investment viewpoints

Alphorum: forewarned is forearmed in fixed income

In the lead commentary of the Q4 2021 issue of Alphorum, our quarterly assessment of fixed-income markets, we focus on the interplay of diverse risks and opportunities – from inflation to supply-chain disruption, Chinese growth and the race to net zero.

Stay tuned in the coming week, as we turn our attention to developed and emerging-market bonds, corporate credit, sustainable fixed income and systematic research.

Pragmatic positivity

As we enter the final quarter of 2021, there is plenty for fixed-income investors to feel positive about.

The global vaccination rollout is progressing. Growth appears to be peaking but remains resilient. And while inflation is definitely a potential concern, most market participants accept central banks’ contention that it is transitory. Both the Federal Reserve (Fed) and the European Central Bank (ECB) are plotting a well-signalled path forward, with the US central bank now expected to start tapering before the end of the year. The ECB is also beginning to build its narrative for reducing asset purchases: it has confirmed it will address the scheduled end of the pandemic emergency purchase programme (PEPP) in December and is expected to soften the drop to its ‘normal’ asset-purchase programme after the PEPP runs out.

With the situation relatively stable, we are maintaining our course, focused on carry but wary of valuations. The year so far has progressed largely in line with our expectations, necessitating only relatively minor changes to our strategy. We are increasing credit hedges as they become cheaper, while a reduction in duration is working well at the moment.

In fixed income, it pays to be prepared

That is not to say, however, that we are resting on our laurels. The asymmetric return profile of fixed income demands that we must always remain watchful of downside risk. And as the events of the last 18 months have so vividly shown, danger rarely comes from where it is expected. When the water seems calm, our job is to look for changes in the current. We meticulously examine meaningful data as they emerge and extrapolate their effects on potential scenarios to ensure the course we have plotted remains, to the best of our knowledge, the right one. We are not just scanning the horizon for the ‘known unknowns’, we are using all the tools at our disposal to be ready to weather any storm. In the words of Cervantes: “forewarned, forearmed; to be prepared is half the victory”. So, what are the issues currently on our radar?

In the US, there exists the possibility that the labour market is less resilient than the Fed wants us to believe. The US Employment Cost Index and Average Hourly Earnings continue to show solid readings, with hard-to-fill job openings running at record levels. Current difficulties in hiring seem to be Covid-related and limited to certain sectors such as hospitality, and the situation could start to shift now that Covid-related benefits have been withdrawn. However, it is unclear how many people have stayed out of the labour market until now, and indeed how many will return. This is part of the inflationary story we will continue to monitor.

In Europe, headline inflation has been somewhat higher than expected and is set to run at 2.5-3% year-on-year through to the end of 2021. As in the US, the consensus remains that this is transitory, yet the currently available data makes it difficult to get a clear read. Meanwhile, changes in the political landscape of the major European powers, with the formation of a new government in Germany and elections due next year in France, could influence monetary policy. In general, high debt levels in the wake of the Covid crisis are exacerbating sensitivity to interest rates, so central banks may be forced to work more closely with governments in this regard.

As already mentioned, while growth is still a feature, high-frequency indicators of economic activity show it is slowing. This is to be expected to some extent as the ‘Covid-bounce’ fades. However, it remains to be seen whether there may be a more significant structural issue. Meanwhile, the withdrawal of fiscal stimulus (and indeed the potential for fiscal restrictions) could slow growth in countries which have relied on it to prop up Covid-battered economies. Inflation concerns may not help, as deficit hawks eye mounting public debt.

Then there are the issues with the global supply chain. Will this feed into price rises in the medium to longer term rather than proving to being purely temporary? This could potentially set in motion a chain of events whereby central banks tighten policy, bringing growth expectations down.

