world in transition

How to improve the sustainability of a passive portfolio

Sustainability is recognised as an increasingly important issue for investors. Its relevance affects the whole of an asset owners’ portfolio, including passively managed strategies. In response to this, investors increasingly need to find cost efficient ways to implement low-tracking error portfolios that integrate sustainability and reflect their individual investment objectives and beliefs.

In this Q&A, Foort Hamelink, who is responsible for integrating ESG into bespoke portfolios at Lombard Odier Investment Managers (LOIM), discusses some of the key considerations investors face in assessing the most appropriate approach to improving the sustainability of a passive portfolio.

Why is it important to integrate sustainability into passive portfolios?

Sustainability affects all regions, sectors, companies and asset classes so it’s increasingly important to integrate it in a holistic way across the whole portfolio. Doing so can meaningfully reduce exposure to non-financial and reputation risks and can help to mitigate the systemic – and therefore undiversifiable – risks associated with climate change. It can also help position a portfolio better for the transition to a more sustainable, low-carbon economy. However, it’s not just about risk. Transition on this scale can create huge opportunities as companies innovate to adapt and mitigate for climate change, for example. Our goal is to manage those risks and benefit from the opportunities.

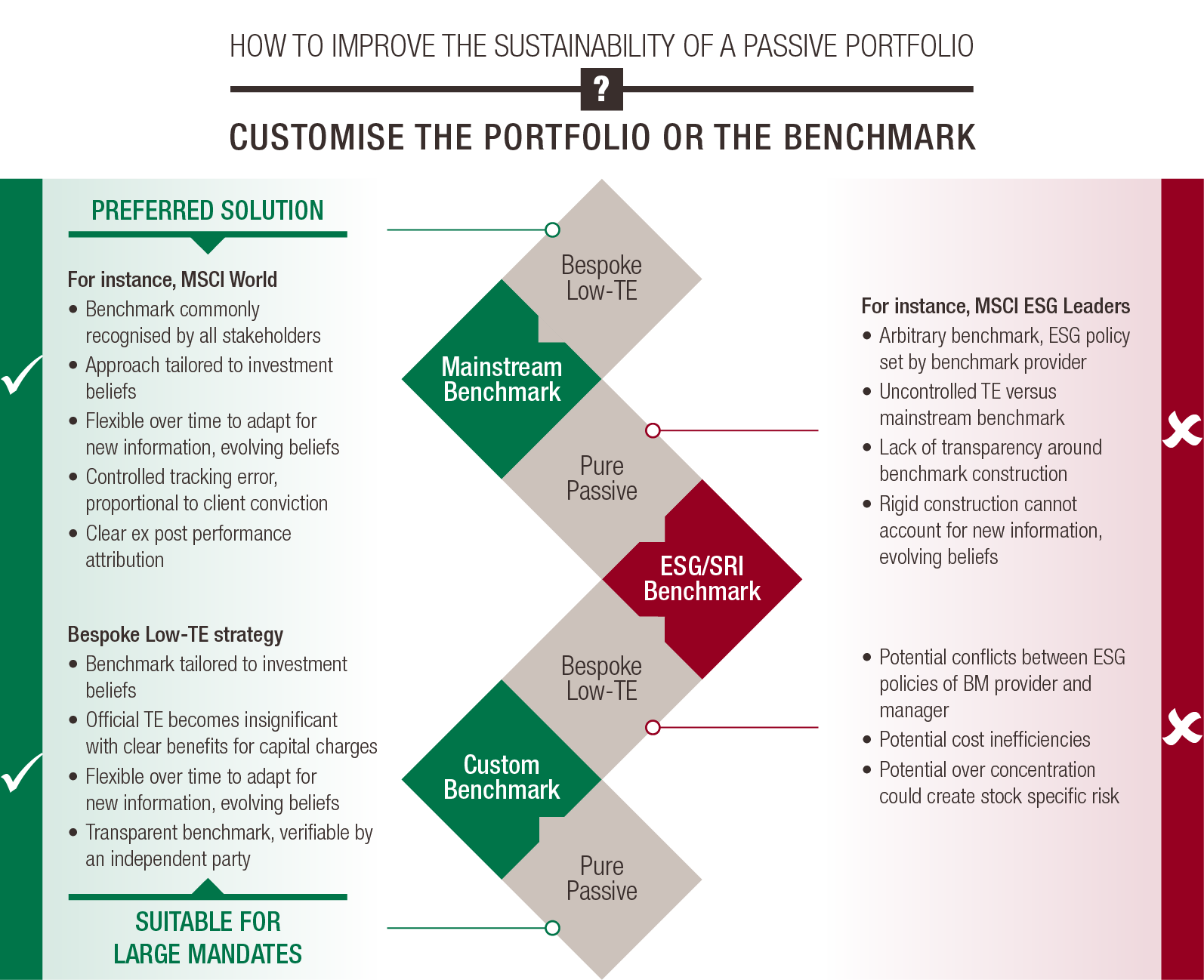

That applies just as much to passive as active strategies, but, clearly, when it relates to passively managed assets, there are a few critical issues to consider. One is tracking error, which needs to be controlled. And the other is whether to integrate sustainability at the benchmark level, or in the portfolio construction.

Our goal is to manage the physical and transition risks associated with climate change, and benefit from the opportunities transition creates.

Should investors customise the benchmark, or the portfolio construction?

