investment viewpoints

From hope to secular growth

We believe that equity markets have moved from a ‘hope’ phase to a phase focusing on secular growth that favours thematics and stock selection

Equity markets typically go through performance phases during which investors preferences tend to shift between different topics. We have identified 4 phases: wall of worries, hope, secular growth and then exuberance.

At the onset of an economic recession, investors are facing a “wall of worries” that translate into very risk-off behaviors. Liquidity, financial strength, resilient quality and growth scarcity are characteristics that very much sought after. During that “wall of worries” phase, equity markets tend to fall precipitously as well as earnings and valuation multiples. Analysing the data available since the early 80s, we see this period can last from 16 months up to 30 months. This time around, it lasted about 4 months.

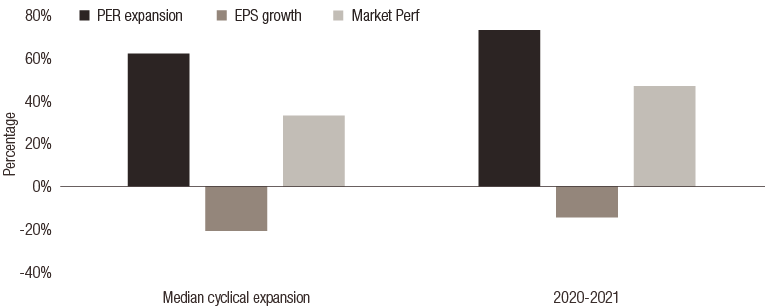

As central banks or government become more accommodative and supportive towards economic recovery, investors move into a risk-on behavior and are willing to look through the “wall of worries”. Even though corporate earnings tend to continue to decrease, “hope” is driving expectation for a cyclical recovery. Equity market tend to re-rate strongly, ahead of earnings, and PERs expand strongly as a result. During that period, the forward yield curve also tend to steepen anticipating at some point in the future that accommodative monetary policies will need to normalise. Historically, during such “hope phase”, PERs expand 60% while EPS could continue to fall (-20% on average) and market jumps over 30% (see chart 1). During this current “hope phase”, PERs have expanded a bit more (73%), EPS have fallen 15% and equity markets rose 47%. On a historical basis, such a phase lasts for 16 months, but this time around, it has lasted for 12 months.

Chart 1: “Hope phase”, comparison of past cyclical expansion with current cyclical expansion

Source: LOIM Research. For illustrative purposes only

We believe the economic data and market moves would suggest we are now transitioning out of the ‘hope’ or ‘expectation phase’ of the market cycle – where markets tend to rebound very strongly and valuations outstrip earnings – to the ‘secular growth phase.’

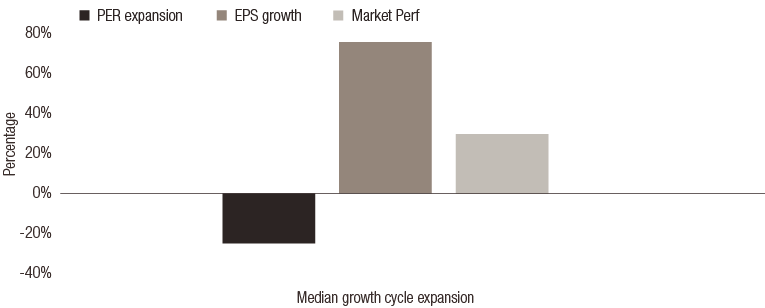

The economy is strengthening and stabilising across industries, which we believe is causing investors’ attention to shift back to secular growth. During this phase, we should see earnings start to catch up to valuations, multiples starting to decrease, and equity markets are still going up but to a much lesser extent than relative to the previous phase. Based on historical analysis, a “secular growth phase” implies a contraction of PERs by almost 25% while the expected growth in earnings is being delivered (almost 80%). This phase lasts on average 38 months during which equity markets can go up by almost 30%, implying an almost 9% annualized price return to which dividend yields can be added.

Chart 2: “Secular Growth phase”, review of historical characteristics

Source: LOIM Research. For illustrative purposes only

We believe that we are now entering this more secular growth phase. The “easier”, more cyclical, more violent, part of the market recovery is most likely behind us. We should move from a market that is less driven by style rotation between factors (cyclicals versus defensives or value versus growth) to a market where stock selection is key. It should talk to High Conviction strategies in particular.

Evidence of the transition

A more hawkish Federal Reserve is now anticipating two interest rate hikes in 2023, in response to an upgraded economic outlook and an uptick in inflation. The US central bank elected to keep the main rate at a range of 0 to 0.25 percent in June, but there are clear signs officials are growing more confident about the economic outlook and the need for tighter monetary policy. But it has also implicitly indicated that it has put back its hands on the steering wheel and could be ready to act in case things overshoot. Data dependency has increased significantly.

