investment viewpoints

Portfolio diversification: bonds and beyond

Bonds have been a highly attractive asset class for the past 30 years, providing consistent income and protecting1 portfolios when recessions hit.

Yet this dynamic has now seemingly reversed, with bond yields low, or even negative - around USD13trillion of bonds have a negative yield.

Central banks are still following an easing monetary policy and governments have embarked on vast fiscal stimulus programs, raising hopes for a rebound in economic growth but stoking fears of a return of inflation. Hence, ‘risk-free interest’ as highly rated sovereign bonds have been known, has become ‘interest-free risk’ as some have coined it.

The role of bonds amid shifting dynamics

Against this backdrop, two questions have risen to the top of investors’ mind: Firstly, are bonds still useful in portfolios, continuing to provide protection and if not, where else can investors turn? And secondly, how do shifting bond market dynamics affect other asset classes, in particular relative to equities?

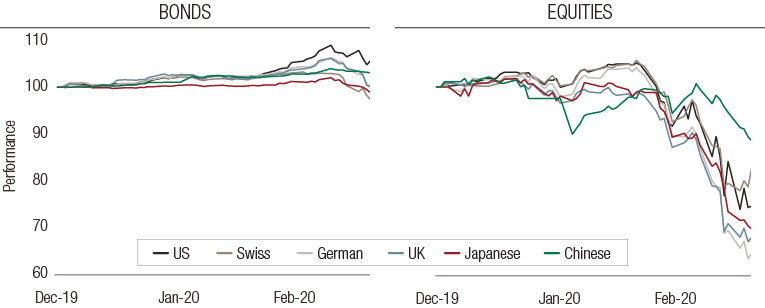

First off, let us remember that 12 months ago, yields were about where they are today. During the Covid shock of February/March 2020, bonds did protect portfolios, albeit unevenly and to a lesser extent than in the past, eg in the financial crisis of 2008 – see Figure 1. For example, Swiss or Japanese government bonds provided no protection at the height of the pandemic shock. They displayed ‘positive correlation’ -their returns were correlated or moved in the same direction as equities- and negative performance that did not offset the negative return of equities.

On the other hand, US bonds, despite a short initial sell-off, did offer some protection, providing negative correlation to equities and positive performance. So, an outright removal of sovereign bonds from portfolios seems too extreme, in our view. What is clear, though, is that the breadth and depth of the protection have diminished.

Figure 1. Performance of bonds and equities Q1 2020

Source: Bloomberg. Indices used: US Bonds: MLT1US10 Index; US Equities: SPXT Index; Swiss Bonds: SBR12T Index; Swiss Equities: SPI Index; German Bonds: RX1 Comdty; German Equities: DAX Index; UK Bonds: G 1 Comdty; UK Equities: UKX Index; Japan Bonds: JB1 Comdty; Japan Equities: NKY Index; Chinese Bonds: I08273CN Index; Chinese Equities: SHCOMP Index.

Identifying diversifiers

So where can investors turn for diversification? There are fortunately a few answers.

Within traditional sovereign bonds to begin with, looking further afield may prove useful. Chinese sovereign bonds for example, had both positive performance and negative correlation to equities during the Covid shock.

Inflation-linked bonds may have a more important role to play going forward, mixing a sensitivity to ‘duration’, or interest rate risk, with some inflation protection.

Another example is foreign exchange as an asset class, with the Japanese yen or the Swiss franc traditionally seen as safe havens, which can be gained through direct exposure to short-dated foreign bonds.

Gold is a popular safe haven and a traditional inflation hedge, too, although its performance during last year’s shock failed both in terms of correlation to equities (positive) and overall performance (negative).

This frantic search for diversification has also led to the development of a number of so-called ‘defensive strategies’, some using systematic trading designed to protect against equity shocks or other events, for instance a rise in bond yields.

Examples include buying the VIX index, known as the ‘fear index’, or capitalising on the tendency of markets to move in trends. This can be on a long-term basis, or in an increasingly popular format, short-term (intra-day) basis. These types of strategies performed very well last year, with performance ranging from the mid-teens to 40-50% over the Covid shock.

