investment viewpoints

A net-zero solution is more than a low-carbon strategy

The race is on. What we are confronting is a new industrial revolution, unfolding at the speed of the digital age, and one that will generate immense opportunities and risks in fixed-income markets.

To convey the scale of the net-zero challenge, Bill Gates uses the analogy of a bathtub slowly filling up with water. Because the effect is cumulative, even the slowest trickle will cause the tub to overflow eventually. At the current rate of emissions – 52 Gt CO2e each year – we have less than 10 years before we breach 1.5° C of global warming, a level judged as vital if we are to limit catastrophic environmental, social and economic damage1.

To be on track for achieving net-zero emissions by 2050, we have nine years to reduce emissions by 50%. This urgency is therefore driving action by policymakers, companies and consumers for rapid decarbonisation. As investors, we must rethink our portfolios for this profound economic transition.

Problems with low-carbon strategies

Today, bond indices carry an immense amount of climate risk that we believe is not accurately priced in. For fixed-income investors with sights on net zero, the obvious question is: how should carbon risk be managed?

Historically, many investors have responded by adopting low-carbon strategies that exclude sectors and companies with high emissions in favour of low emitters. In our view, this approach is flawed, for a number of reasons:

• Missed opportunities: By ignoring companies with large carbon footprints but credible decarbonisation trajectories, it prevents investors from accessing climate-transition opportunities

• Slowing the transition: By excluding essential companies – such as steel and cement businesses – that are truly decarbonising and whose progress is vital achieving net zero, it slows the pace of the transition

• Concentration risk: By significantly restricting the investible universe, low-carbon strategies can reduce diversification and therefore increase concentration risk

In our view, investors seeking to capture opportunity and avoid risk in the net-zero transition should take an economy-wide, forward-looking view that extends far beyond current carbon footprints.

Ultimately, they must identify companies – which, irrespective of their sector or current carbon footprints – are executing credible plans to reduce their emissions in alignment with a net-zero future.

We call this investing in the transition.

Cooling portfolios, cooling the economy

Investing in the transition requires stepping beyond carbon-footprint analyses and gaining a clear sight of companies’ decarbonisation trajectories. By doing so, investors can judge whether businesses are transition opportunities to be captured or risks to be avoided.

With this forward-looking view, we believe that some of the best net-zero opportunities exist among companies whose current emissions would exclude them from low-carbon strategies but, due to their action on achieving carbon-reduction targets, indicate that they are on viable decarbonisation pathways. Their potential to thrive in a world aligning to – and achieving – net zero could be underpriced by the market.

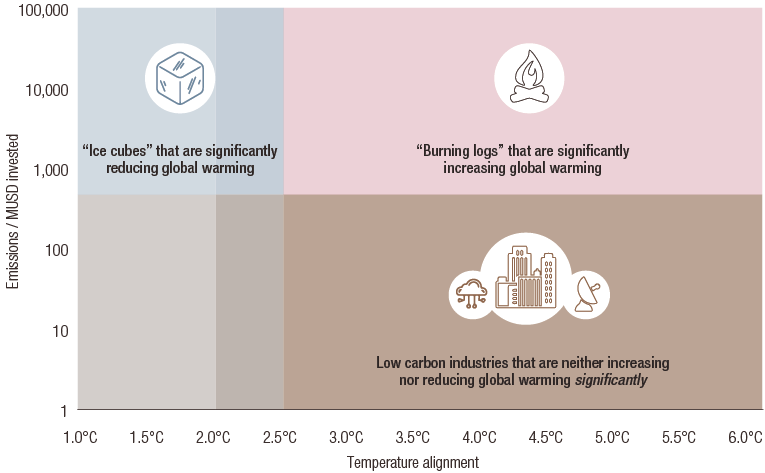

We define these transition opportunities as ‘ice cubes’ because their progress on reducing emissions is helping to cool the economy. In direct contrast, what we define as transition risks or ‘burning logs’ are the heavy emitters with no apparent plans to decarbonise. They are doing nothing to advance the transition and will likely become casualties at or on the way to net zero.

