private assets

Private credit assets: catalysts for climate impact

Need to know

|

|---|

The COP26 climate summit played a pivotal role in opening investors' eyes to the harsh reality our world will face if we do not act quickly to reduce CO2 emissions on a global scale, but it also shed light on the many opportunities available for investors to capture if they choose to invest in and harness the power of nature.

“The window is still open, scientifically, to act,” according to Professor Johan Rockström, architect of the nine planetary boundaries – environmental thresholds for humanity recently popularised by the Netflix documentary, “Breaking Boundaries”.

During the Zero-Hour Sessions, an event convened by Lombard Odier during COP26, Rockström stressed that our planet – “a complex, adaptive, self-regulating biophysical system” – has tipping points which, if triggered, cause “self-enforced drift in the wrong direction”.

While the stability of our planet, and the economic activity it supports, depends on humanity keeping within these science-based thresholds and avoiding the “no-go zones” beyond them, we have already broken through four limits: toxic waste, air pollution, freshwater overuse and agrochemical pollution – and are on course for transgressing a critical fifth boundary: keeping global warming within 1.5°C above pre-industrial levels.

According to the IEA, COP26 commitments reduced the forecast global temperature rise from 2.7°C to 1.8°C1. While further policy impetus is essential in directing real decarbonisation throughout the economy, private sector resources must be marshalled to realise the required emissions reductions. The financing gap to put the world on a path to net zero is estimated to be USD $32 trillion in the next decade2.

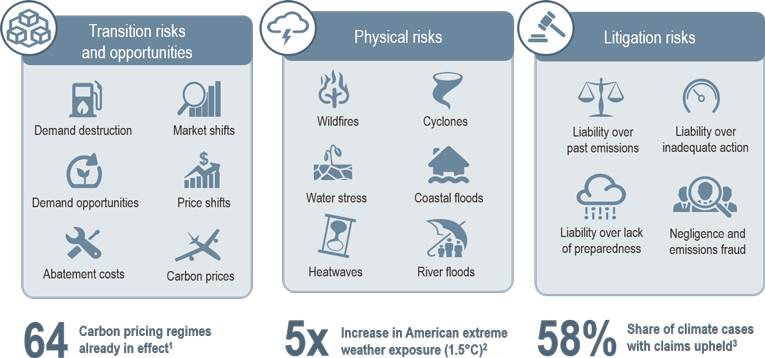

New arenas of risk and opportunity

Economy-wide decarbonisation presents new variables to consider in evaluating risk-adjusted returns as transitional, physical and liability risks increasingly factor into corporate profitability and valuations:

- Transitional risk includes shifts in demand among climate-aware consumers, companies’ ability to reduce emissions and the impact of higher carbon costs and regulation

- Physical risk includes the damage caused by more frequent extreme weather events and the associated degradation of agricultural yields and less-productive labour forces

- Liability risk includes historical responsibility for climate change among companies and sovereigns, as well as mitigation and adaptation costs

Three categories of climate risk for investors

Source: LOIM as at December 2021.

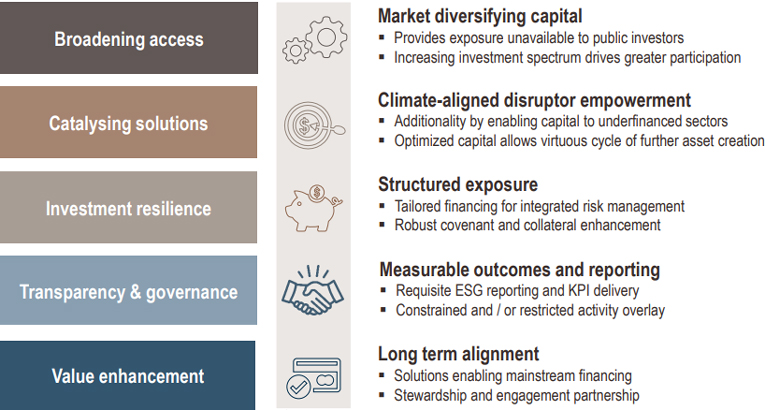

Forward-looking investors may identify public and private businesses that are mitigating climate risk and acting on the opportunities generated by the transition. Lombard Odier believes there are significant opportunities available to advance the transition to net zero through not just traditional public equity and debt markets, but also through private markets. While private equity capital has been well-deployed towards sustainable finance, we believe the broad versatility of solutions-oriented private credit is positioned to play an important role in accelerating the transition into a low-carbon carbon-resilient economy.

