global perspectives

Markets in a Milky Way warp

Key views

- We maintain our positive stance on duration risk for now. Still, without further evidence of a sharp escalation in the trade war, and/or evidence of fundamental weakness, it is hard to see strong upside given current valuations

- We are positive on gold as real rates are likely to remain negative in key economies for the forseeable future

- We are neutral on equities as there are signs of cracks in consumer and services sector confidence. That said, we think over-delivery of easing may stabilize sentiment in the short-term as the cost of capital is likely to remain very low

- On the trade war front, we see continued to-and-fro with little possibility of a deal in 2019. As a result, in emerging markets we prefer relatively low-risk carry exposure, especially in hard currency space, where spread cushion is still available

- We are also watching FX developments carefully and see unilateral USD intervention risks rising if Fed easing fails to dampen dollar dynamics in coming weeks. JPY, and increasingly EUR, appear to be the main risk-off proxies in the current environment

For years, astronomers assumed that the Milky Way was relatively flat like most other spiral galaxies. A new study of the Milky Way, however, has found that our home galaxy is significantly warped, with a noticeable twist at the edges.

The macro and policy environment currently in play also appears considerably warped compared to 12-months ago. Maybe it was always distorted, but the period between 2017 to mid-2018 gave the impression that the old normal of Goldilocks was re-appearing. Fast forward to August 2019 when global bond markets indicate perhaps another recession is inevitable, while the rest of the risky asset market complex remains consistent with far more benign economic outcomes.

The real economy is likewise signaling a skewed reality. Thus, consumption and services are managing to remain resilient despite the sharp downshift in both sentiment and activity in manufacturing and global capex trends. Indeed, the message from bond markets (guided by central bank policy shifts) is more in line with manufacturing and capex dynamics, while equity market developments are more consistent with services and consumer trends. In short: bond trends are signaling a potential recession while equity cues are notably more optimistic.

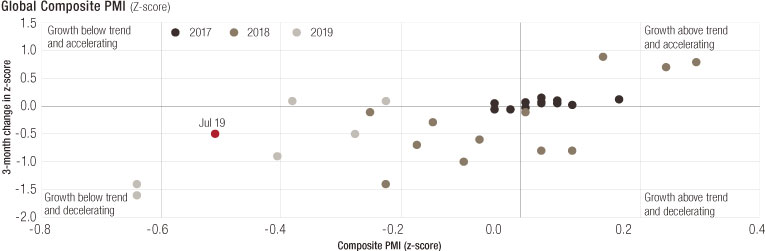

Figure 1: Global PMI survey trends – below average and still falling, driven by weakness in manufacturing

Source: Markit, JP Morgan, z-score calculated using 1998-2019 data. Z score captures how far the indicator is from its long-term average.

Of course, monetary policy-induced pressure on bond markets cannot be underestimated. After the 2008-2009 financial crisis, ebb and flow in central bank activism and shifts in policy cycles have been critical to both risk-free rates and risky asset returns.

And since May 2018, political developments in the age of rising populism have additionally impacted both the real economy and market dynamics in powerful ways. Specifically, the trade policy clash between the US and China began with narrow current account concerns expressed by President Trump. The clash now encompasses more wide-ranging issues such as technology, intellectual property and foreign access to Chinese domestic sectors. As such, the complexity of the clash and the polarity of views has increased in recent months.

As things stand, we see little likelihood of a near-term deal, with rising probability that President Trump adopts an “at war” stance going into the presidential elections next year, leading to dilution of what is often referred to as the “Trump put”.

Global business investment – the key fundamental risk

Away from markets, the key fundamental weakness remains the heavy pressure on global capital expenditure (capex), which we believe is now in contractionary territory. In addition, business survey indicators, especially on the manufacturing side, continue to fall. This has led a variety of nowcasters derived from these surveys to indicate that a very strong possibility of sustained contraction looms over global business investment in coming months.

The weakness in global capex is percolating despite the falling cost of capital. To us, this clearly indicates the high level of continued uncertainty from the trade war and its negative implications on supply chain configuration. Indeed this downward trend has been in place since Q1 2018 and has progressed unabated despite the twists and turns in US-China trade negotiations. Ultimately, we believe the future of the current economic cycle will be determined by the length and depth of weakness in global capex.

How long will the global consumer prop up growth?