FIG 1 Ice cubes and burning logs: illustrative examples

Towards a net-zero solution

We do not expect the net-zero transition to be smooth. Instead of targeting low-carbon sectors today, or managing to a climate benchmark with step-change reductions in emissions, we aim to adapt to changes in emission levels and reduction targets at the industry and company level. At LOIM, our sustainability team has developed forward-looking, science-based carbon expertise that underpins our net-zero investment approach. Broadly, it consists of four steps:

-

We assess the overall CO2 exposure of a company in terms of scope 1, 2 and 3 emissions2. This goes further than most climate-risk models on the market, including the European Union Climate benchmarks, which is delaying the inclusion of scope 3 emissions.

-

We assess the company’s expected rate of decarbonisation and performance against the level required for its industry to become aligned with a net-zero world.

-

We consider the impact of emissions-curbing regulations and peer pressure created by decarbonising competitors, and identify opportunities to drive change through stewardship.

-

Combining all of this information, we assess how closely a potential investment’s emissions trajectory is declining to 100% decarbonisation by 2050, validated by interim targets.

Targeting net zero in fixed income

In fixed-income markets, the universe of net-zero-aligned companies is limited. A truly net-zero portfolio of corporate bonds is therefore currently impracticable – although we expect this to become possible in the coming years as the transition accelerates. But our conviction in investing in the transition compels us to seek ice cubes, avoid burning logs and engage to accelerate progress in achieving net zero.

In doing so, we look forward and across the entire economy – not restricting ourselves to low-carbon sectors – aiming to decarbonise, diversify and drive the transition.

Sources

important information.

For professional investor use only

This document has been issued by Lombard Odier Funds (Europe) S.A. a Luxembourg based public limited company (SA), having its registered office at 291, route d’Arlon, 1150 Luxembourg, authorised and regulated by the CSSF as a Management Company within the meaning of EU Directive 2009/65/EC, as amended; and within the meaning of the EU Directive 2011/61/EU on Alternative Investment Fund Managers (AIFMD). The purpose of the Management Company is the creation, promotion, administration, management and the marketing of Luxembourg and foreign UCITS, alternative investment funds ("AIFs") and other regulated funds, collective investment vehicles or other investment vehicles, as well as the offering of portfolio management and investment advisory services.

Lombard Odier Investment Managers (“LOIM”) is a trade name.

The Fund is authorised and regulated by the Luxembourg Supervisory Authority of the Financial Sector (CSSF) as a UCITS within the meaning of EU Directive 2009/65/EC, as amended. The management company of the Fund is Lombard Odier Funds (Europe) S.A. (hereinafter the “Management Company”), a Luxembourg based public limited company (Société Anonyme SA), having its registered office at 291, route d’Arlon, L-1150 Luxembourg, authorized and regulated by the CSSF as a Management Company within the meaning of EU Directive 2009/65/EC, as amended. The Fund is only registered for public offering in certain jurisdictions. The articles of association, the prospectus, the Key Investor Information Document, the subscription form and the most recent annual and semi-annual reports are the only official offering documents of the Fund’s shares (the “Offering Documents”). They are available on http//www.loim.com or can be requested free of charge at the registered office of the Fund or of the Management Company, from the distributors of the Fund or from the local representatives as mentioned below.