Private credit opportunities aligned with the net-zero transition

Source: LOIM as at December 2021.

Climate commitment

The forces driving the net-zero transition are clear. COP26 provided further evidence of policy and social tipping points for recommitting to the Paris Agreement’s 1.5°C threshold. The private sector is delivering novel solutions today to profitably adapt and reduce carbon emissions, while improving resilience. Frameworks such as Rockström’s planetary boundaries provide a guide for investors who seek businesses that are adapting their business models to be profitable in a sustainable future.

“There is no question about the direction of travel anymore,” Rockström said. “The question is: can we act fast enough in order to land in a safe operating space for humanity?”

Much of the answer lies in action within the real economy, where private credit is essential to catalysing and scaling additional impact.

The LOIM Sustainable Private Credit solution

Using our private credit skillset in combination with our Sustainable Investment Research, Strategy and Stewardship team, we have built an infrastructure to be able to assess opportunities to lend to companies that require financing to strengthen operations that help advance the transition to net zero.

The Private Credit team is well known throughout funding circles as ‘go to’ managers enabling tailored financing to businesses aligned to the transitional theme within quick timeframes.

The opportunities the team accesses range from lending to help a company create renewable-electricity storage in battery solutions to fulfil a contract with a tier 1 electricity provider, to refinancing a solar and biogas company whose renewable-energy output exceeds that of two coal power plants. The loans are predominantly senior secured, and are not exposed to risks associated with new technologies or other early-stage initiatives more suitable for private equity or venture capital investors.

As a sustainable private-asset manager, LOIM has an obligation to be more than capital providers to our partners: we help create mutual value by positively influencing corporate behaviours and actions. Our expert team can provide guidance and technical support to growing enterprises seeking to overcome various challenges, such as aligning with the United Nations Sustainable Development Goals, complying with regulatory frameworks, achieving transparency on key performance indicators and managing environmental, social and governance risks. We hold active stewardship and engagement conversations with our investee and investor partners.

important information.

For professional investor use only

This document is a Corporate Communication and is intended for Professional Investors only.

This document is a Corporate Communication for Professional Investors only and is not a marketing communication related to a fund, an investment product or investment services in your country. This document is not intended to provide investment, tax, accounting, professional or legal advice.

This document is issued by :

This document is issued by Lombard Odier Asset Management (USA) Corp, a corporation organized under the laws of the State of Delaware, USA, having its principal place of business at 452 Fifth Avenue, New York NY 10018 USA.

This document is approved at the date of the publishing. The Company is clustered within the Lombard Odier Investment Management Division (“LOIM”) of Lombard Odier Group which support in the preparation of this document and LOIM is a trade name.

Any opinions or forecasts provided are as of the date specified, may change without notice, do not predict future results and do not constitute a recommendation or offer of any investment product or investment services. Lombard Odier Asset Management (USA) Corp's website and its associated links offer news, commentary, and generalized research, not personalized investment advice. Nothing on this website should be interpreted to state or imply that past performance is an indication of future performance. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with a tax professional before implementing any investment strategy.

This document is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful, nor is it aimed at any person or entity to whom it would be unlawful to address such a document. This material is not, nor is it intended to be, marketing material or advertising within the meaning of the Investment Advisers Act of 1940, the rules and guidance of the Securities and Exchange Commission (“SEC”) or the Conduct Rules of the Financial Industry Regulatory Authority (“FINRA”), (iii) is for informational use only by the receiving party for general information purposes only in relation to overall market views.

This document is provided for information purposes only and does not constitute an offer or a recommendation to purchase or sell any security. It contains the opinions of Lombard Odier, as at the date of issue. These opinions do not take into account individual investor circumstances, objectives, or needs. No representation is made that any investment or strategy is suitable or appropriate to individual circumstances or that any investment or strategy constitutes a personal recommendation to any investor. Each investor must make his/her own independent decisions regarding any securities or financial instruments mentioned herein. Before entering into any transaction, an investor should consider carefully the suitability of a transaction to his/her particular circumstances and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. The information and analysis contained herein are based on sources believed to be reliable. However, Lombard Odier does not guarantee the timeliness, accuracy, or completeness of the information contained in this document, nor does it accept any liability for any loss or damage resulting from its use. All information and opinions as well as the prices indicated may change without notice.

