global perspectives

Simply put: connecting market moves with long-term rates

In our latest multi-asset macro update, we share the following views:

- Long-term interest rates have historically played a pivotal role in driving financial markets, and even more so today.

- Currently, long rates may seem far from their fundamentals but, in fact, they fairly reflect high inflation expectations, excess savings and active central bank policies.

- With strong growth prompting monetary normalisation, real rates could soon resume their ascent.

This year, long-term interest rates have played a key role in understanding and anticipating market fluctuations: their movements have shaped rotations within asset classes. Since early August, interest rates have been rising again and we expect this trend to continue, which raises the question: how far can they go? To answer this question, we believe it is necessary to explore the full scope of the fundamentals behind these moves.

In a Journal of Finance article soberly titled "Discount Rates", John Cochrane, then professor of financial economics at the University of Chicago, presented the idea that interest-rate fluctuations alone explain 100% of the movements in the price-to-dividend ratio. What dividends do not explain about the behaviour of stocks, interest-rate variations do. The point here is not to simply say that monetary policy governs equities, but to understand that, empirically, increases and decreases in long-term interest rates have a significant influence on them. Looking at the 2020-2021 period, it is hard to find any examples that refute Cochrane's conclusion.

When considering interest-rate fluctuations, confusion naturally arises between the drivers of short rates and long rates – especially during a prolonged period of quantitative easing. This confusion can lead some to believe that long rates are disconnected from their fundamentals. Short rates in most mature economies are governed by the relevant central bank, reflecting its objectives which are generally to control inflation and economic activity directly or indirectly. This is known as the Taylor rule: short rates are empirically a function of expected inflation and various expected measures of economic activity and the labour market.

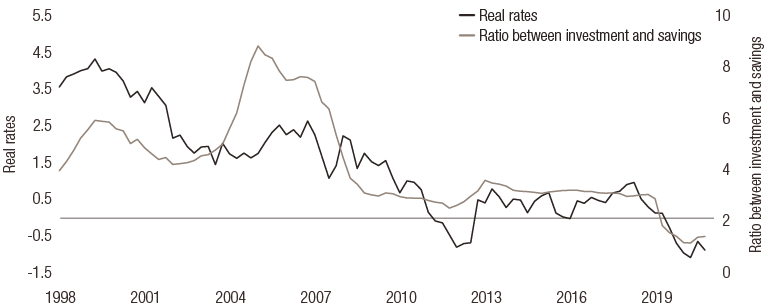

Policy rates in the US and in Europe, at 0.25% and 0% respectively, currently reflect the Federal Reserve and European Central Bank’s (ECB’s) expectations of high, but temporary, inflation and growth, with more downside than upside risks. Using the Taylor rule, factoring in the US labour market and current inflation levels, we can calculate that the policy rate should reach 2.45% in the US: well above the current rate of 0.25%.

Figure 1 shows that if we assume inflation is temporary, and eventually returns to a level of 2.5%, this same calculation is closer to 1% (as indicated by the red dot on the chart). This suggests the Fed’s policy rates are too low by 1% and this is having a stimulative effect on the US economy. The improving economic outlook should prompt the Fed to raise its policy rate during the next few quarters and the market is already anticipating a rate hike at the end of 2022. In short, nothing is disconnected, everything is tied to expectations.

Chart 1: Taylor rule based on inflation and the labour market with inertia

Through quantitative easing, the ECB, the Bank of England (BoE) and the Bank of Japan (BoJ) have extended their influence over the long end of the yield curve. The temptation to formulate a ‘Taylor rule’ for long rates is strong. Yet if a Taylor-style regression is undertaken, the explanatory power of the model collapses and its parameters become notoriously unstable. Such an intellectual shortcut may be attractive, but it is nonetheless refuted by market data: long rates do not solely respond to the economic cycle.

Cochrane’s "Discount factor" paper outlines four main factors in rates: the macroeconomic situation, behavioural factors, structural effects (that depend on the type of investors in the market) and a liquidity factor. During the last two years, while the macroeconomic factor explains some of the levels reached, it is not the only explanation.

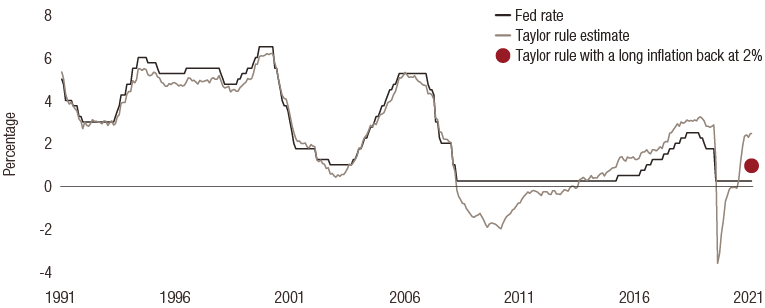

The high level of savings now stored as cash in deposit accounts on both sides of the Atlantic has been a downward force on long-term rates, via real rates. In the US alone, these deposit accounts reached USD 5.3 trillion in April 2021 and have since declined by USD 800 billion. In 2018, these same deposits contracted by USD 500 billion, explaining a 50bp rise in real rates. This year's USD 800 billion decrease only saw real rates rise by 25 bps – this is not surprising given Fed policy expectations are weighing on the market and slowing the progression of real rates.

