investment viewpoints

From hope to secular growth

We believe that equity markets have moved from a ‘hope’ phase to a phase focusing on secular growth that favours thematics and stock selection

Equity markets typically go through performance phases during which investors preferences tend to shift between different topics. We have identified 4 phases: wall of worries, hope, secular growth and then exuberance.

At the onset of an economic recession, investors are facing a “wall of worries” that translate into very risk-off behaviors. Liquidity, financial strength, resilient quality and growth scarcity are characteristics that very much sought after. During that “wall of worries” phase, equity markets tend to fall precipitously as well as earnings and valuation multiples. Analysing the data available since the early 80s, we see this period can last from 16 months up to 30 months. This time around, it lasted about 4 months.

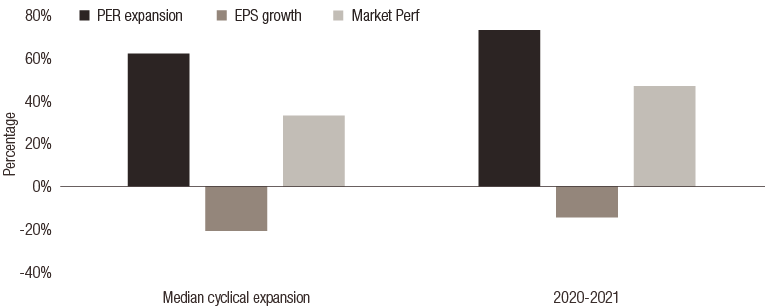

As central banks or government become more accommodative and supportive towards economic recovery, investors move into a risk-on behavior and are willing to look through the “wall of worries”. Even though corporate earnings tend to continue to decrease, “hope” is driving expectation for a cyclical recovery. Equity market tend to re-rate strongly, ahead of earnings, and PERs expand strongly as a result. During that period, the forward yield curve also tend to steepen anticipating at some point in the future that accommodative monetary policies will need to normalise. Historically, during such “hope phase”, PERs expand 60% while EPS could continue to fall (-20% on average) and market jumps over 30% (see chart 1). During this current “hope phase”, PERs have expanded a bit more (73%), EPS have fallen 15% and equity markets rose 47%. On a historical basis, such a phase lasts for 16 months, but this time around, it has lasted for 12 months.

Chart 1: “Hope phase”, comparison of past cyclical expansion with current cyclical expansion

Source: LOIM Research. For illustrative purposes only

We believe the economic data and market moves would suggest we are now transitioning out of the ‘hope’ or ‘expectation phase’ of the market cycle – where markets tend to rebound very strongly and valuations outstrip earnings – to the ‘secular growth phase.’

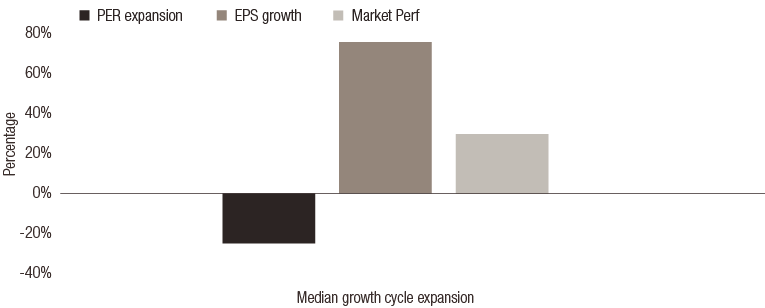

The economy is strengthening and stabilising across industries, which we believe is causing investors’ attention to shift back to secular growth. During this phase, we should see earnings start to catch up to valuations, multiples starting to decrease, and equity markets are still going up but to a much lesser extent than relative to the previous phase. Based on historical analysis, a “secular growth phase” implies a contraction of PERs by almost 25% while the expected growth in earnings is being delivered (almost 80%). This phase lasts on average 38 months during which equity markets can go up by almost 30%, implying an almost 9% annualized price return to which dividend yields can be added.

Chart 2: “Secular Growth phase”, review of historical characteristics

Source: LOIM Research. For illustrative purposes only

We believe that we are now entering this more secular growth phase. The “easier”, more cyclical, more violent, part of the market recovery is most likely behind us. We should move from a market that is less driven by style rotation between factors (cyclicals versus defensives or value versus growth) to a market where stock selection is key. It should talk to High Conviction strategies in particular.

Evidence of the transition

A more hawkish Federal Reserve is now anticipating two interest rate hikes in 2023, in response to an upgraded economic outlook and an uptick in inflation. The US central bank elected to keep the main rate at a range of 0 to 0.25 percent in June, but there are clear signs officials are growing more confident about the economic outlook and the need for tighter monetary policy. But it has also implicitly indicated that it has put back its hands on the steering wheel and could be ready to act in case things overshoot. Data dependency has increased significantly.

In March, seven out of a possible 18 Federal Open Market Committee (FOMC) members said there would be cause to raise rates in 2023. In the June meeting, 13 members predicted the first rate rise would occur in 2023.

The Federal Reserve said it expects to maintain an accommodative stance of monetary policy until maximum employment is achieved along with inflation at the target rate of 2 percent. The Fed has also revised up its expectations for economic growth this year, from 6.5% at the March meeting to 7% in June. Unemployment is expected to fall to 4.5% by the end of the year, and to 3.8% in 2022, and core inflation is now expected to be 3% this year – up from the 2.2% forecast in March.