Finally, cash as a protective asset, used tactically, remains an underutilised option, even though it obviously fits the bill with the additional advantage of it simplicity. However, it must be noted that most of these options will themselves lose small amounts of money. For example, with cash rates so low, the value of money on deposit is being eroded by inflation.

Perhaps combining a comfortable yield and a solid diversification potential in a single asset is a thing of the past!

Diversification within equity sectors

With the US Federal Reserve now expecting interest rates to start rising in 2023- investors have started to analyse the sensitivity of their portfolio to rising rates, in particular their equity portfolio.

Historically, the sensitivity of equities to interest rates has varied through time, but recently growth stocks have become increasingly negatively sensitive to rates, with tech stocks selling off on fears of rates rising. At the same time, ‘value’ stocks’ display the opposite behaviour, as shown in Figure 2.

Figure 2. Rate sensitivity for growth and value stocks

Source: Bloomberg, LOIM calculations, Data from 1998-2021.

So the rate sensitivity of an equity portfolio overall may largely depend on its specific exposure to the value and growth sectors.

More generally, if we look at a broader set of equity factors or styles, a similar analysis shows that quality and size currently have a positive rates sensitivity, similar to value above, whereas momentum has a negative sensitivity, like growth.

A finer analysis at sector level sheds an interesting light, with financials, industrials, materials or energy having positive sensitivity to rates. These could potentially be able to offset the negative sensitivity of utilities, telecommunication services, IT and consumer sectors.

In short, it does appear that the sensitivity of equity portfolios to rate movements has accelerated since early 2020. A rotation towards value might be explained in part by a desire to position favourably against a rise in bond yields.

More generally, in our view, allocation to individual sectors can potentially reduce this exposure, but this requires an active, rather than passive, approach, and as a whole, the S&P 500 index has negative sensitivity currently due to its growth bias.

Sources

1 Capital protection represents a portfolio construction goal and cannot be guaranteed.

important information.

For professional investor use only

This document has been issued by Lombard Odier Funds (Europe) S.A. a Luxembourg based public limited company (SA), having its registered office at 291, route d’Arlon, 1150 Luxembourg, authorised and regulated by the CSSF as a Management Company within the meaning of EU Directive 2009/65/EC, as amended; and within the meaning of the EU Directive 2011/61/EU on Alternative Investment Fund Managers (AIFMD). The purpose of the Management Company is the creation, promotion, administration, management and the marketing of Luxembourg and foreign UCITS, alternative investment funds ("AIFs") and other regulated funds, collective investment vehicles or other investment vehicles, as well as the offering of portfolio management and investment advisory services.

Lombard Odier Investment Managers (“LOIM”) is a trade name.

This document is provided for information purposes only and does not constitute an offer or a recommendation to purchase or sell any security or service. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful. This material does not contain personalized recommendations or advice and is not intended to substitute any professional advice on investment in financial products. Before entering into any transaction, an investor should consider carefully the suitability of a transaction to his/her particular circumstances and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. This document is the property of LOIM and is addressed to its recipient exclusively for their personal use. It may not be reproduced (in whole or in part), transmitted, modified, or used for any other purpose without the prior written permission of LOIM. This material contains the opinions of LOIM, as at the date of issue.

Neither this document nor any copy thereof may be sent, taken into, or distributed in the United States of America, any of its territories or possessions or areas subject to its jurisdiction, or to or for the benefit of a United States Person. For this purpose, the term "United States Person" shall mean any citizen, national or resident of the United States of America, partnership organized or existing in any state, territory or possession of the United States of America, a corporation organized under the laws of the United States or of any state, territory or possession thereof, or any estate or trust that is subject to United States Federal income tax regardless of the source of its income.

Source of the figures: Unless otherwise stated, figures are prepared by LOIM.

Although certain information has been obtained from public sources believed to be reliable, without independent verification, we cannot guarantee its accuracy or the completeness of all information available from public sources.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by LOIM to buy, sell or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change. They should not be construed as investment advice.

No part of this material may be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorised agent of the recipient, without Lombard Odier Funds (Europe) S.A prior consent. In Luxembourg, this material is a marketing material and has been approved by Lombard Odier Funds (Europe) S.A. which is authorized and regulated by the CSSF.

©2021 Lombard Odier IM. All rights reserved.