investment viewpoints

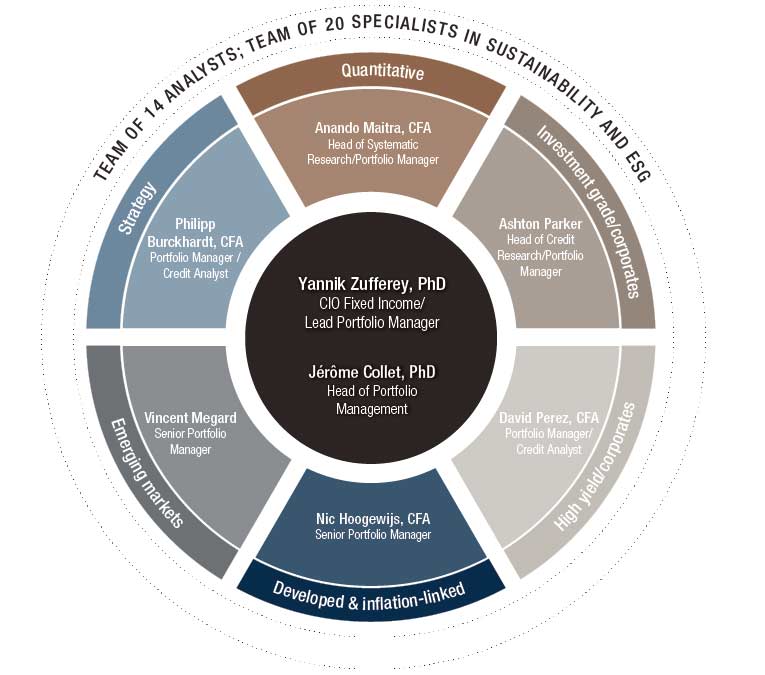

Our edge in sustainable fixed income: multiple PMs

We begin with a simple premise: targeting a return of cash+3% over a 3-5 year cycle1. To reach this target our global fixed income opportunities strategy uses a dynamic and disciplined process for asset allocation. The real difference is in our execution: we use a distinctive multi-portfolio manager (PM) approach where each PM is allocated an individual risk budget to express their convictions within the parameters of the overall allocation. We round out our method by a thorough integration of sustainability for both risk and return, using our bespoke CLIC™ framework as well as in-house, proprietary tools such as LOPTA2.

Our approach to global fixed income opportunities aims to maximise our ability to adapt investments to varying market conditions, reacting quickly to developments to recalibrate exposure and always with a view to generating consistent results over time. Flexibility is at the centre of our ethos, enabling our experts to be nimble, move fast and act aggressively in their calls if necessary.

Flexibility is at the centre of our ethos, enabling our experts to be nimble, move fast and act aggressively in their calls if necessary.

What is a multi-PM approach?

When it comes to building a portfolio in our unconstrained total return strategy, there is strength in numbers: we believe a portfolio constructed by a team of experts is highly suited to adding alpha. As such, we work as a committee of specialists when implementing our tactical asset allocation, with each expert acting as a portfolio manager (rather than an analyst exclusively) in their respective fields to make key decisions.

The approach captures greater expertise within the global fixed income segments, as each expert expresses distinct views according to their individual risk budget. The budgets are designed to promote accountability, and regularly reviewed in order to reward profitable calls.

The CIO manages a separate overlay in order to implement discretionary hedges in credit, rates and foreign exchange. This overlay enables the CIO to steer the portfolio in terms of the overall risk profile: for instance, by seeking to adjust convexity, tame volatility or balance out potential concentration. The framework gives our specialists latitude to implement their individual ideas, according to their specialisation and skill set, while remaining within the overall allocation parameters.

Figure 1. Multi-PM approach: capturing expertise

Source: LOIM. For illustrative purposes only. Investment teams are subject to change.

What are the benefits?

Our multi-PM approach benefits investors because it offers a more de-correlated strategy across a global universe. The expertise in different fields typically creates distinct views over diverse time horizons. A portfolio based on multiple views can prevent concentration and help avoid unintended risk biases.

The framework also enables our team to react quickly, with each expert using their risk budget to enact calls, and adding or reducing risk as they see fit. There is wide berth to make choices within the field of expertise (remaining within the allocation parameters) because PMs have the latitude to over/underweight sources of risk according to their risk budget. This gives us the ability to re-position portfolios extensively and extremely, if that is what we believe is required in order to meet the target return.

