards month end, with a 25% tariff on autos globally, with a warning that tariffs plans were real and not just for negotiation purposes. The start date of these measures was added to an agenda for April 2nd, which was increased in prominence and dubbed 'Liberation day', with promises of unveiling a full tariff program. The unveiling of the April 2nd tariffs was a monumental event, with the levies coming in much higher and broader than anticipated. A minimum level of 10% globally was implemented (including Switzerland and with the notable exclusions of Canada and Mexico) with what was described as a reciprocal tariff regime applied to others. However, the numbers showed little resemblance to actual tariffs levied on the US, being more closely linked to trade balances as a percent of US exports. This left and Emerging economies particularly hit, with the EU and Japan also heavily hit. Fall out is ongoing but the market reaction has been heavily risk off, with spreads spiking higher and yields falling, as negative growth concerns heavily outweighs the upside inflation impact.The US also announced reciprocal tariffs of 31% towards Switzerland. More importantly for Switzerland, a few exemptions were announced, which include pharmaceuticals, making up of 51% of Swiss exports to the US. While tariffs on the exemptions can be addressed at a later stage, so far, the announcement seems to hit Switzerland's effective tariff rate as a whole at a lower rate, more in the vicinity of 10% on a headline level. The full 31% headline rate will be applied to categories like watches, machinery, electronic equipment, coffee and tea. Central bank meetings in the month were largely as expected, with the Fed holding and ECB cutting, but both unwilling to commit to their next moves with such uncertainty around the impact of fiscal events. The Fed in particular now faces a stagflationary mix which will be particularly complex to navigate, particularly as clarity on trade policy's impact likely won't be seen in hard data fully for a few months at least. Macro data itself continued to look weak growth wise in US soft data, but hard data still painted a more robust picture. In Switzerland, activity continued to rebound especially in manufacturing data while inflation remained somewhat volatile. The SNB held rates on hold, as expected, but the tariff shock clearly increased odds for a further cut ahead to the zero lower bound. We continue to believe the bar to be high for negative rates.

Portfolio activity

In the CHF primary market, we participated in the new issues of Temenos 2030 (TEMNSW), Clariant (CLNVX), Implenia (IMPNSW), Liechtensteinische Landesbank (LLBSW), BPCE (BPCEGP), Athene Global Funding (ATH), Commonwealth Bank Australia (CBAAU) and Engie (ENGIFP) for alpha purposes. In the CHF secondary market, we bought Matterhorn Telecom (MATTER) and Black Sea Trade and Development Bank (BSTDBK). We sold Temenos 2028 (TEMNSW), Barry Callebaut (BARY), Kernkraftwerke Leibstadt (KKWLEB), BNP Paribas (BNP), HSBC (HSBC), Banco Santander Chile (BSANCI), Banco del Estado Chile (BANCO), UBS (UBS) and EFG Bank (EFGBNK).In the foreign currency primary market, we did not participate in any new issue.In the foreign currency secondary market, we bought Infrastrutture Wireless (INWIM), Aroundtown (ARNDTN) and ELO Holding / Auchan (ELOFR). We sold Iceland Food (ICELTD) and Tereos (TEREOS).In terms of sector allocation, we are overweight mainly in Real Estate and Financials while underweight mainly in Industrials, Materials and Consumer Staples.

Performance Comments

In March, the CHF treasury curve experienced a bull-steepening, with short-term rates (2 years or less) declining and long-term rates (10+ years) rising. During the same period, CHF credit spreads widened slightly in the A-BBB rating bucket by approximately 1-2 bps, while remaining flat in the AAA-AA rating bucket.At the sector level, all sectors experienced spread widening by about 1-2 bps.Consequently, the total return for both the LOF (CH) - Swiss Franc Credit Bond and its benchmark, the SBI® A-BBB Index, was negative.The fund's underperformance, on a gross-of-fees basis, was driven mainly by our sector allocation and other (i.e. FX hedging costs).However, both systematic and discretionary credit hedging strategies were able to mitigate partially negative contribution from our sector allocation.Year to date, the total return for the LOF (CH) - Swiss Franc Credit Bond is negative, but its relative performance is positive on a gross of fees basis.

Outlook

The tariff upheaval has accelerated the rewriting of the geopolitical status quo, global trade relations being completely rewritten. The market has clearly chosen the side of recession fears over inflation concerns, which should continue to favour duration even after these sharp moves lower in yields. The risk off episode has been blanket and hit credit at a blanket level, but with such repricing comes the chance to pick up fundamentally robust names that have been caught in the crossfire and offer alpha potential. In risk off epsiodes, remaining nimble and ready to act is vital, as such times usually offer the best opportunities for alpha, but selectivity remains key.