It depends. Large investors can more readily work with a fund manager or other party to create a custom benchmark. There are benefits to doing this, not least the implications for capital charges because a portfolio that passively tracks a custom benchmark should show negligible tracking error, and the benchmark can be perfectly tailored to meet the asset owners’ investment beliefs. We have seen a number of large pension funds moving in this direction.

But this isn’t suitable for everyone. The other option is to customise the portfolio construction and allow a degree of tracking error against a mainstream benchmark. There are a number of key advantages to this approach.

First, the benchmark is commonly recognised by all stakeholders, which helps establish a baseline that everyone understands and has a good degree of comfort with. Second, bespoke implementation allows investors to tailor the portfolio to fit their individual investment beliefs to hit specific carbon reduction targets, for example, or to track one or a group of Sustainable Development Goals. The tracking error can be controlled so it is proportionate to the clients’ conviction in their beliefs – if they want more carbon reduction, or a higher ESG score, that is perfectly possible, but it may mean a slightly higher tracking error.

Importantly, bespoke implementation also means the mandate is flexible and can adapt over time to reflect new information like developments in data or regulation, and also to reflect evolutions in the clients’ investment beliefs.

It’s also worth noting that the bespoke low-tracking-error portfolio I’ve just referred to can also be used to set the rules for a custom benchmark. This would provide strong transparency and can be easily verified by an independent third party.

Why not just track one of the index providers’ sustainable indexes?

This is one option, but, in our view, it doesn’t necessarily deliver an optimal outcome.

These benchmarks cannot be customised, for example, which leaves the investors subject to the ESG policy of the benchmark provider. This may not necessarily be the best reflection of the investors’ objectives, and they are also not very flexible to adapt over time. Passively tracking one of these benchmarks can also lead to uncontrolled tracking error versus the more widely recognised benchmarks, which most stakeholders are not familiar with.

The other route would be to implement a bespoke low-tracking-error portfolio against one of these ESG/SRI benchmarks, but that is fraught with conceptual problems. For one, there may be conflicts between the index provider’s ESG policy and that of the manager, which cannot always be easily resolved. Consider, for example, if the ESG/SRI benchmark already significantly allocates to a specific stock, which also has a good ESG rating by the manager: should this stock be overweighed versus the already concentrated ESG/SRI index? This could add significant stock-specific risk. Or, by contrast, the views on the ESG score of a company could differ meaningfully between the benchmark provider and the fund manager – how would that be dealt with in the portfolio? This approach can also create the potential for cost inefficiency as ESG/SRI benchmarks tend to be more expensive than mainstream benchmarks.

In our view, transparency is also really important and that is likely to be optimised when the client is involved in setting the rules for the ESG strategy.

important information.

This document has been issued by Lombard Odier Funds (Europe) S.A. a Luxembourg based public limited company (SA), having its registered office at 291, route d’Arlon, L-1150 Luxembourg, authorized and regulated by the CSSF as a Management Company within the meaning of EU Directive 2009/65/EC, as amended.

Lombard Odier Investment Managers (“LOIM”) is a trade name.

This document is provided for informational purposes only and does not constitute an offer or a recommendation to purchase or sell any security or service. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful. This document does not contain personalized recommendations or advice and is not intended to substitute any professional advice on investment in financial products. Before entering into any transaction, an investor should consider carefully the suitability of a transaction to his/her particular circumstances and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. This document is the property of LOIM and is addressed to its recipients exclusively for their personal use. It may not be reproduced (in whole or in part), transmitted, modified, or used for any other purpose without the prior written permission of LOIM. The contents of this document are intended for persons who are sophisticated investment professionals and who are either authorised or regulated to operate in the financial markets or persons who have been vetted by LOIM as having the expertise, experience and knowledge of the investment matters set out in this document and in respect of whom LOIM has received an assurance that they are capable of making their own investment decisions and understanding the risks involved in making investments of the type included in this document or other persons that LOIM has expressly confirmed as being appropriate recipients of this document. If you are not a person falling within the above categories you are kindly asked to either return this document to LOIM or to destroy it and are expressly warned that you must not rely upon its contents or have regard to any of the matters set out in this document in relation to investment matters and must not transmit this document to any other person. This document contains the opinions of LOIM, as at the date of issue. The information and analysis contained herein are based on sources believed to be reliable. However, LOIM does not guarantee the timeliness, accuracy, or completeness of the information contained in this document, nor does it accept any liability for any loss or damage resulting from its use. All information and opinions as well as the prices indicated may change without notice. Neither this document nor any copy thereof may be sent, taken into, or distributed in the United States of America, any of its territories or possessions or areas subject to its jurisdiction, or to or for the benefit of a United States Person. For this purpose, the term "United States Person" shall mean any citizen, national or resident of the United States of America, partnership organized or existing in any state, territory or possession of the United States of America, a corporation organized under the laws of the United States or of any state, territory or possession thereof, or any estate or trust that is subject to United States Federal income tax regardless of the source of its income.

Source of the figures: Unless otherwise stated, figures are prepared by LOIM.

Although certain information has been obtained from public sources believed to be reliable, without independent verification, we cannot guarantee its accuracy or the completeness of all information available from public sources.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by LOIM to buy, sell or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change. They should not be construed as investment advice.

No part of this material may be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorised agent of the recipient, without Lombard Odier Funds (Europe) S.A prior consent.

©2019 Lombard Odier IM. All rights reserved.