Our multi-PM approach benefits investors because it offers a more de-correlated strategy across a global universe.

The end result is for this group of experts to add more value collectively than they do individually. Aristotle said “The whole is greater than the sum of its parts." In this instance, we believe each PM adds a distinct speciality, but together all of these specialties create a portfolio that goes beyond each individual call. Many judgements are reflected in this framework, and the way we combine the different views creates an advantage in itself.

A structured and disciplined framework

Rather than replicating a benchmark, we take a highly active and high conviction approach to global fixed income opportunities. Our multi-PM approach is one layer of a structured, three step process created to meet our target return1. This process provides a strict framework for our teams to work within, but allows them the needed flexibility to express individual convictions, react nimbly and implement quickly.

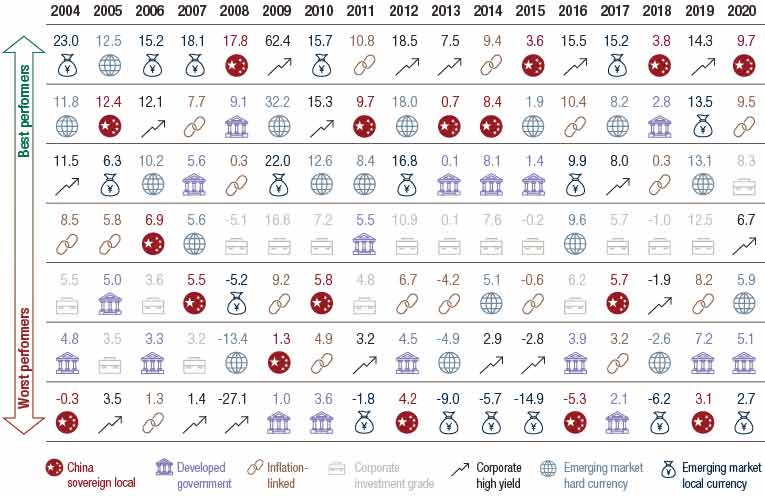

The CIO oversees the strategic asset allocation (SAA) to choose the various segments of fixed income in the long term, recognising that segments perform differently depending on the macroeconomic and market environment, as shown in Figure 2. The SAA is reviewed annually, at least, and we invest in every fixed income segment: developed and emerging market debt, sovereign and corporate bonds, investment grade and high yield ratings, as well as inflation-linked bonds. Most recently, for instance, we have added China sovereign local debt as a standalone segment. This approach maximises true diversification and gives investors the opportunity to benefit from the distinct correlations between various segments.

Figure 2. Fixed income segment performance 2004-2020

Source: Bloomberg. Figures refer to annual returns in percent. For illustrative purposes only. Past performance is not a reliable indicator of future returns. As at 31-December 2020. Developed government: Bloomberg Barclays Global Aggregate Treasuries (USD H); Inflation-linked: Bloomberg Barclays Global Inflation-linked (USD H); Corporate investment grade: Bloomberg Barclays Global Aggregate Corporate (USD H); Corporate high yield: Bloomberg Barclays Global HY Corporate (USD H); Emerging market hard currency: Bloomberg Barclays Global EM Sovereign Quasi Sovereign (USD); Emerging market local currency: JPM GBI-EM Global Div. Composite (USD); China sovereign local: Bloomberg Barclays China Aggregate Treasury Index (USD). Any reference to a specific company or fund does not constitute a recommendation to buy, sell, hold or directly invest in the company or funds.

Recognising that market conditions can change quickly, our experts revisit the tactical asset allocation (TAA) of each fixed income segment at a monthly review in light of short- to medium-term dynamics and dislocations. Tactical changes are encouraged between monthly meetings to optimise the agility needed to seize opportunities. The CIO chairs the overall TAA process and has the ultimate sign off.

Tactical changes are encouraged between monthly meetings to optimise the agility needed to seize opportunities.

Finally, we construct the portfolio using the multi-PM approach, capitalising on the expertise of our entire team to express views directly. Each of the segments is implemented though a high conviction approach that concentrates the number of lines in order to imitate risk characteristics of the index but with higher conviction on each position.

We believe this process goes far beyond mimicking a benchmark as it provides clear parameters for our experts to make the informed choices necessary for meeting the return objective1.

