investment viewpoints

Embedding sustainability in convertibles

We believe a sustainability revolution is transforming our economies and the companies that drive them. Because sustainability is upending the traditional investment landscape in terms of both risks and rewards, we screen our investments according to sustainability criteria. Because such a momentous change can be challenging to measure, we have developed a proprietary approach to embed sustainability in our investment process and to optimise data metrics. And because sustainability is such a powerful force driving how companies operate, we integrate it fully into our investment process for convertible bonds and indeed, across all mainstream asset classes at Lombard Odier Investment Managers.

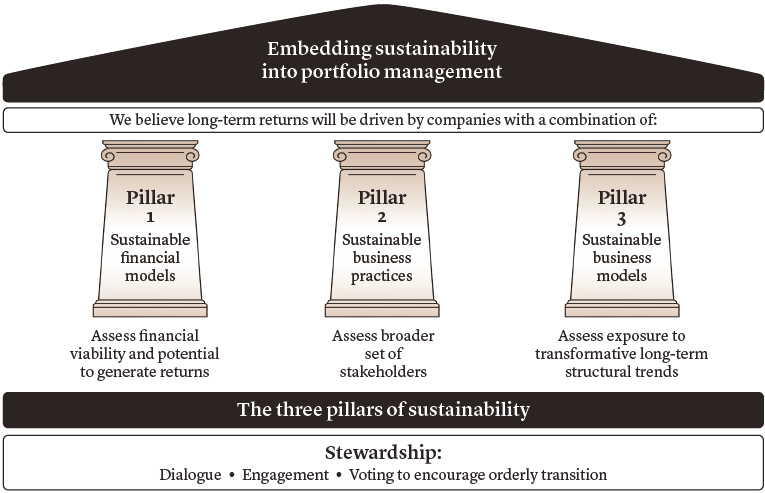

Our central investment philosophy is that companies with a combination of sustainable financial models, sustainable business practices and sustainable business models will deliver sustainable excess risk-adjusted returns over the long-term. As such, we evaluate issuers relative to sustainability metrics in these three areas.

Financial models and convexity

The first area, or pillar, involves assessing issuers based on their financial models. We look at a company’s financial viability and if it represents an attractive opportunity to generate returns. Specifically for convertible bonds, our investment approach aims to maximise risk-adjusted returns by finding securities with the most attractive, asymmetric characteristics, which we measure as convexity.

The value of this convexity stems from convertibles containing both a bond element and an equity option. Convertibles embed investor exposure to a company’s share price, therefore our financial model assessment focuses on the potential for the company’s share to generate excess economic returns. The bond element of convertibles, meanwhile, exposes investors to that company’s credit risk. This means our assessment must consider an issuer’s creditworthiness. We also screen the convertible universe for many other factors, such as taking into account the liquidity of an issue and favouring only larger issuance of more than USD 150 million.

We then conduct fundamental analysis on credit quality, looking at a company’s leverage, the upcoming maturity of its debt, its capital structure, its cash flow, sources it can tap for repayment and how it remunerates investors for the risk taken. For the equity portion of exposure, we look at the attractiveness of the sector, how the equity is priced, how volatile the share has been, what the management strategy is and how the company is positioned for competitive advantage.

“Our investment approach aims to maximise risk-adjusted returns by finding securities with the most attractive, asymmetric characteristics”

Our technical reviews involve finding the most balanced bonds according to strict technical factors. Here we look at the convertible’s convexity, its yield and how the equity optionality is priced. Overall, in pillar one, our convertible experts focus on issuers who are financially viable in terms of the future of their share price, as well as in terms of their ability to repay debt.

Delivering long-term value

The second pillar looks at how businesses behave in relation to their broader ecosystem of stakeholders. For a company to deliver long-term value, we believe it needs to be focused on all its stakeholders, including regulators, shareholders, employees, clients, suppliers, the environment and its local community. Here again, we analyse business practices for both the credit and equity elements of our process.

We believe business practices can drive operating performance in the same way as costs and revenue. In our view, companies that can show strong performance on environmental, social and governance (ESG) issues will benefit from stronger growth over the long-term, not least because they can avoid the pitfalls of potentially value-destructive controversies. We have developed a proprietary approach to measuring sustainability-driven change.

