investment viewpoints

Is your multi-asset fund behaving as advertised?

The one-stop-shop offering of multi-asset funds can be compelling for many reasons. Their flexible and diversified approach often pledges to participate in market upsides while preserving capital during down markets.

Yet, one size does not fit all in this investment space and multi-asset strategies can differ widely in terms of portfolio construction and risk profile, which can have significant consequences on the returns they deliver.

While not a new concept, the multi-asset phenomenon proliferated in the aftermath of the Great Financial Crisis (GFC) as investors embraced this notion of low volatility, with attractive returns. Market conditions during this time have been largely benign, making it difficult to assess which multi-asset funds have been true to their commitment to deliver upside growth and downside protection. Until now that is.

The multi-asset phenomenon proliferated in the aftermath of the Great Financial Crisis (GFC) as investors embraced this notion of low volatility, with attractive returns

2019 presented a very rare investment environment where nearly all asset classes delivered positive returns for the year. In contrast, the first quarter of 2020 witnessed a deep bear market for many asset types and levels of volatility that had not been seen since the GFC. While it is standard practice, and arguably fairer, to assess fund performance over much longer periods of time – such as three and five years – we believe these two distinct market environments present a useful lens through which we can analyse the performance of multi-asset funds.

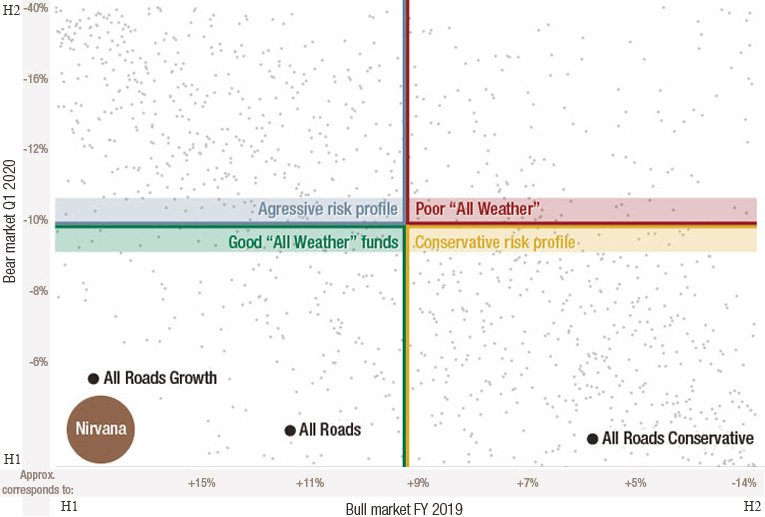

As mentioned above, it is understood that multi-asset funds with vastly different risk profiles would perform differently in each of these market environments. The expectation is that strategies that apply a more aggressive risk profile would have performed well 2019, but may have struggled in Q1 2020. Conversely, those strategies with a more conservative risk profile may have underperformed in 2019, but should have outperformed in Q1 2020.

To see how this worked in practice, we combined both of Morningstar’s Cautious and Flexible Allocation categories, which are composed of just under 1,200 funds1, all of which can be assumed to invest in more than one asset class. We ranked these funds in terms of performance (rank 1 being the best) during the period of strong market conditions (full-year 2019) and challenging market conditions (Q1 2020).

Figure 1: Universe of Cautious and Flexible funds ranked by performance

Source: Morningstar

Unsurprisingly, our analysis (Figure 1) showed a wide dispersion of performance across this universe of funds. For this reason, we grouped the funds into four quadrants in order to best capture their likely risk characteristics. Those funds which performed poorly in 2019 (ranked in the third and fourth quartiles) but well in Q1 2020 (top and second quartiles) are assumed to have a more conservative risk profile. Whereas those funds which performed well in 2019 (ranked in the top and second quartiles) but poorly in Q1 2020 (third and fourth quartiles) are assumed to have a more aggressive risk profile. These are characterised on Figure 1 as the bottom-right and top-left quadrants, respectively.

This leaves us with two remaining quadrants (top-right and bottom-left). Those which were in the top half of performers during both periods are considered to be ‘Good’ all weather funds (bottom-left), as they have shown consistently good performance in both market environments; those which were in the bottom half are considered to be ‘Poor’ all weather funds (top-right), as they have delivered consistently poor performance.

In this analysis, no funds ranked near the top in both time periods, reflecting this near impossible goal – more akin to the Nirvana of investing. Rather we firmly believe it is the funds that are delivering strong growth during positive market conditions, while protecting capital during downside periods that can truly be considered to be successfully delivering on their stated commitments.

The three Lombard Odier All Roads strategies were all shown to have delivered on their aims2. The All Roads Conservative strategy behaved in line with its conservative risk profile, while the All Roads and All Roads Growth strategies were both in the top performing, good all weather funds category. In fact, the Growth strategy was close to being in Nirvana.

While only conducted over two relatively short time periods, we believe this result shows that the philosophy underpinning our All Roads strategies, which seeks to smooth out portfolio sensitivity to the economic cycle through strategic, tactical and downside management layers, has proven to deliver robust returns regardless of the market environment. In short, we think the All Roads strategies can successfully answer the question of whether your multi-asset funds are delivering as advertised.

sources.

important information.

This document has been issued by Lombard Odier Funds (Europe) S.A. a Luxembourg based public limited company (SA), having its registered office at 291, route d’Arlon, 1150 Luxembourg, authorised and regulated by the CSSF as a Management Company within the meaning of EU Directive 2009/65/EC, as amended; and within the meaning of the EU Directive 2011/61/EU on Alternative Investment Fund Managers (AIFMD). The purpose of the Management Company is the creation, promotion, administration, management and the marketing of Luxembourg and foreign UCITS, alternative investment funds ("AIFs") and other regulated funds, collective investment vehicles or other investment vehicles, as well as the offering of portfolio management and investment advisory services.

Lombard Odier Investment Managers (“LOIM”) is a trade name.

This document is provided for information purposes only and does not constitute an offer or a recommendation to purchase or sell any security or service. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful. This material does not contain personalized recommendations or advice and is not intended to substitute any professional advice on investment in financial products. Before entering into any transaction, an investor should consider carefully the suitability of a transaction to his/her particular circumstances and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. This document is the property of LOIM and is addressed to its recipient exclusively for their personal use. It may not be reproduced (in whole or in part), transmitted, modified, or used for any other purpose without the prior written permission of LOIM. This material contains the opinions of LOIM, as at the date of issue.

Neither this document nor any copy thereof may be sent, taken into, or distributed in the United States of America, any of its territories or possessions or areas subject to its jurisdiction, or to or for the benefit of a United States Person. For this purpose, the term "United States Person" shall mean any citizen, national or resident of the United States of America, partnership organized or existing in any state, territory or possession of the United States of America, a corporation organized under the laws of the United States or of any state, territory or possession thereof, or any estate or trust that is subject to United States Federal income tax regardless of the source of its income.

Source of the figures: Unless otherwise stated, figures are prepared by LOIM.

Although certain information has been obtained from public sources believed to be reliable, without independent verification, we cannot guarantee its accuracy or the completeness of all information available from public sources.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by LOIM to buy, sell or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change. They should not be construed as investment advice.

No part of this material may be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorised agent of the recipient, without Lombard Odier Funds (Europe) S.A prior consent. ©2020 Lombard Odier IM. All rights reserved.