Sustainability for both sides of risk and return

Embedding sustainability on both sides of the risk-return equation is a crucial way our philosophy differs from other asset managers. ESG3 analysis allows us to avoid controversies and mitigate impact, and forward-looking sustainability analysis helps to improve risk-adjusted returns by avoiding potential stranded assets, while also identifying opportunities to allocate capital to issuers who have significant sustainable projects on their balance sheets.

There is substantial outstanding debt at risk of default in the future due to sustainability issues, according to a Moody’s assessment . The ratings agency found that of 84 sectors representing $74.6 trillion in rated debt, $3.4 tn worth of debt already faces heightened environmental credit risk. Moody’s identified 16 sectors with $4.5 tn in rated debt having very high or high inherent exposure to carbon transition risk. It cited a number of other sectors with high inherent exposure to physical climate risks; very high or high inherent exposure to waste and pollution risk; heightened inherent exposure to natural capital risk; and very high or high inherent exposure to water management risk.

We believe sustainability is set to become a major driver of returns, so we use it to identify innovative sources of alpha and risk mitigation.

We believe sustainability is set to become a major driver of returns, so we use it to identify innovative sources of alpha and risk mitigation. Generally speaking, we choose issuers that we believe will benefit from the transition to a more sustainable economic model. In our opinion, this means finding issuers with strong, forward-looking management and the vision to understand and exploit the underlying trends driving the transition, while navigating the pitfalls and stranded assets in the years to come.

Part of this analysis involves favouring Green, Social and Sustainability (GSS) impact bonds from an issuer, where they are available. For such instruments, our SIRSS5 team of 20 specialists carefully evaluates the sustainability credentials of all GSS bonds and passes judgement to the investment teams to avoid greenwashers or potential weaknesses.

Some of the factors that are examined in this process include: the strength and quality of the issuer’s framework and external review; use of proceeds; alignment with best practice guidelines elaborated by the ICMA Green, Social, Sustainability Bond Principles; national and regional guidelines (e.g. the EU Green Bond Standard); and the overall ESG profile and sustainability alignment (using our proprietary ESG and LOPTA methodologies).

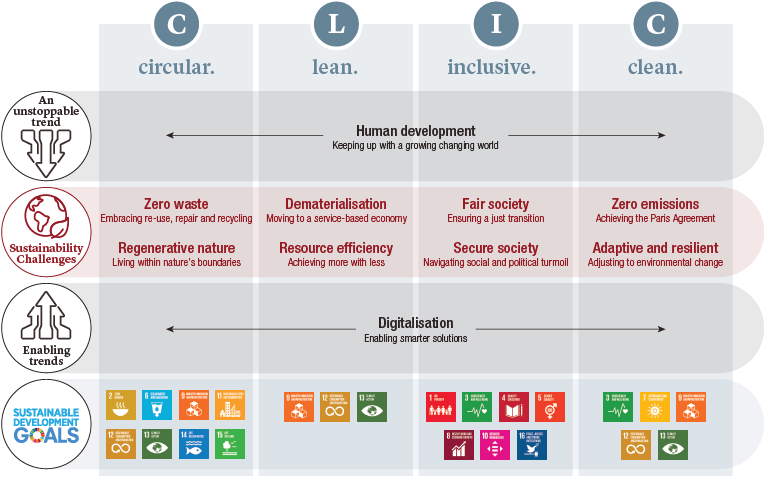

The CLIC™ transition

Our core belief is that the global economy must transition to a model that is Circular, Lean, Inclusive and Clean. The good news is that this transition is already underway. We call this the CLIC™ economic model and we use it to identify companies aligned with these principles. The CLIC™ model is geared towards leveraging the vast value-creation opportunities that sustainability has to offer.

- A Circular economy emphasises the re-use, re-manufacture and recycling of products to extend their economic life.

- A Lean economy focuses on resource efficiency: using smarter materials in production, dematerialisation, and the sharing economy.

- Recognising that inequality can act as a hidden drag on growth, greater Inclusivity can be a driver of innovation, performance and opportunity. Here the focus is on access - from healthcare to financial services to education - as well as the availability of resources such as clean energy and clean water.

- Lastly, a Clean economy considers activities focused on either reducing emissions (clean-tech, renewables, carbon capture), as well as transitioning industries in heavy-carbon sectors that need to decarbonise (heavy-duty transport, cement, chemicals, buildings, power).

As shown in Figure 3, we have identified eight key sustainability challenges. We use these challenges, plus the two overarching trends of human development and digitalisation, to help us analyse and quantify the sustainability of business models.

