investment viewpoints

Ways the pandemic could benefit FinTech

We expect the COVID-19 pandemic to act as very strong accelerator for digital trends, creating substantial opportunities for financial technology (or FinTech) companies. Our FinTech1 strategy is based on five core beliefs that we believe will galvanise industry growth in the future. Such major trends – from growth in digital payments to the need for cyber security - preceded the pandemic, and now stand to gain even greater traction, in our opinion.

The pandemic is already speeding up societal changes. For instance, we clearly see digital payments being favoured, as e-commerce is booming and offline shops prefer non-cash payments for hygiene reasons. Other online financial services, such as mortgages and asset management, are also gaining share rapidly due to the closure of bank branches.

With the next round of quantitative easing (QE) underway, the subject of official crypto currencies issued by central banks is back on the agenda. COVID-19 has also lowered the valuation hurdle for M&A and, for the first time, the services of FinTechs are being used to distribute tax refunds in US.

A boom for payments

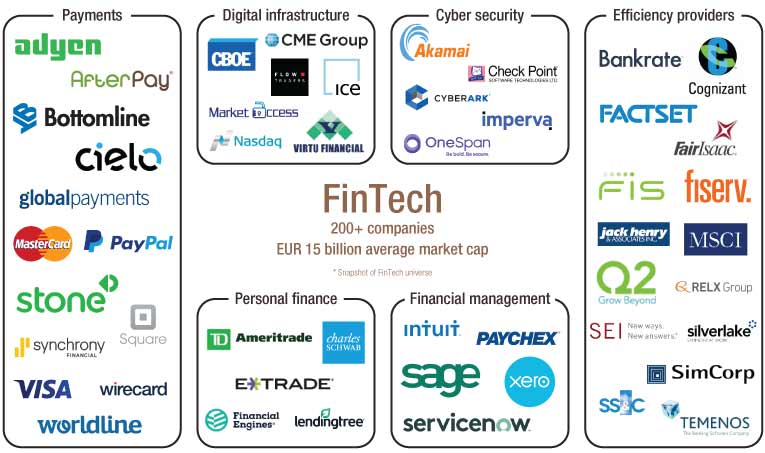

Payments are a large part of our strategy’s investible universe, making up about one third of investible companies on the listed FinTech side. This universe is also comprised of personal finance (robo-advice), digital infrastructure (tech-savvy exchanges and market makers), financial management software, efficiency providers (those companies that deliver software solutions to financial companies in order to remain competitive in a digital financial world) and finally cyber security (specified as software companies and insurance companies that deliver specialised cybersecurity products to the financial sector).

Figure 1. The investible FinTech universe

Digital payments edge out cash

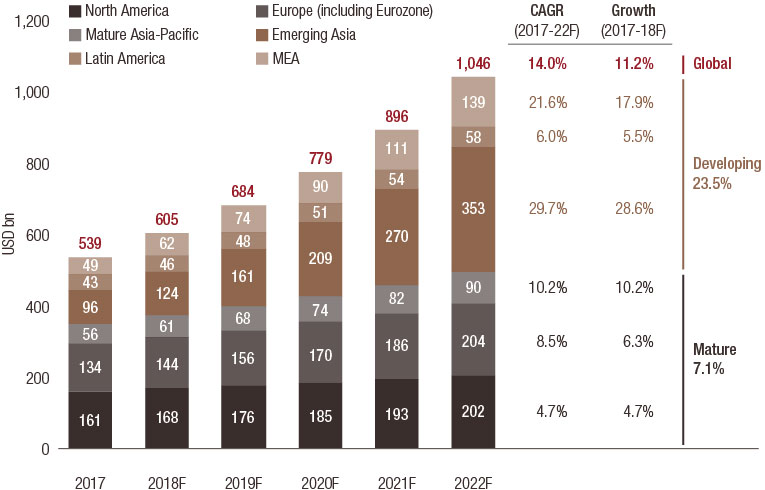

We expect the strong secular growth trend in digital payments to build further and edge out physical cash. On an annual basis, digital forms of payment were expected to grow at around 15 percent per year for the coming five years, globally. This contrasts with physical cash, which has grown by around 1 to 2 percent per year. The ‘mix effect’ will therefore make digital payments a larger percentage of total payments. That does not imply, however, negative volume growth in cash payments.

We believe COVID-19 will have a significant impact in this space. For example, cash withdrawals from ATMs in the UK dropped by more than 60% in March 2020. In some countries hit hardest by the crisis, there is considerable overlap with physical cash usage. Governments and health organisations in Italy, for instance, urged people to pay digitally either via card or smart phone.

Negative physical cash growth during the crisis period will hit some businesses harder than others. Restaurants, bars and local non-essential shops are all cash-dependent and are all closed. Grocery shopping saw a steep increase in revenues, and is one area where companies and governments urge people to pay digitally for hygiene reasons.

In addition, e-commerce use significantly increased in 2020 - obviously, all e-commerce payments are digital.

Figure 2. Number of worldwide non-cash transactions (billions), by region, 2017-2022E

Source: : Capgemini Financial Services Analysis 2019, World Payments Report 2019. For illustrative purposes only.

