investment viewpoints

Adapting to the inevitability of climate change

The world today faces no greater crisis than our changing climate and environment. An effective response will require a two-pronged approach, including activities aimed at mitigating the advance of climate change in a carbon-constrained world on the one hand, and activities aimed at adaptation to the inevitable consequences of climate change on the other. Both of these sets of efforts are not only vital components of an effective climate strategy, but also create unique, underappreciated, and growing investment opportunities.

Following years of awareness-raising, most attention related to climate change has remained centered on mitigation, and activities that are either already low carbon or can survive a carbon-constrained world. To meet the highest ambition of the Paris Agreement (1.5°C), radical cuts in emissions need to be pursued, roughly halving global emissions by 2030 and reaching net zero carbon emissions (and by the 2060s for total greenhouse gas emissions).

Yet, even in a best-case scenario, communities and businesses around the world will still face profound changes in their operational environment and way of life as climate-damage manifests. Severe economic damage is inevitable and could reach as much as USD 54 to 69 trillion in a 1.5°C and 2°C scenario respectively1. Consequently, the need for investment in improving resilience and adaptive capability has never been greater.

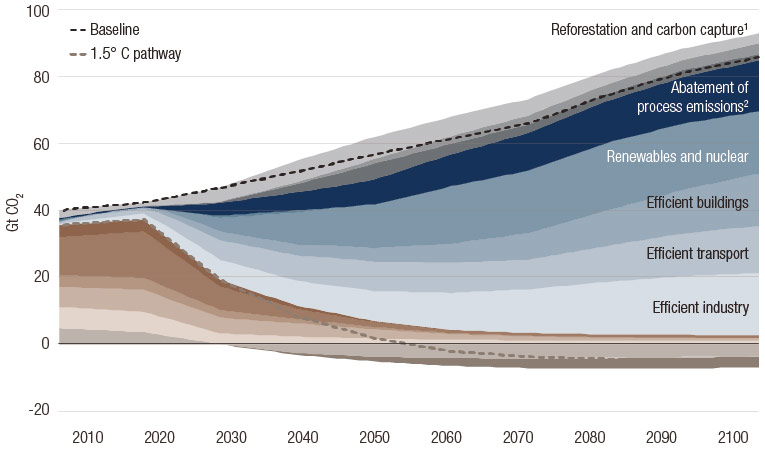

Figure 1. Necessary transitions to achieve the net-zero economy (Gt Co2)

Source: LOIM analysis. 1Agriculture, forestry and land use change (AFOLU); 2Industry emission not related to energy, such as emissions from cement manufacturing.

Adaptation has been an underappreciated aspect of investment products geared to sustainable investment, but has gained increased recognition in international initiatives. The 2015 Paris Agreement, for instance, established a Global Goal for Adaptation (GGA), with the aim of “enhancing adaptive capacity, strengthening resilience and reducing vulnerability to climate change”2. The World Bank, similarly, has launched an action plan under which direct adaptation finance will ramp up to USD 50 billion over the period from 2021 to 20253, placing adaptation and resilience on an equal footing with climate mitigation actions. And, under the new EU Taxonomy for sustainable finance agreed in 2019, adaptation is recognised as an eligible activity in the same vein as actions aimed at mitigation.

How do we adapt?

The United Nations Environmental Programme (UNEP) has estimated as much as USD 500 billion will be required globally for adaptation activities per year4. To date, only 5% of climate change investment is currently spent on adaptation efforts5. Early investment in adaptation is estimated to offer a cost-benefit ratio of one-to-four, since it offers a means of avoiding far worse damage later on.

At present, few products are available to investors to invest in adaptation opportunities directly. Green/cleantech funds offer exposure to highly-publicised technologies in renewable energy or electric mobility, and low-carbon funds tend to cherry-pick exposure to selected subindustries with a smaller emissions footprint. Neither of these types of funds tackle the full scope of the required transition, nor touch on the large and growing requirements for adaptation to a climate-damaged world.

It is reasonable to assume that the market for adaptation activities is likely to grow. Between them, the members of the G20 countries have planned some USD 60 to 70 trillion in infrastructure spending alone over the period to 20306. Meanwhile, ongoing urbanisation means around 60% of the urban environment that will host the world’s population by 2050 is yet to be constructed7. So not only is there a need to increase investment in infrastructure to keep pace with global economic and population growth but also for existing infrastructure to transition to lower carbon intensity and greater resilience to climate damage.

Adaptation in action

Projects related to adaptation are increasing in number, scale and scope. In New York, a USD 10 billion project has been announced to protect Manhattan from rising sea levels and flood risks8. In China, USD 300 billion has been earmarked for investment in so-called “sponge cities”, aimed at increasing cities’ ability to absorb and channel water through soft infrastructure, green spaces and porous roads, rather than the traditional concrete-dominated model or urban growth. Other cities and countries will need to follow these examples as they prepare themselves for the future ahead.

The LO Climate Transition fund regards climate-damage adaptation activities as an intrinsic part of the climate transition. Improving resilience through strengthening infrastructure, monitoring risks through meteorological tools, and managing impact through re-insurance activities are all examples of activities that provide a competitive advantage to companies at risk, as well as an investable opportunity among the providers of these solutions.

The fund gives concrete shape to the call for carbon-constraining activities to be given equal footing with early climate-damage adaptation activities, by explicitly including within its investment universe those companies that we believe offer opportunities to adapt to and monitor climate damage.

Please click here to read the full report.

sources.

important information.

Neither this document nor any copy thereof may be sent, taken into, or distributed in the United States of America, any of its territories or possessions or areas subject to its jurisdiction, or to or for the benefit of a United States Person. For this purpose, the term "United States Person" shall mean any citizen, national or resident of the United States of America, partnership organized or existing in any state, territory or possession of the United States of America, a corporation organized under the laws of the United States or of any state, territory or possession thereof, or any estate or trust that is subject to United States Federal income tax regardless of the source of its income.

Source of the figures: Unless otherwise stated, figures are prepared by LOIM.

Although certain information has been obtained from public sources believed to be reliable, without independent verification, we cannot guarantee its accuracy or the completeness of all information available from public sources.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by LOIM to buy, sell or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change. They should not be construed as investment advice.

No part of this material may be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorised agent of the recipient, without Lombard Odier Funds (Europe) S.A prior consent. ©2020 Lombard Odier IM. All rights reserved.