investment viewpoints

How FinTech aids financial inclusion

Digital technology plays a pivotal role in bolstering financial inclusion. This greater inclusion applies to both emerging and developed markets, underscoring how FinTech can enable a more inclusive society by broadening access to financial services.

There is a tremendous cost advantage to digitalising financial services, making financial inclusion a natural by-product of FinTech, in our opinion.

The implications of cost efficiency for emerging markets are important. Before FinTech it was not possible to serve most people in rural emerging markets because the costs were too high relative to the limited services rural populations would consume. FinTech changed the economics, however, and made it possible to service previously unserved people.

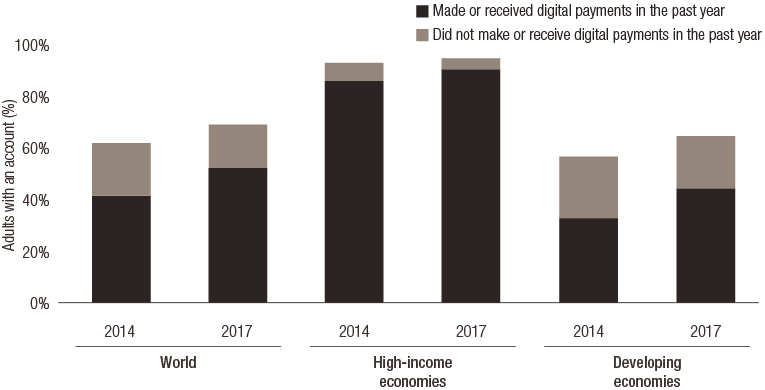

According to the World Bank, globally 69% of adults (3.8 billion people) had an account at a bank or mobile money provider in 2018. This is up from just 51% in 2011. The same report found increased mobile phone usage has contributed to a rise in the share of account owners sending or receiving payments digitally from 67% in 2014 to 76% percent globally in 2017. In the developing world it rose from 57% to 70%. However, 1.7 billion adults remain unbanked, despite two thirds of them owning a mobile phone.

Figure 1. Digital payments rising worldwide

Source: Global Findex database

India leads surge in new bank accounts

In South Asia, the share of adults with a bank account has risen by 23 percentage points since 2014, to 70%. Progress was driven by India, where a government policy to increase financial inclusion through biometric identification pushed the share with an account up to 80%.

For instance, more than 350 million Indian households obtained a bank account over just 5 years, thanks to a combination of software (AADHAAR) and hardware (finger print and iris scanner). In the past, it was impossible for banks to open branches in all areas. Now, FinTech enables local shops to provide banking services on behalf of banks.

Furthermore, the Indian government introduced the mandatory conversion of old banknotes into new notes. Only bank account holders registered in the AADHAAR system could exchange the notes. This further fuelled the growth of Indian bank accounts. The AADHAAR system increased financial inclusion (by as much as 600%) by drastically increasing the number of bank account holders.

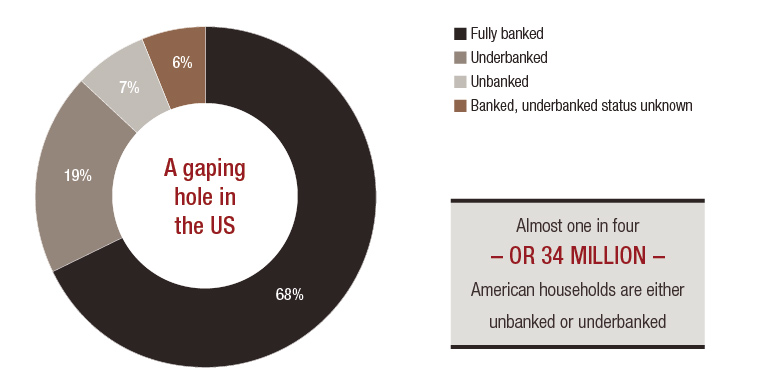

Under-served US households

Financial inclusion is also a theme in developed countries where many customers are under-served. Such customers have a bank account, but receive inadequate service because of insufficient earnings or the value of their assets being too low. For instance, roughly a quarter of US households are either unbanked or underbanked.

Figure 2. A missing piece in the US

Source: FDIC. 2017 American Banker. For illustrative purpose only.

FinTech, in the form of robo-advice1, for instance, can offer solutions in this realm.

Uber2, a US ride-sharing company, is offering financial inclusion to all their drivers, of which a substantial proportion is currently unbanked, in the form of prepaid cards, online wallets and lending. At the start of the day, the Uber driver can fill up on petrol with an amount that is loaned by UberMoney. The driver then pays back this borrowed amount via the Uber rides. At the end of the day, the driver can ask for the money made on that day to be deposited in the online wallet or on the prepaid card (with other companies, this payout is weekly or monthly). Uber does not facilitate all of these financial services on their own, hence they partner up with FinTech companies. One example of such a company that is enabling Uber to roll out these services is Green Dot.

Payments and insurance could present some barriers to inclusion, however, for people who do not own a phone. Lack of phone ownership means such people cannot participate in technological advances conferred by FinTech because they have a lighter or no digital footprint. This group of people is relatively large and represents a majority of payments for amounts below USD10 in the US.

People with no digital trace may also find it difficult to become insured. Insurers use automated risk models that are only able to generate a profile if the client has a digital footprint. They are unable to underwrite clients without a digital history.

As a result, some groups of people will not be serviced by digital finance. Their numbers stand in contrast to the significant number of people for whom new technology has substantially increased service.

New FinTech initiatives are considering how to include under- or un-serviced customers: the economics make sense from a business/profit model point of view.

A more inclusive society

We see FinTech as a key enabler of a more inclusive society. Digitisation is an overarching, irreversible trend and key enabler of FinTech. Digitisation is also vital to future economic growth and the Sustainability Revolution. But there must be the correct balance between decoupled digital growth, greater energy efficiency across harder-to-abate sectors enabled by the digital revolution, and a focus on the tech sector as a net-negative emissions generator. Digital growth must be managed sustainably.

The digital industry's energy usage is increasing by 4% a year, which runs counter to the objective of the Paris Agreement to decouple energy consumption from GDP growth. Digital devices and back-end infrastructure consume a vast amount of electricity. This adds up to a risk that the massive investments made in digital technology will ultimately lead to a net increase in the environmental footprint of the sector, even as the sector provides multiple solutions to decarbonise other industries.

Efforts are being made to reduce the environmental impact of digital technologies so that their innovative potential in service of a climate transition isn't tarnished by growing energy consumption. There is a balance that must be struck between the need to reduce emissions from the technology sector and the vitally important role digital technologies, and in particular FinTech, play in economic and social development — and in keeping the world connected in times of emergency. The end goal of this transformation is a CLIC economy (Circular, Lean, Inclusive and Clean). The CLIC economy leverages efficient production and consumption, and the sharing economy; reducing the wasteful accumulation of idle assets.

As it supports greater financial inclusion, we believe FinTech is one step towards this transformation.

sources.

Download whitepaper

Investing in the digitalisation of financial services provides noteworthy return potential, in our opinion. A large number of high quality companies exist in the FinTech universe and, given the right expertise in both financials and technology, it is possible to construct a diversified portfolio that reaps potential benefits.