Austria. Supervisory Authority: Finanzmarktaufsicht (FMA), Representative: Erste Bank der österreichischen Sparkassen AG, Am Belvedere 1, 1100 Vienna - Belgium. Financial services Provider: CACEIS Belgium S.A., Avenue du Port 86C, b320, 1000 Brussels - France. Supervisory Authority: Autorité des marchés financiers (AMF), Representative: CACEIS Bank, place Valhubert 1-3, F-75013 Paris - Germany. Supervisory Authority: Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin), Representative: DekaBank Deutsche Girozentrale, Mainzer Landstraße 16, D-60325 Frankfurt am Main - Gibraltar. Supervisory Authority: Gibraltar Financial Services Commission (GFSC), Information agent: Lombard Odier & Cie (Gibraltar) Limited, Suite 921 Europort - Greece. Supervisory Authority: Hellenic Capital Market Commission. Paying agent: PIRAEUS BANK S.A., 4, Amerikis Str., 105 64, Athens - Italy. Supervisory Authority: Banca d’Italia (BOI) / ConSob, Paying Agents: Société Générale Securities Services S.p.A., Via Benigno Crespi, 19/A - MAC 2, 20159 Milano, State Street Bank International GmbH - Succursale Italia, Via Ferrante Aporti, 10, 20125 Milano, Banca Sella Holding S.p.A., Piazza Gaudenzio Sella, 1, 13900 Biella, Allfunds Bank S.A.U., Milan Branch,Via Bocchetto 6, 20123 Milano, BNP Paribas Securities Services, With its registered office in Paris, rue d'Antin, 3, and operating via its Milan subsidiary at Piazza Lina Bo Bardi, 3, 20124 Milan - Liechtenstein. Supervisory Authority: Finanzmarktaufsicht Liechtenstein (“FMA”), Representative, LGT Bank AG Herrengasse 12, 9490 Vaduz - Netherlands. Supervisory Authority: Autoriteit Financiële Markten (AFM). Representative: Lombard Odier Funds (Europe) S.A. – Dutch Branch, Parklaan 26, 3016BC Rotterdam - Spain. Supervisory Authority: Comisión Nacional del Mercado de Valores (CNMV), Representative: Allfunds Bank, S.A.U. C/ de los Padres Dominicos, 7, 28050, Madrid – Sweden. Supervisory Authoriy: Finans Inspektionen (FI). Representative: SKANDINAVISKA ENSKILDA BANKEN AB (publ), Kungsträdgårdsgatan, SE-106 40 Stockholm – Switzerland. Supervisory Authority: FINMA (Autorité fédérale de surveillance des marchés financiers), Representative: Lombard Odier Asset Management (Switzerland) SA, 6 av. des Morgines, 1213 Petit-Lancy; Paying agent: Bank Lombard Odier & Co Ltd, 11 rue de la Corraterie, CH-1204 Geneva. UK. Supervisory Authority: Financial Conduct Authority (FCA), Representative: Lombard Odier Asset Management (Europe) Limited, Queensberry House, 3 Old Burlington Street, London W1S3AB,

NOTICE TO RESIDENTS OF THE UNITED KINGDOM The Fund is a Recognised Scheme in the United Kingdom under the Financial Services & Markets Act 2000. Potential investors in the United Kingdom are advised that none of the protections afforded by the United Kingdom regulatory system will apply to an investment in LO Funds and that compensation will not generally be available under the Financial Services Compensation Scheme. This document does not itself constitute an offer to provide discretionary or non-discretionary investment management or advisory services, otherwise than pursuant to an agreement in compliance with applicable laws, rules and regulations.

Singapore: This marketing communication has been approved for use by Lombard Odier (Singapore) Ltd for the general information of accredited investors and other persons in accordance with the conditions specified in Sections 275 and 305 of the Securities and Futures Act (Chapter 289). Recipients in Singapore should contact Lombard Odier (Singapore) Ltd, an exempt financial adviser under the Financial Advisers Act (Chapter 110) and a merchant bank regulated and supervised by the Monetary Authority of Singapore, in respect of any matters arising from, or in connection with this marketing communication. The recipients of this marketing communication represent and warrant that they are accredited investors and other persons as defined in the Securities and Futures Act (Chapter 289). This advertisement has not been reviewed by the Monetary Authority of Singapore.

