Macro and Market Review

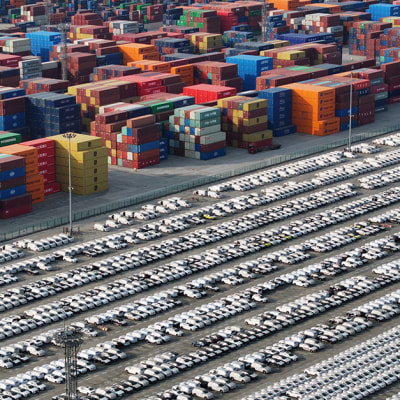

Volatility returned with a vengeance in April across assets as the US administration's Liberation Day tariff announcements sent markets reeling. The whipsaw in policy announcements that followed saw huge market moves in both directions as uncertainty rocketed and trade-related headlines drove sentiment. Despite the early April shock, policy walk-backs and a softening tone from the US government saw spreads recover from the wides, leaving total returns for the month flat in both US IG and HY and moderately positive in EUR corporates and treasuries, supported by the Euro duration component. Sector performance was clearly a function of tariff exposure, with import-heavy US sectors such as basic industry and consumer retailers hit hardest.The breadth and magnitude of the tariffs implemented on 2 April cannot be understated, taking national tariff levels to century-highs and threatening to completely upend the fabric of global trade. Of equal concern was confusion around the way in which the tariffs had been calculated. The new tariffs were headlined as being 'reciprocal' but in reality showed little relation with actual tariff levels currently levied on the US, making it hard to decipher how progress could be made on any potential reductions. The uncertainty generated by the economic upheaval sent risk assets spiralling, with the S&P falling 10% in just two sessions, taking the total sell-off into bear-market territory. Credit markets were somewhat better behaved but still saw US and EUR HY spreads widening by 120 bps and 110 bps, respectively - to the highest levels in two years.The initial reaction in rates markets was in line with that of a growth shock, as cuts were priced in and term premia shrank, with yields falling across the curve. However, this reversed and actually pushed yields higher as concerns shifted to a potential mass reduction in US asset holdings from abroad. The mixture of risk assets falling, currency depreciating and yields pushing higher is a familiar sight in Emerging Market economies facing balance sheet crises and mass capital flight, but not in the world's biggest economy and reserve currency. Ultimately, it was a sharp move higher in yields in Asian hours on 9 April that threatened financial stability and coincided with a U-turn from the Trump administration. A single social media post saw tariffs reduced universally to 10% for an initial three-month period, from the exceptionally high levels presented a week earlier. This resulted in a huge reversal in risk asset flows, with US stocks posting their largest intraday gains in decades.The one exception to the tariff reduction was China. As the only nation to retaliate to the Liberation Day announcements, levies there eventually rose to 145%, effectively halting all trade between the nations. These levels are not sustainable, as has been highlighted even by US government officials, but remain in place as of writing. The longer these levies remain, the worse the economic scarring will be. That said, the U-turn was sufficient to stem the market rout and ease volatility, setting the base for risk assets to recover through the remainder of the month. Further key support came from a softening in trade rhetoric, showing more appetite for bilateral deals. Another risk was removed as Trump confirmed that he wouldn't look to fire Fed Chair Powell despite sharp criticism of his unwillingness to cut interest rates. Concerns around Powell's potential removal had been haunting risk assets and long-end treasuries for some time. While the news flow from US policy and its impact on sentiment drove markets for the month, fundamental data did produce some interesting points. US growth for Q1 came in lower than expected at -0.3% QoQ, the first negative quarter since 2022, driven by a sharp increase in imports ahead of tariff implementation. Labour market data remained robust though, affirming the Fed's stance that further rate cuts aren't needed imminently, particularly with the inflationary impact of tariffs a looming unknown. The ECB, on the other hand, with fewer pressing inflation issues to hold it back, continued to respond to soft growth with a further cut, but also highlighted uncertainty around trade-induced growth/price impacts moving forward.