This notion that equity markets are moving into a new phase in the cycle is reinforced by a number of factors, including the slope of the US treasury yield curve. The steepening of the yield curve has paused and started to flatten, in anticipation of potential rate hikes, and the 10-year yield was down by 0.2 percentage points in late June compared with the end of March. Meanwhile, the US dollar has been strengthening, while the VIX volatility index climbed from 15 to 20 in June. Initial flattening in the yield curve tend to be a good indicator in the transition between equity market phases.

Inflationary pressures

A key uncertainty out there remain whether cyclical or transitory inflation could morph into more structural inflation. This has the potential to create significant disruption.

There are a number of potential catalysts which could lead to such structural rise in inflation that we continue to monitor. These include the stimulus packages under negotiation, such as President Biden’s USD 1.2tn infrastructure bill, the risk of a rapid appreciation of the renminbi, and the possibility of further trade friction. ‘Uberconsumption’ is another factor which may feed inflationary pressures as consumers unleash their savings that have built up during the pandemic. In addition, more structurally, we see a large numbers of workers start to exit the workforce in the decade to come due to ageing, leading to a potential scarcity of labour.

Thematic focus

In this environment, it is our view that weighing exposures to factors such as growth or value becomes less important and stock selection comes to the fore. This presents a good opportunity to catch ‘laggers’ – stocks which have yet to catch up with their valuations - and maintain a focus on quality stock selections. It also presents an opportunity to pick attractively priced structural growth themes, that have been left behind during the “hope” phase as investors have mostly focused on cyclicality. These attractive growth themes are sustainability, silver economy, world brands, digitalisation and the rise of north Asia.

For a PDF version of this article, please the download button provided.

informations importantes.

À l’usage des investisseurs professionnels uniquement

Le présent document a été publié par Lombard Odier Funds (Europe) S.A., société anonyme (SA) de droit luxembourgeois, ayant son siège social sis 291, route d’Arlon, 1150 Luxembourg, agréée et réglementée par la CSSF en tant que Société de gestion au sens de la directive 2009/65/CE, telle que modifiée, et au sens de la directive 2011/61/UE sur les gestionnaires de fonds d’investissement alternatifs (directive GFIA). La Société de gestion a pour objet la création, la promotion, l’administration, la gestion et la commercialisation d’OPCVM luxembourgeois et étrangers, de fonds d’investissement alternatifs (« FIA ») et d’autres fonds réglementés, d’organismes de placement collectif ou d’autres véhicules d’investissement, ainsi que l’offre de services de gestion de portefeuille et de conseil en investissement.

Lombard Odier Investment Managers (« LOIM ») est un nom commercial.

Ce document est fourni à titre d’information uniquement et ne constitue pas une offre ou une recommandation d’acquérir ou de vendre un titre ou un service quelconque. Il n’est pas destiné à être distribué, publié ou utilisé dans une quelconque juridiction où une telle distribution, publication ou utilisation serait illégale. Ce document ne contient pas de recommandations ou de conseils personnalisés et n’est pas destiné à remplacer un quelconque conseil professionnel sur l’investissement dans des produits financiers. Avant de conclure une transaction, l’investisseur doit examiner avec soin si celle-ci est adaptée à sa situation personnelle et, si besoin, obtenir des conseils professionnels indépendants au sujet des risques, ainsi que des conséquences juridiques, réglementaires, financières, fiscales ou comptables. Ce document est la propriété de LOIM et est adressé à son destinataire pour son usage personnel exclusivement. Il ne peut être reproduit (en totalité ou en partie), transmis, modifié ou utilisé dans un autre but sans l’accord écrit préalable de LOIM. Ce document contient les opinions de LOIM, à la date de publication.

Ni ce document ni aucune copie de ce dernier ne peuvent être envoyés, emmenés ou distribués aux États-Unis, dans l’un de leurs territoires, possessions ou zones soumises à leur juridiction, ni à une personne américaine ou dans l’intérêt d’une telle personne. À cet effet, l’expression « Personne américaine » désigne tout citoyen, ressortissant ou résident des États-Unis d’Amérique, toute association organisée ou existant dans tout État, territoire ou possession des États-Unis d’Amérique, toute société organisée en vertu des lois des États-Unis ou d’un État, d’un territoire ou d’une possession des États-Unis, ou toute succession ou trust soumis dont le revenu est imposable aux États-Unis, qu’en soit l’origine.

Source des chiffres : sauf mention contraire, les chiffres sont fournis par LOIM.

Bien que certaines informations aient été obtenues auprès de sources publiques réputées fiables, sans vérification indépendante, nous ne pouvons garantir leur exactitude ni l’exhaustivité de toutes les informations disponibles auprès de sources publiques.

Les avis et opinions sont exprimés à titre indicatif uniquement et ne constituent pas une recommandation de LOIM pour l’achat, la vente ou la détention de quelque titre que ce soit. Les avis et opinions sont donnés en date de cette présentation et sont susceptibles de changer. Ils ne devraient pas être interprétés comme des conseils en investissement.

Aucune partie de ce document ne saurait être (i) copiée, photocopiée ou reproduite sous quelque forme et par quelque moyen que ce soit, ou (ii) distribuée à toute personne autre qu’un employé, cadre, administrateur ou agent autorisé du destinataire sans l’accord préalable de Lombard Odier Funds (Europe) S.A. Au Luxembourg, ce document est utilisé à des fins marketing et a été approuvé par Lombard Odier Funds (Europe) S.A., qui est autorisée et réglementée par la CSSF.

© 2021 Lombard Odier IM. Tous droits réservés.