Past performance is no guarantee of current or future returns, and the investor may receive back less than he invested. The value of any investment in a currency other than the base currency of a portfolio is subject to foreign exchange rate risk. These rates may fluctuate and adversely affect the value of the investment when it is realized and converted back into the investor’s base currency. The liquidity of an investment is subject to supply and demand. Some products may not have a well-established secondary market or in extreme market conditions may be difficult to value, resulting in price volatility and making it difficult to obtain a price to dispose of the asset.

The information presented herein is intended to be a summary only and Lombard Odier makes no representation as to the accuracy of such information. This presentation may contain targeted returns and forward-looking statements. “Forward-looking statements,” can be identified by the use of forward-looking terminology such as “may”, “should”, “expect”, “anticipate”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof, or variations thereon, or other comparable terminology. Investors are cautioned not to place undue reliance on such returns and statements, as actual returns and results could differ materially due to various risks and uncertainties. In considering any transactional history or prior performance information contained herein, investors should bear in mind that transactional history or prior performance is not necessarily indicative of future results, and there can be no assurance that the Fund will achieve comparable results. Such descriptions are provided for illustrative purposes only and there can be no assurance that Lombard Odier will be able to implement its investment strategies in a similar manner or pursue similar transactions or be able to avoid losses.

The categorizations, estimates, quantifications, sensitivities and other information provided in this presentation may not reflect the criteria employed by Lombard Odier to evaluate exposure, risks, or trading strategies. No representation is made that the categorizations, estimates, quantifications, sensitivities and any other information in this presentation are complete or adequate, or that they would be useful in successfully limiting exposure or risk, identifying and/or evaluating profitable or risky trading strategies, or constructing a profitable or limited-risk portfolio. The presentation of the exposures or risks identified in this presentation is not intended to be complete. There may be other exposures or risks, of which Lombard Odier may or may not be aware, that would affect the performance or risks of an investment portfolio. In addition, trading strategies may involve, among other techniques, leverage, short selling and various derivatives, each of which entails separate and distinct risks.

This material is intended to outline a strategy which may in the future form the basis of an investment product. The terms of any such product are not finalized and may be subject to change and may differ substantially from the terms set out in this document. Moreover, there is no guarantee that any such product will be created or launched.

Investing in private credit strategies can involve a high degree of risk. Amongst other things, the viability of private credit investments depends upon the ability of borrowers to repay loans together with interest. Adverse changes to the financial position of a borrower or to the economies in which a borrower may sit may impair the ability of a borrower to pay back some or all of monies borrowed, which could ultimately lead to loses for investors, including in certain circumstances, a loss of the total amounts invested.

Target performance/risk represents a portfolio construction goal based on current interest rate projections, the floating rate may go up or down. It does not represent past performance/risk and may not be representative of actual future performance/risk. Capital protection/Capital preservation represents a portfolio construction goal and cannot be guaranteed.

Important information on ESG results

While any results presented are based on certain assumptions that are believed to reflect actual circumstances, these assumptions may not include all of the variables that may affect, or have affected in the past, the ratings calculations.

The following factors are taken into account in the calculation of the ratings:

1. The ESG team uses data issued from a recognized third party provider to establish the severity level of corporate controversies

2. LOIM has developed its own business rating methodology that integrates data from multiple sources. The scores thus obtained are updated on a weekly basis and represent an assessment of the Environmental, Social and Governance quality of a company. These grades were designed by LOIM's ESG experts and take into account the most relevant extra-financial dimensions applicable to each company’s activity.

Although certain information has been obtained from public sources believed to be reliable, without independent verification, we cannot guarantee its accuracy or the completeness of all information available from public sources.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by LOIM to buy, sell or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change. They should not be construed as investment advice.

LOIM does not provide accounting, tax or legal advice.

For more information on LOIM’s data protection policy, please refer to www.lombardodier.com/privacy-policy.

No part of this material may be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient, without Lombard Odier Asset Management (USA) Corp’s prior consent.