In March, seven out of a possible 18 Federal Open Market Committee (FOMC) members said there would be cause to raise rates in 2023. In the June meeting, 13 members predicted the first rate rise would occur in 2023.

The Federal Reserve said it expects to maintain an accommodative stance of monetary policy until maximum employment is achieved along with inflation at the target rate of 2 percent. The Fed has also revised up its expectations for economic growth this year, from 6.5% at the March meeting to 7% in June. Unemployment is expected to fall to 4.5% by the end of the year, and to 3.8% in 2022, and core inflation is now expected to be 3% this year – up from the 2.2% forecast in March.

This notion that equity markets are moving into a new phase in the cycle is reinforced by a number of factors, including the slope of the US treasury yield curve. The steepening of the yield curve has paused and started to flatten, in anticipation of potential rate hikes, and the 10-year yield was down by 0.2 percentage points in late June compared with the end of March. Meanwhile, the US dollar has been strengthening, while the VIX volatility index climbed from 15 to 20 in June. Initial flattening in the yield curve tend to be a good indicator in the transition between equity market phases.

Inflationary pressures

A key uncertainty out there remain whether cyclical or transitory inflation could morph into more structural inflation. This has the potential to create significant disruption.

There are a number of potential catalysts which could lead to such structural rise in inflation that we continue to monitor. These include the stimulus packages under negotiation, such as President Biden’s USD 1.2tn infrastructure bill, the risk of a rapid appreciation of the renminbi, and the possibility of further trade friction. ‘Uberconsumption’ is another factor which may feed inflationary pressures as consumers unleash their savings that have built up during the pandemic. In addition, more structurally, we see a large numbers of workers start to exit the workforce in the decade to come due to ageing, leading to a potential scarcity of labour.

Thematic focus

In this environment, it is our view that weighing exposures to factors such as growth or value becomes less important and stock selection comes to the fore. This presents a good opportunity to catch ‘laggers’ – stocks which have yet to catch up with their valuations - and maintain a focus on quality stock selections. It also presents an opportunity to pick attractively priced structural growth themes, that have been left behind during the “hope” phase as investors have mostly focused on cyclicality. These attractive growth themes are sustainability, silver economy, world brands, digitalisation and the rise of north Asia.

For a PDF version of this article, please the download button provided.

important information.

For professional investor use only

This document has been issued by Lombard Odier Funds (Europe) S.A. a Luxembourg based public limited company (SA), having its registered office at 291, route d’Arlon, 1150 Luxembourg, authorised and regulated by the CSSF as a Management Company within the meaning of EU Directive 2009/65/EC, as amended; and within the meaning of the EU Directive 2011/61/EU on Alternative Investment Fund Managers (AIFMD). The purpose of the Management Company is the creation, promotion, administration, management and the marketing of Luxembourg and foreign UCITS, alternative investment funds ("AIFs") and other regulated funds, collective investment vehicles or other investment vehicles, as well as the offering of portfolio management and investment advisory services.

Lombard Odier Investment Managers (“LOIM”) is a trade name.

This document is provided for information purposes only and does not constitute an offer or a recommendation to purchase or sell any security or service. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful. This material does not contain personalized recommendations or advice and is not intended to substitute any professional advice on investment in financial products. Before entering into any transaction, an investor should consider carefully the suitability of a transaction to his/her particular circumstances and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. This document is the property of LOIM and is addressed to its recipient exclusively for their personal use. It may not be reproduced (in whole or in part), transmitted, modified, or used for any other purpose without the prior written permission of LOIM. This material contains the opinions of LOIM, as at the date of issue.

Neither this document nor any copy thereof may be sent, taken into, or distributed in the United States of America, any of its territories or possessions or areas subject to its jurisdiction, or to or for the benefit of a United States Person. For this purpose, the term "United States Person" shall mean any citizen, national or resident of the United States of America, partnership organized or existing in any state, territory or possession of the United States of America, a corporation organized under the laws of the United States or of any state, territory or possession thereof, or any estate or trust that is subject to United States Federal income tax regardless of the source of its income.

Source of the figures: Unless otherwise stated, figures are prepared by LOIM.

Although certain information has been obtained from public sources believed to be reliable, without independent verification, we cannot guarantee its accuracy or the completeness of all information available from public sources.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by LOIM to buy, sell or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change. They should not be construed as investment advice.

No part of this material may be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorised agent of the recipient, without Lombard Odier Funds (Europe) S.A prior consent. In Luxembourg, this material is a marketing material and has been approved by Lombard Odier Funds (Europe) S.A. which is authorized and regulated by the CSSF.

©2021 Lombard Odier IM. All rights reserved.