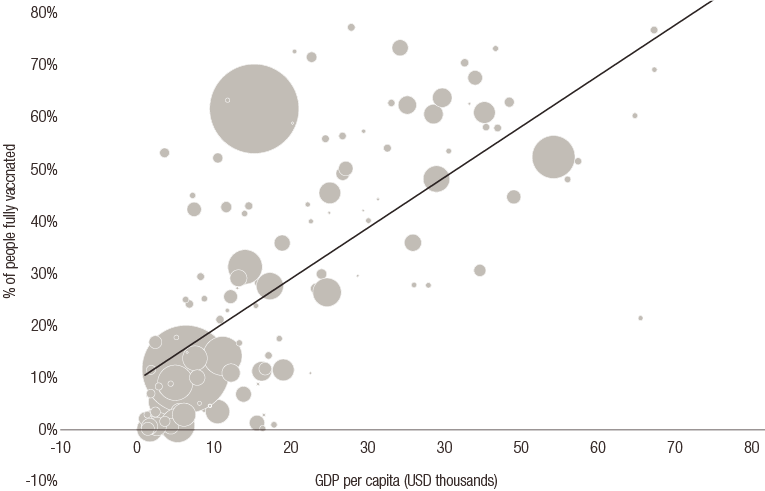

Covid appears to have been tamed, at least in the developed world, for now. As you can see from the charts below, vaccination levels are closely correlated with GDP but the constantly increasing pace of vaccine production should ensure sufficient supply for global vaccination in 2022 (see figures 1 and 2). However, it would be unwise to assume it will all be plain sailing from here.

FIG. 1 Covid vaccination levels relative to GDP

FIG. 2 Forecast Covid vaccination production

Source: Duke University at October 2021. For illustrative purposes only.

The Chinese economy’s rapid rebound from Covid was a strong driver of the global recovery and we are still positive on China in the long term. However, growing evidence of a slowdown could be cause for concern. Shipping and power disruptions may be temporary, and the consequences of Xi Jinping’s policy shift towards ‘common prosperity’ remain to be seen, but we are also mindful of the policy support for sectors including technology and advanced manufacturing in the current Five-Year Plan (2021-2025) and Vision 2035. The fallout from property developer Evergrande’s collapse looks quite contained so far, if you look at the Asian high-yield market, but risk is picking up and could have wider repercussions at some point1. A sustained Chinese slowdown could have global implications for both growth and inflation, so it is something to watch closely.

Will COP26 bring the winds of change?

Given the sustainability focus of our investment approach – and our belief in the need to rethink net zero – we await the outcomes of COP26, the global climate summit to be held in Glasgow in November, with interest. As fixed-income investors, our fundamental interest is in managing risk. One of the key goals of COP26 is for countries to set ambitious 2030 emissions-reduction targets which align with achieving net zero by 2050. Assuming such targets are successfully set, this will translate into significant transition risk and financial losses as the global economy moves towards a fossil-free model. Those companies who fail to adapt (and those who invest in them) will face not only long-term risk from punitive fines (and even obsolescence) but short-term risk from reputational damage, or from policy changes that can happen much faster than what is already priced in by the market.

Of course, targets will only work to address climate change if the necessary policies are put in place to achieve them. One example of where this is already starting to happen is the integration of climate-related risk by central banks, which is being coordinated through the Network for Greening the Financial System (NGFS).

The ECB’s roadmap on climate-change-related actions was released after the central bank’s strategic review this summer. Currently, the ECB’s Corporate Sector Purchase Programme (CSPP) is market neutral, holding bonds in proportion to outstanding totals. This results in a high exposure to firms in high-emitting sectors. The bank is therefore evaluating a switch to market efficiency, incorporating the impact of central bank purchases on firms’ cost of capital and the share of capital funded by bonds. This approach will tend to favour bonds in less carbon-intensive sectors such as services, as well as transitioning companies from all industries. The roadmap includes the provision of concrete proposals for alternative benchmarks in 2022.

How much of the universe is geared to net zero?

With all this in mind, what progress does the corporate credit universe need to make in order to be aligned with a net-zero economy?

Analysis by LOIM’s Sustainability team shows that nearly two-thirds of investment-grade issuers have already disclosed some form of net-zero emissions target. However, only 47 companies from an investible universe of 2,722 have set reduction targets for 2050 that go beyond scope 1 emissions. Meanwhile, in the high-yield universe, 27% of firms have made net-zero commitments, with a mere five out of 1,674 having setting targets that cover more than scope 1 emissions. While the direction of travel is clear and we expect these figures to rise rapidly in the wake of COP26, they do show that there is a long way to go.