Figure 3. Eight key sustainability challenges

Source: LOIM. For illustrative purposes only.

It is vital to invest sustainably today. An eco-friendly transition to a CLIC ™ economy is being driven by a powerful combination of regulatory, market, consumer and investor forces. As this transition unfolds, we believe it is pivotal to align our global fixed income opportunities strategy to this revolution.

LOPTA for emissions trends

We also use in-house sustainability tools created to assess borrowers in a holistic manner relative to both risk mitigation and return potential. ESG is an extremely useful risk tool to mitigate negative risks, but it is also vital to focus on the sustainability of business models to understand the direction companies are moving in, and thereby detect future risks of stranded assets and physical risk.

Our science-based tool, LOPTA (Lombard Odier’s Portfolio Temperature Alignment), is a forward-looking metric that aims to provide quantifiable analysis of one of the key sustainability challenges: zero-emissions. Such analysis enables a better understanding of the trajectory of a given issuer’s path towards net-zero alignment. This tool goes beyond the simple ESG analysis of many of our competitors, which is often based on static data, such as carbon footprint, and only gives a view on where a company stands today, not on the direction of travel.

We use our LOPTA tool to identify those borrowers that are decarbonising and those

that are failing to react quickly enough to the transition.

LOPTA was developed to understand how company emissions are trending relative to the Paris Agreement on climate change, and to help determine temperature trajectories of industries and companies. We use it to identify those borrowers that are decarbonising and those that are failing to react quickly enough to the transition. High-emission companies failing to lower their temperature could face higher refinancing costs in the future, in our opinion.

Overall, our global fixed income opportunities strategy is tailored to maximise flexibility in the investment process, and integrate sustainability as a driver of both risk and return. Our highly-structured approach aims to be agile and reactive, with a key benefit of multiple PM expertise. In sustainability, our CLIC™ framework and tools such as LOPTA guide us when taking investment decisions. We believe that flexibility and sustainability are key to creating a diversified portfolio that is both sustainability-aligned and ESG-integrated.

sources.

important information.

FOR PROFESSIONAL INVESTOR USE ONLY

This document has been issued by Lombard Odier Funds (Europe) S.A. a Luxembourg based public limited company (SA), having its registered office at 291, route d’Arlon, 1150 Luxembourg, authorised and regulated by the CSSF as a Management Company within the meaning of EU Directive 2009/65/EC, as amended; and within the meaning of the EU Directive 2011/61/EU on Alternative Investment Fund Managers (AIFMD). The purpose of the Management Company is the creation, promotion, administration, management and the marketing of Luxembourg and foreign UCITS, alternative investment funds ("AIFs") and other regulated funds, collective investment vehicles or other investment vehicles, as well as the offering of portfolio management and investment advisory services.

Lombard Odier Investment Managers (“LOIM”) is a trade name.

This document is provided for information purposes only and does not constitute an offer or a recommendation to purchase or sell any security or service. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful. This material does not contain personalized recommendations or advice and is not intended to substitute any professional advice on investment in financial products. Before entering into any transaction, an investor should consider carefully the suitability of a transaction to his/her particular circumstances and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. This document is the property of LOIM and is addressed to its recipient exclusively for their personal use. It may not be reproduced (in whole or in part), transmitted, modified, or used for any other purpose without the prior written permission of LOIM. This material contains the opinions of LOIM, as at the date of issue.

Neither this document nor any copy thereof may be sent, taken into, or distributed in the United States of America, any of its territories or possessions or areas subject to its jurisdiction, or to or for the benefit of a United States Person. For this purpose, the term "United States Person" shall mean any citizen, national or resident of the United States of America, partnership organized or existing in any state, territory or possession of the United States of America, a corporation organized under the laws of the United States or of any state, territory or possession thereof, or any estate or trust that is subject to United States Federal income tax regardless of the source of its income.

Source of the figures: Unless otherwise stated, figures are prepared by LOIM.

Although certain information has been obtained from public sources believed to be reliable, without independent verification, we cannot guarantee its accuracy or the completeness of all information available from public sources.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by LOIM to buy, sell or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change. They should not be construed as investment advice.

No part of this material may be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorised agent of the recipient, without Lombard Odier Funds (Europe) S.A prior consent. In Luxembourg, this material is a marketing material and has been approved by Lombard Odier Funds (Europe) S.A. which is authorized and regulated by the CSSF.

©2021 Lombard Odier IM. All rights reserved.