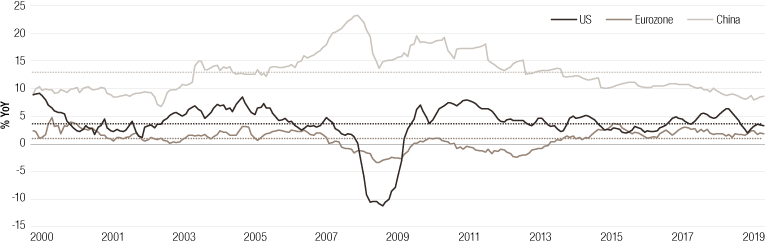

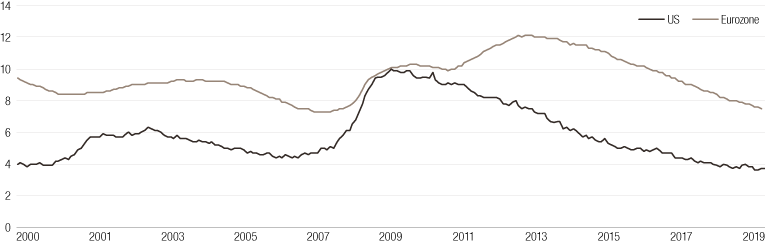

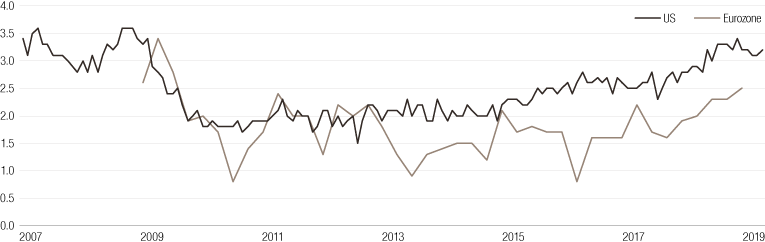

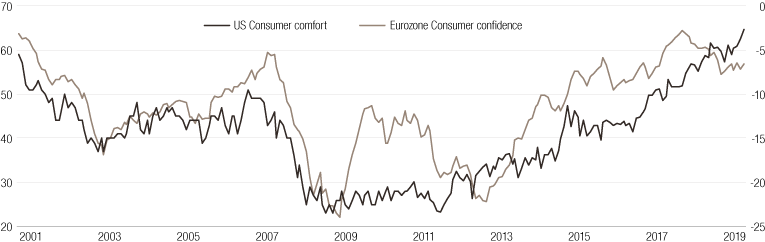

The continued disconnect between consumers and the business environment is a key factor underpinning the distorted nature of markets and global economic health. The easing of financial conditions, strong labor market conditions and rising wages (both in the US and Europe) have so far buoyed the consumption driven sectors of the global economy (see Figure 2).

And while the services sector also remains relatively strong, we are concerned it also could be at risk due to the sharp fall in manufacturing and global capex pulling down economic growth and in turn leading to a widespread confidence shock. Given this backdrop, we are watching the recent high frequency softening in consumer and services sector (albeit from high levels) very closely.

Figure 2 – Global consumer behaviour remains stable so far

A: Retail sales (% YoY, 3mma)

Source: Bloomberg. Dotted lines represent series average.

B: Unemployment (%)

C: Wage growth (% YoY)

D: Consumer confidence indices

Source: Bloomberg

More policy support ahead – 50bp Fed cut on the table

Despite fundamental data (especially global manufacturing) weakening well beyond levels in November/December, risky asset markets have held up quite well based on YTD return profiles. This comes despite the sharp wobble in August after the latest escalation in the US-China trade war. The key difference has been the easing of financial conditions initiated by the main central banks, which is spreading into a more generalised theme globally.

The Federal Reserve’s sharp pivot early in 2019, coupled with tangible shifts in European Central Bank (ECB) policy, have prompted rate cutting cycles to start across the globe. Moreover, in China the growth damage from the trade war is being met with continued measured stimulus (mainly fiscal, with signs of credit easing appearing on the horizon as well).

As such, with global manufacturing in as bad shape as in 2015-2016, if not worse, further easing which goes beyond market expectations remains the key lever still operating in the global macroeconomic policy space.

Fed chair Jerome Powell’s somewhat rigid comments at the July FOMC meeting were misguided, in our view, amid evidence that international developments continue to deteriorate, particularly in Europe.

The US now has ample ground for accelerating the easing cycle and is the country with the most policy space available on interest rates: this will be critical in avoiding a repeat of the late-2018 recession obsession. Easing will also help mitigate the shock to confidence (so far concentrated in the business sector) from passing through the system – to that end, Powell’s dovish speech at the Jackson Hole conference was an important indication that the Fed’s message is once again being influenced by market-driven financial conditions and we think a potential 50bp cut in September is a possibility.

On the ECB front, we expect a wide-ranging package with additional quantitative easing (QE) as the central piece of fresh easing measures. At the very least, we envisage a package in line with market expectations will be necessary to anchor sentiment.

On the fiscal policy front, talk of easing has picked up in Germany as the economy nears a recession, but it is frustrating to see that fiscal stimulus is only being considered if the situation worsens, despite clear evidence that the cycle is deteriorating further in Europe.

Turning to currencies, USD strength remains a headwind especially for emerging market assets (specifically, FX and equities). Weakness in CNY implies that China is using the currency to buffer against rising tariffs to a moderate extent. However, this reaction is increasingly drawing criticism from the Trump administration and we see the risk of unilateral USD intervention rising, especially if Fed easing fails to dampen USD dynamics.

important information.

This document has been issued by Lombard Odier Funds (Europe) S.A. a Luxembourg based public limited company (SA), having its registered office at 291, route d’Arlon, 1150 Luxembourg, authorised and regulated by the CSSF as a Management Company within the meaning of EU Directive 2009/65/EC, as amended; and within the meaning of the EU Directive 2011/61/EU on Alternative Investment Fund Managers (AIFMD). The purpose of the Management Company is the creation, promotion, administration, management and the marketing of Luxembourg and foreign UCITS, alternative investment funds ("AIFs") and other regulated funds, collective investment vehicles or other investment vehicles, as well as the offering of portfolio management and investment advisory services.