At the Fed’s November meeting, Chair Jerome Powell is expected to commence the path to normalisation as deposit accounts continue to empty. By the end of the quarter, those 25bps of real rates will need to be caught up. Longer-term, a normalisation of monetary policy, savings and a return of investments to pre-pandemic levels would imply real rates reverting to about 0.5%. This, combined with an inflation premium of 2.5% (the Fed's target) would bring rates back to 3% at the end of the cycle: 0.5% above the Fed's forecast for its long-term short rate. It is therefore clear that fundamentals and markets are connected and valuations should gradually adapt.

Chart 2: - The investment:savings ratio versus real rates in the US

Source : Bloomberg, LOIM as at October 2021. For illustrative purpose only.

|

Simply put, to understand market fluctuations you need to understand the fluctuations in long-term interest rates. These long rates should continue to rise as real rates reflect the benign economic conditions the world is currently enjoying. What lies ahead of us is a rise in the cost of capital (this is what rates ultimately are). This is part of the recovery process and will have a significant impact on markets. |

Informazioni importanti.

RISERVATO AGLI INVESTITORI PROFESSIONISTI

Il presente documento è stato pubblicato da Lombard Odier Funds (Europe) S.A., una società per azioni di diritto lussemburghese avente sede legale a 291, route d’Arlon, 1150 Lussemburgo, autorizzata e regolamentata dalla CSSF quale Società di gestione ai sensi della direttiva europea 2009/65/CE e successive modifiche e della direttiva europea 2011/61/UE sui gestori di fondi di investimento alternativi (direttiva AIFM). Scopo della Società di gestione è la creazione, promozione, amministrazione, gestione e il marketing di OICVM lussemburghesi ed esteri, fondi d’investimento alternativi ("AIF") e altri fondi regolamentati, strumenti di investimento collettivo e altri strumenti di investimento, nonché l’offerta di servizi di gestione di portafoglio e consulenza per gli investimenti.

Lombard Odier Investment Managers (“LOIM”) è un marchio commerciale.

Questo documento è fornito esclusivamente a scopo informativo e non costituisce un’offerta o una raccomandazione di acquisto o vendita di titoli o servizi. Il presente documento non è destinato a essere distribuito, pubblicato o utilizzato in qualunque giurisdizione in cui tale distribuzione, pubblicazione o utilizzo fossero illeciti. Il presente documento non contiene raccomandazioni o consigli personalizzati e non intende sostituire un'assistenza professionale in materia di investimenti in prodotti finanziari. Prima di effettuare una transazione qualsiasi, l’investitore dovrebbe valutare attentamente se l’operazione è idonea alla propria situazione personale e, ove necessario, richiedere una consulenza professionale indipendente riguardo ai rischi e a eventuali conseguenze legali, normative, creditizie, fiscali e contabili. Il presente documento è proprietà di LOIM ed è rivolto al destinatario esclusivamente per uso personale. Il presente documento non può essere riprodotto (in tutto o in parte), trasmesso, modificato o utilizzato per altri fini senza la previa autorizzazione scritta di LOIM. Questo documento riporta le opinioni di LOIM alla data di pubblicazione.

Né il presente documento né copie di esso possono essere inviati, portati o distribuiti negli Stati Uniti d’America, nei loro territori e domini o in aree soggette alla loro giurisdizione, oppure a o a favore di US Person. A tale proposito, con l’espressione “US Person” s’intende un soggetto avente cittadinanza, nazionalità o residenza negli Stati Uniti d’America, una società di persone costituita o esistente in uno qualsiasi degli stati, dei territori, o dei domini degli Stati Uniti d’America, o una società di capitali disciplinata dalle leggi degli Stati Uniti o di un qualsiasi loro stato, territorio o dominio, o ogni patrimonio o trust il cui reddito sia soggetto alle imposte federali statunitensi, indipendentemente dal luogo di provenienza.

Fonte dei dati: se non indicato diversamente, i dati sono elaborati da LOIM.

Alcune informazioni sono state ottenute da fonti pubbliche ritenute attendibili, ma in assenza di una verifica indipendente non possiamo garantire la loro correttezza e completezza.

I giudizi e le opinioni qui espresse hanno esclusivamente scopo informativo e non costituiscono una raccomandazione di LOIM a comprare, vendere o conservare un titolo. I giudizi e le opinioni sono validi alla data della presentazione, possono essere soggetti a modifiche e non devono essere intesi come una consulenza di investimento. Non dovrebbero essere intesi come una consulenza di investimento.

Il presente documento non può essere (i) riprodotto, fotocopiato o duplicato, in alcuna forma o maniera, né (ii) distribuito a persone che non siano dipendenti, funzionari, amministratori o agenti autorizzati del destinatario, senza il previo consenso di Lombard Odier Funds (Europe) S.A. ©2021 Lombard Odier IM. Tutti i diritti riservati.