global perspectives

Simply put: connecting market moves with long-term rates

In our latest multi-asset macro update, we share the following views:

- Long-term interest rates have historically played a pivotal role in driving financial markets, and even more so today.

- Currently, long rates may seem far from their fundamentals but, in fact, they fairly reflect high inflation expectations, excess savings and active central bank policies.

- With strong growth prompting monetary normalisation, real rates could soon resume their ascent.

This year, long-term interest rates have played a key role in understanding and anticipating market fluctuations: their movements have shaped rotations within asset classes. Since early August, interest rates have been rising again and we expect this trend to continue, which raises the question: how far can they go? To answer this question, we believe it is necessary to explore the full scope of the fundamentals behind these moves.

In a Journal of Finance article soberly titled "Discount Rates", John Cochrane, then professor of financial economics at the University of Chicago, presented the idea that interest-rate fluctuations alone explain 100% of the movements in the price-to-dividend ratio. What dividends do not explain about the behaviour of stocks, interest-rate variations do. The point here is not to simply say that monetary policy governs equities, but to understand that, empirically, increases and decreases in long-term interest rates have a significant influence on them. Looking at the 2020-2021 period, it is hard to find any examples that refute Cochrane's conclusion.

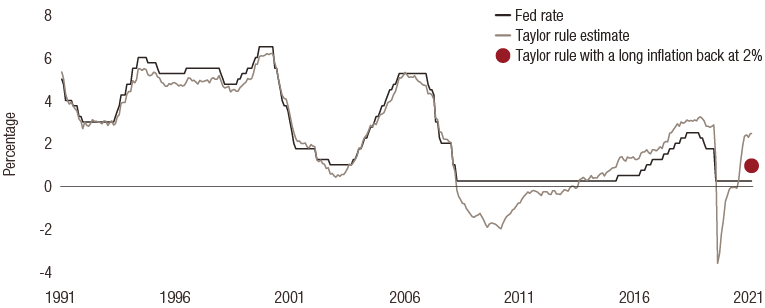

When considering interest-rate fluctuations, confusion naturally arises between the drivers of short rates and long rates – especially during a prolonged period of quantitative easing. This confusion can lead some to believe that long rates are disconnected from their fundamentals. Short rates in most mature economies are governed by the relevant central bank, reflecting its objectives which are generally to control inflation and economic activity directly or indirectly. This is known as the Taylor rule: short rates are empirically a function of expected inflation and various expected measures of economic activity and the labour market.

Policy rates in the US and in Europe, at 0.25% and 0% respectively, currently reflect the Federal Reserve and European Central Bank’s (ECB’s) expectations of high, but temporary, inflation and growth, with more downside than upside risks. Using the Taylor rule, factoring in the US labour market and current inflation levels, we can calculate that the policy rate should reach 2.45% in the US: well above the current rate of 0.25%.

Figure 1 shows that if we assume inflation is temporary, and eventually returns to a level of 2.5%, this same calculation is closer to 1% (as indicated by the red dot on the chart). This suggests the Fed’s policy rates are too low by 1% and this is having a stimulative effect on the US economy. The improving economic outlook should prompt the Fed to raise its policy rate during the next few quarters and the market is already anticipating a rate hike at the end of 2022. In short, nothing is disconnected, everything is tied to expectations.

Chart 1: Taylor rule based on inflation and the labour market with inertia

Through quantitative easing, the ECB, the Bank of England (BoE) and the Bank of Japan (BoJ) have extended their influence over the long end of the yield curve. The temptation to formulate a ‘Taylor rule’ for long rates is strong. Yet if a Taylor-style regression is undertaken, the explanatory power of the model collapses and its parameters become notoriously unstable. Such an intellectual shortcut may be attractive, but it is nonetheless refuted by market data: long rates do not solely respond to the economic cycle.

Cochrane’s "Discount factor" paper outlines four main factors in rates: the macroeconomic situation, behavioural factors, structural effects (that depend on the type of investors in the market) and a liquidity factor. During the last two years, while the macroeconomic factor explains some of the levels reached, it is not the only explanation.