Sustainable investment has come in for criticism of late, some of it justified, some of it less so (we expand on this in the Sustainability section of this issue of Alphorum). The core argument of critics like former BlackRock sustainable investing CIO Tariq Fancy is that ESG investing is no substitute for government policy and regulation. We agree, but would also argue that sustainability challenges require market-based solutions, which in turn require capital. From an investment standpoint, sustainability is about considering how ‘new’ factors are likely to impact the risk-return profile of an investment opportunity. These include both climate-related risks (such as transition, physical and litigation risks) and risks from social and governance factors such as equality and diversity.

In terms of climate-related risks, decisions made at COP26 will decide which will become dominant and feature most strongly in climate-related financial risk models: a strong policy commitment will emphasise transition risks; on the other hand, if no agreement is reached, physical risks will begin to dominate. Companies (and investors) who fail to keep a close eye on which way the wind is blowing may find the ship has sailed.

As Cervantes said, forewarned is forearmed.

To read the full Q4 2021 issue of Alphorum, please use the download button provided.

Sources

1 Any reference to a specific company or security does not constitute a recommendation to buy, sell, hold or directly invest in the company or securities. It should not be assumed that the recommendations made in the future will be profitable or will equal the performance of the securities discussed in this document.

informations importantes.

Ce document est publié par Lombard Odier Asset Management (Europe) Limited, autorisée et supervisée par l'autorité de surveillance des services financiers (Financial Conduct Authority ou FCA) et enregistrée sous le numéro 515393 dans le registre de la FCA.

Lombard Odier Investment Managers (“LOIM”) est un nom commercial.

Ce document est fourni exclusivement à des fins d’information et ne constitue pas une offre ou une recommandation d’achat ou de vente d’une valeur mobilière ou d’un service. Il n’est pas destiné à être distribué, publié ou utilisé dans une juridiction où une telle distribution, publication ou utilisation serait illégale. Ce document ne contient pas de recommandations ou de conseils personnalisés et n'est pas destiné à remplacer des conseils professionnels au sujet d’investissements dans des produits financiers. Avant de conclure une transaction, l’investisseur doit examiner avec soin si celle-ci est adaptée à sa situation personnelle et, si besoin, obtenir des conseils professionnels indépendants au sujet des risques, ainsi que des conséquences juridiques, réglementaires, financières, fiscales ou comptables. Ce document est la propriété de LOIM et est adressé à son destinataire pour son usage personnel exclusivement. Il ne peut être reproduit (en partie ou dans son intégralité), transmis, modifié ou utilisé dans un autre but sans l’accord écrit préalable de LOIM. Ce document contient les opinions de LOIM à la date de publication.

Ni le présent document, ni une copie de celui-ci ne peuvent être envoyés, amenés ou distribués aux États-Unis d’Amérique, dans l’un de leurs territoires, possessions ou zones soumis à leur juridiction, ou à l’attention ou dans l’intérêt d’un ressortissant américain (US Person). À cet effet, le terme « ressortissant » désigne tout citoyen, ressortissant ou résident des États-Unis d’Amérique, tout partenariat organisé ou existant dans un État, territoire ou possession des États-Unis d’Amérique, toute société de capitaux soumise au droit des États-Unis d’Amérique ou d’un État, territoire ou possession des États-Unis d’Amérique, ou toute propriété ou tout trust soumis à l’impôt fédéral des États-Unis d’Amérique, quelle que soit la source de ses revenus.

Source des chiffres : sauf mention contraire, les chiffres sont fournis par LOIM.

Bien que certaines informations proviennent de sources publiques réputées fiables, en l’absence de vérification indépendante, nous ne pouvons garantir leur exactitude et leur exhaustivité.

Les avis et opinons sont exprimés à titre informatif uniquement et ne constituent pas une recommandation de LOIM pour l'achat, la vente ou la détention de quelque titre que ce soit. Les avis et opinions sont exprimés en date de cette présentation et sont susceptibles de changer. Ils ne doivent pas être interprétés comme des conseils en investissement.

Aucune partie de ce document ne saurait être (i) copiée, photocopiée ou reproduite sous quelque forme que ce soit ou (ii) distribuée à toute personne autre qu’un employé, cadre, administrateur ou agent autorisé du destinataire sans l’accord préalable de Lombard Odier Asset Management (Europe) Limited . Au Royaume-Uni, ce document constitue une promotion financière et a été approuvé par Lombard Odier Asset Management (Europe) Limited , qui est autorisée et supervisée par la FCA. © 2021 Lombard Odier IM. Tous droits réservés.