Portfolio activity

Issuance in the primary market was briefly interrupted by the spike in volatility following Liberation Day, but supply quickly returned as financial markets recovered. In general, initial price talks on the new deals were generous, but strong order books - signalling ongoing strong technicals - allowed many companies to significantly tighten guidance and issue close to fair value. We continue to maintain our pricing discipline and only participated in one new deal: Harbour Energy (oil & gas) is a high-quality oil & gas company that conducted a routine refinancing of its hybrid debt. The new issue offered an attractive premium as it was the inaugural issue after the company received a credit rating from Standard & Poor's. The S&P rating materially reduces the (already low) extension risk. The company has a solidly investment-grade business profile and prudent financial policies.In the secondary market, we took advantage of the volatility to add in the following: Medco Energy (oil & gas) is an Indonesian oil & gas company with additional operations in power generation and mining. The company has a defensive operating structure in the O&G space with among the lowest production costs in the sector. The bonds sold off materially to a yield above 10% due to a combination of tariff fears, pressure on oil prices and energy companies and exposure to emerging markets. The company has stated an intention to buy back bonds at lower prices, which limits the downside.Ibercaja (banking) is a second-tier Spanish bank with a strong asset management franchise, providing a balanced revenue mix between net interest income and non-interest income, which we view as attractive in an environment where the ECB is expected to cut interest rates. We added a position in its Tier 2 bonds, which decompressed during the recent volatility and are now trading wide to similarly rated Spanish and European banking peers.We reduced several positions, reflecting recent news flow and performance:Worldline (digital payment solutions provider) is a leading provider of digital payment services (#1 in Europe) with a broad geographic reach in Europe and solid market shares in key markets. While Q1 results were in line with consensus and company expectations, management removed the full-year 2025 outlook, citing elevated market uncertainty and the new CEO's limited tenure. The company will reassess its outlook and aims to provide an update at the 1H25 results on 30 July. As a result, we decided to reduce our exposure to the issuer.We closed a pair trade between Long risk TDC (wireless telecommunications) and Short risk Cellnex (wireless telecommunications) due to its underperformance relative to our expectations. The initial pair trade was implemented in July 2024.We took profit on part of our position in EP Infrastructure (European energy infrastructure company).We took profit on our Long CDS protection in Senior Financials and Subordinated Financials.We trimmed our position in Banking Additional Tier 1 securities.

Performance

In April, the Fund underperformed the benchmark. The Fund's allocation to BBs detracted from performance as crossover-rated bonds underperformed higher-rated ones. There was a negative contribution from security selection, particularly within the USD Retail-Service-Consumer sector, which is expected to be one of the most impacted by US tariffs, and within the Banking sector, as decompression across the capital structure led to the underperformance of junior subordinated bonds.YTD, the Fund has underperformed the benchmark. The Fund's allocation to BBs detracted from performance as crossover-rated bonds underperformed higher-rated ones. There was a negative contribution from security selection, particularly within the USD Retail-Service-Consumer sector, which is expected to be one of the most impacted by US tariffs, and within the Banking sector, as decompression across the capital structure led to the underperformance of junior subordinated bonds. Yield curve positioning and FX allocation contributed positively. Top single-name contributors to performance include satellite operators SES and Eutelsat. The largest detractor from performance was department store Kohl's, which is undergoing some operational challenges and is exposed to softer consumer sentiment in the US. We remain comfortable with our holdings given management's disciplined balance sheet management.

Outlook

Clearly, the ramifications of April's vast policy shifts will take time to filter through to hard data and corporate fundamentals, but the ultimate outcome of the debacle is likely to be a sizable growth hit to the US and globally, with a heightened stagflation risk in the former as tariff price increases are passed through to consumers. That said, the impact at a corporate level is likely to affect margins more than creditworthiness, and hence may well be more impactful for equities than credit in the short to medium term. Nevertheless, the environment calls for caution, but the sharp reversal seen mid-month on policy shifts can highlight the risk of reducing risk at inopportune moments in such markets. Remaining invested but defensive in credit remains our view, particularly now, with spreads at more elevated levels. We still prefer duration, as we envisage central banks prioritising growth and labour markets if conditions worsen, with inflation shocks likely to be more short-term in such a scenario.