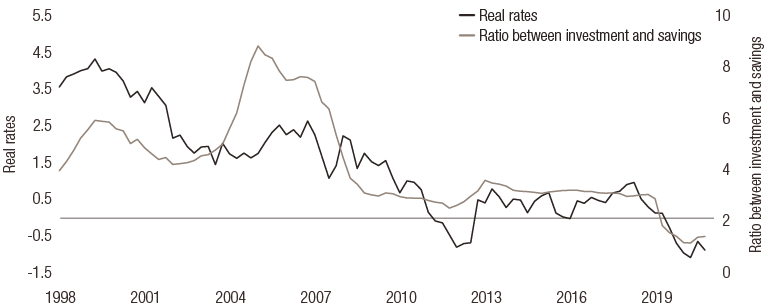

The high level of savings now stored as cash in deposit accounts on both sides of the Atlantic has been a downward force on long-term rates, via real rates. In the US alone, these deposit accounts reached USD 5.3 trillion in April 2021 and have since declined by USD 800 billion. In 2018, these same deposits contracted by USD 500 billion, explaining a 50bp rise in real rates. This year's USD 800 billion decrease only saw real rates rise by 25 bps – this is not surprising given Fed policy expectations are weighing on the market and slowing the progression of real rates.

At the Fed’s November meeting, Chair Jerome Powell is expected to commence the path to normalisation as deposit accounts continue to empty. By the end of the quarter, those 25bps of real rates will need to be caught up. Longer-term, a normalisation of monetary policy, savings and a return of investments to pre-pandemic levels would imply real rates reverting to about 0.5%. This, combined with an inflation premium of 2.5% (the Fed's target) would bring rates back to 3% at the end of the cycle: 0.5% above the Fed's forecast for its long-term short rate. It is therefore clear that fundamentals and markets are connected and valuations should gradually adapt.

Chart 2: - The investment:savings ratio versus real rates in the US

Source : Bloomberg, LOIM as at October 2021. For illustrative purpose only.

|

Simply put, to understand market fluctuations you need to understand the fluctuations in long-term interest rates. These long rates should continue to rise as real rates reflect the benign economic conditions the world is currently enjoying. What lies ahead of us is a rise in the cost of capital (this is what rates ultimately are). This is part of the recovery process and will have a significant impact on markets. |

important information.

For professional investor use only

This document is issued by Lombard Odier Asset Management (Europe) Limited, authorised and regulated by the Financial Conduct Authority (the “FCA”), and entered on the FCA register with registration number 515393.

Lombard Odier Investment Managers (“LOIM”) is a trade name.

This document is provided for information purposes only and does not constitute an offer or a recommendation to purchase or sell any security or service. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful. This material does not contain personalized recommendations or advice and is not intended to substitute any professional advice on investment in financial products. Before entering into any transaction, an investor should consider carefully the suitability of a transaction to his/her particular circumstances and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. This document is the property of LOIM and is addressed to its recipient exclusively for their personal use. It may not be reproduced (in whole or in part), transmitted, modified, or used for any other purpose without the prior written permission of LOIM. This material contains the opinions of LOIM, as at the date of issue.

Neither this document nor any copy thereof may be sent, taken into, or distributed in the United States of America, any of its territories or possessions or areas subject to its jurisdiction, or to or for the benefit of a United States Person. For this purpose, the term "United States Person" shall mean any citizen, national or resident of the United States of America, partnership organized or existing in any state, territory or possession of the United States of America, a corporation organized under the laws of the United States or of any state, territory or possession thereof, or any estate or trust that is subject to United States Federal income tax regardless of the source of its income.

Source of the figures: Unless otherwise stated, figures are prepared by LOIM.

Although certain information has been obtained from public sources believed to be reliable, without independent verification, we cannot guarantee its accuracy or the completeness of all information available from public sources.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by LOIM to buy, sell or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change. They should not be construed as investment advice.

No part of this material may be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorised agent of the recipient, without Lombard Odier Asset Management (Europe) Limited prior consent. In the United Kingdom, this material is a marketing material and has been approved by Lombard Odier Asset Management (Europe) Limited which is authorized and regulated by the FCA. ©2021 Lombard Odier IM. All rights reserved.