Hong Kong: This marketing communication has been approved for use by Lombard Odier (Hong Kong) Limited, a licensed entity regulated and supervised by the Securities and Futures Commission in Hong Kong for the general information of professional investors and other persons in accordance with the Securities and Futures Ordinance (Chapter 571) of the laws of Hong Kong.

An investment in the Fund is not suitable for all investors. There can be no assurance that the Fund's investment objective will be achieved or that there will be a return on capital. Past or estimated performance is not necessarily indicative of future results and no assurance can be made that profits will be achieved or that substantial losses will not be incurred. Where the fund is denominated in a currency other than an investor's base currency, changes in the rate of exchange may have an adverse effect on price and income. All performance figures reflect the reinvestment of interest and dividends and do not take account the commissions and costs incurred on the issue and redemption of shares/units; performance figures are estimated and unaudited. Net performance shows the performance net of fees and expenses for the relevant fund/share class over the reference period. This document does not contain personalized recommendations or advice and is not intended to substitute any professional advice on investment in financial products. Before making an investment in the Fund, an investor should read the entire Offering Documents, and in particular the risk factors pertaining to an investment in the Fund, consider carefully the suitability of such investment to his/her particular circumstances and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. This document is the property of LOIM and is addressed to its recipient exclusively for their personal use. It may not be reproduced (in whole or in part), transmitted, modified, or used for any other purpose without the prior written permission of LOIM. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful. This document contains the opinions of LOIM, as at the date of issue. The information and analysis contained herein are based on sources believed to be reliable. However, LOIM does not guarantee the timeliness, accuracy, or completeness of the information contained in this document, nor does it accept any liability for any loss or damage resulting from its use. All information and opinions as well as the prices indicated may change without notice. Neither this document nor any copy thereof may be sent, taken into, or distributed in the United States of America, any of its territories or possessions or areas subject to its jurisdiction, or to or for the benefit of a United States Person. For this purpose, the term "United States Person" shall mean any citizen, national or resident of the United States of America, partnership organized or existing in any state, territory or possession of the United States of America, a corporation organized under the laws of the United States or of any state, territory or possession thereof, or any estate or trust that is subject to United States Federal income tax regardless of the source of its income.

Source of the figures: Unless otherwise stated, figures are prepared by LOIM.

The Fund's investments in Fixed Income securities are subject to the risks associated with debt securities including economic conditions, government regulations, market sentiment, and local and international political events. In addition, the market value of fixed income securities will fluctuate in response to changes in interest rates, currency values, and the creditworthiness of the issuer. If an issuer’s financial condition worsens, the credit quality of the issuer may deteriorate making it difficult for an investor to sell such investments.

Towards sustainability label is based on specific quantitative and qualitative rules referred as Quality Standards. It requires exclusion of the financing of a limited number of practices that are widely regarded as unsustainable. The quality standard does not stipulate how the requirements should be fulfilled in practice: this is left to the expertise of the product manager. The standard provides a mix of exclusion, impact, engagement, transparency and accountability. The balance of these elements and the specific requirements associated, will evolve and be adapted over time to reflect the evolving expectations of investors and the needs of society, and the legislative translation of these needs and expectations. As such, the quality standard is not fixed and shall be evaluated regularly in a multi-stakeholder context. Independent supervision by the Central Labeling Agency (CLA) protects the integrity of the quality standard and the label, and will manage their continuing development.

Although certain information has been obtained from public sources believed to be reliable, without independent verification, we cannot guarantee its accuracy or the completeness of all information available from public sources.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by LOIM to buy, sell or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change. They should not be construed as investment advice.

No part of this material may be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorised agent of the recipient, without Lombard Odier Funds (Europe) S.A prior consent. In Luxembourg, this material is a marketing material and has been approved by Lombard Odier Funds (Europe) S.A. which is authorized and regulated by the CSSF.

©2021 Lombard Odier IM. All rights reserved.