Will new payment habits stick?

The biggest question is, however: will people stick to digital payment habits or return to cash when life goes back to “normal”?

Paying has two components: the technology and the social element. Obviously, technology infrastructure is necessary to make and accept digital payments. FinTech has been enabling this for many years and we see adoption levels increasing with consumers installing mobile payment apps and merchants increasing card and mobile phone payment acceptance.

The social component, however, is often underestimated. If something is technologically possible, it does not necessarily imply that it will be adopted. That is apparent in countries like Germany, Spain, Greece, Italy, India, South Africa, Brazil and many others. There, cash usage remains widespread because it is socially preferable to pay with cash, despite the infrastructure being present to pay digitally. COVID-19 is pressuring this group of people towards paying digitally.

We believe it is very likely that those previously paying with cash will now experience the speed, security and hygiene of paying digitally; and they will stick to paying digitally after restrictions are lifted. However, it will take a very long time before physical cash is completely phased out, if ever. We expect to see a strong acceleration in digital payments and perhaps, for the first time ever a decrease in physical cash use.

Greater use of digital personal finance

COVID-19 is boosting digital financial services within areas such as mortgage advice, lending and wealth management. The evidence suggests that social distancing measures lead clients to make greater use of online and mobile channels to manage their finances. The number of online mortgage applications, for example, is increasing fast because people want to re-finance their mortgage in order to benefit from lower interest rates. In addition, online applications are more convenient. Clients can log onto a website as they work from home instead of having to take a day off to go to the physical branch. In Germany, the lockdown led to 2.5 million online bank accounts being opened in just one day in March 2020.

The digitalisation of financial services is a long-term trend - we expect it to have the same impact that digitalisation had on the consumer side with online shopping, social media and e-sports, for example. The current pandemic environment further strengthens this push into digital services.

Financial inclusion and government stimulus

The economic disruption caused by the pandemic is highlighting the importance of serving people who are currently outside the financial system, both in emerging and developed economies. It is very possible that COVID-19 will lead to greater financial inclusion because of recent government programmes around the world to help low-income households.

As many FinTechs made it their mission to democratise financial services by providing basic financial services in a fair and transparent way, they can play an important role in distributing benefits to more vulnerable populations. We have seen FinTechs like Intuit, PayPal or Square2 play an active role already in getting money to people in an efficient way. All of these companies were used by the US Federal government in April to distribute fiscal stimulus to households and companies.

Central bank digital currencies: window opens

A surprise window of opportunity might open for central banks to issue their own digital currencies, or CBDCs. We have been looking at cryptocurrencies for some time now, and we strongly believe that the underlying technology could be used for asset tokenisation. However, we have always been sceptical about payment crypto coins and we expect most of them will fail. A regulated form of crypto payment coins in the form of central bank-backed initiatives could very well become a success, in our opinion.

One of the biggest frustrations for central banks is that most of the quantitative easing (QE) measures in past years did not lead to equivalent real-economy liquidity improvements because most of the money was used to improve bank balance sheets. With CBDC, the distribution of money can be better managed by central banks and distributed directly to companies or even consumers. The massive helicopter money project in the US, distributing USD1200 to every eligible American, has faced big operational challenges, as many people who needed the money the most were not banked.

While FinTech solutions were used to distribute funds - in the form of prepaid cards, for example – we believe online wallets with CBDC would be even more efficient. With a smart contract overlay, CBDC could even be translated into purpose coins that can be programmed to be spent on specific categories like groceries or utilities, rather than gambling, for instance. CBDC is not yet available in Europe or the US, but the current pandemic might put the subject on central banks’ agenda, especially since China is very close to launching its own digital yuan.

The return of M&A

Within payments, mergers and acquisition (M&A) has always been a very important component. In listed names, we have seen some very large deals: FIS, Fiserv, Global Payments and Worldline on the payments side, or Charles Schwab and Morgan Stanley in wealth management3. The number one rationale for acquisitions in FinTech is the operating leverage of the network. Either companies can grow organically, or through M&A, which is much faster but comes with integration challenges. With ever-higher valuations on the private side in 2019, we noticed a slowdown in M&A activity on the listed side towards the end of 2019 and the start of 2020. It is likely that M&A comes back on the agenda again, with valuations having fallen to more affordable levels on the listed side, while access to funding has become difficult on the private side (especially for early-stage ventures as many investors focused on established FinTechs with clear business models).

Cybersecurity more important than ever

Cyber security is a pivotal issue able to compromise the digitalisation of the financial sector. Indeed, COVID-19 could potentially fuel greater digital fraud. The European Central Bank (ECB) recently warned that many more customers are engaging in digital banking rather than visiting physical bank branches, potentially exposing services to greater cybercrime. The ECB recommended that banks work with third-party security contractors to keep themselves safe for the duration of the pandemic. As a result, we expect banks and FinTechs to accelerate investment in cybersecurity and cyber insurance.

From digital payments to crypto currencies, M&A and cybersecurity, we believe the trends driving our FinTech strategy are well positioned to benefit from COVID-19.