In our view, analysing business practices is about much more than applying third-party ESG ratings. Our long experience in this area has taught us the importance of collecting, verifying and enhancing large amounts of raw data through careful analysis and information exchange with companies. We use our own methodology to score companies based on 115 distinct, identifiable and credible data points to analyse whether they are aligned with best practice in terms of ESG matters, and whether they are making progress in transitioning to more sustainable business practices.

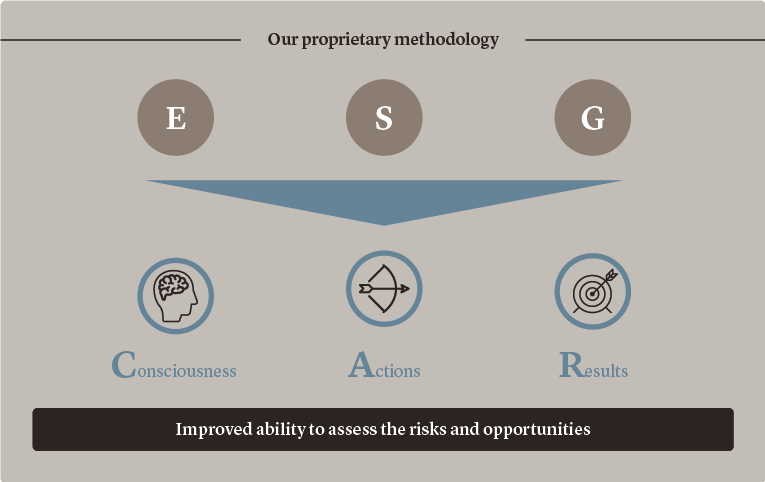

We have also developed a proprietary ‘CAR’ methodology, which helps us differentiate between companies that are talkers, doers or achievers when it comes to sustainability. We believe this methodology - which breaks ESG data down into consciousness, action and results (CAR) - is more valuable than relying solely on external aggregated ratings as it helps identify companies making genuine progress towards more sustainable business practices.

Using our proprietary ESG/CAR analysis enriches our process because it provides our convertible bond analysts and portfolio managers a framework of non-financial information alongside their financial analysis. In turn, this improves the ability to assess the risks and opportunities associated with a company, ultimately leading to better-informed decisions.

In the second pillar, we also evaluate an issuer’s exposure to controversies. A company’s exposure to controversies in the short-term is a strong signal that it is not focused on best business practices over the long-term. We use the classification of incidents established in the UN Global Compact Principles and an assessment of each incident's severity.

We look at what impact measures the company is undertaking in its business practices, by analysing, for instance, a company’s carbon emissions and water consumption. This helps us assess how companies are trying to reduce their economic risk in a carbon- and water-constrained economy. In turn, that gives us a better understanding of their resilience to the future path of regulation.

Business models and impact measures

Pillar three homes in on a company’s ability to take advantage of transformative long-term structural trends, or sustainable business models. This third pillar is particularly relevant in the context of assessing the equity option of a convertible bond as it speaks to the likely long-term growth of the issuer’s share price, and thus the value of the option.

At LOIM, we expect demographics, climate change, natural resources, the digital revolution and inequality to transform the global economy. Within each of these so-called megatrends, we map out the likely path of future development for a more sustainable outcome in order to better understand which sectors will be impacted, and how. As a consequence, we aim to identify opportunities that can be translated into investment themes and, ultimately, determine how well or poorly a company is positioned.

In addition to our investment analysis, we strongly believe in the importance of active ownership, or stewardship. In our view, companies with engaged shareholders are more likely to deliver superior, sustainable risk-adjusted returns. A significant element of our stewardship efforts involves engaging with companies to enhance our understanding of a company’s sustainability, and thereby strengthen our investment process.

As the sustainability revolution continues to unfold, our pillar-based approach enables our team of convertible bond specialists to better assess how these changes will affect companies. We believe that equipping our investment specialists with a bespoke framework to evaluate sustainability helps them make more informed choices, which, in turn, promote better investment outcomes1.

Please find key terms in the glossary.