investment viewpoints

Convertibles for an upturn in volatility

After three years of below-trend volatility, we expect the 2020 global markets to bring a return of equity volatility and risk assets in general. This volatility could come, in our view, from a combination of high equity valuations, an uncertain macro and political environment (trade wars, Brexit, US elections and geopolitical tensions), and the reduced effectiveness of monetary stimulus from central banks.

Against this backdrop of expected volatility, the risk-reward characteristics of the convertible bond asset class could prove particularly useful for investors. In particular, we see balanced, global convertible bond strategies focusing on the most asymmetric profiles as best-placed to gain. Convertible bonds are said to be balanced when they combine a strong bond component (or bond floor) with significant equity sensitivity.

We also recommend a focus on the better-quality credit instruments within the convertible bond asset class because they provide superior protection1 against potential corrections. As such, we believe it is important to be rigorous about the credit quality of issuers, and require solid balance sheets.

At the regional level, the US universe is interesting for the large share of issuing companies related to the theme of digitalisation, as well as to high growth sub-sectors such as biotechnology or internet media. In contrast, European convertibles tend to be issued by value companies such as aeronautics and infrastructure. In addition, European issues are, on average, of better credit quality, and have more balanced profiles than the American universe.

Finally, the Asia-Pacific region is a major source of yielding convertibles, presenting a defensive profile for investors seeking exposure to Asian equities while requiring a buffer against potential corrections.

Optionality valuations stand to benefit

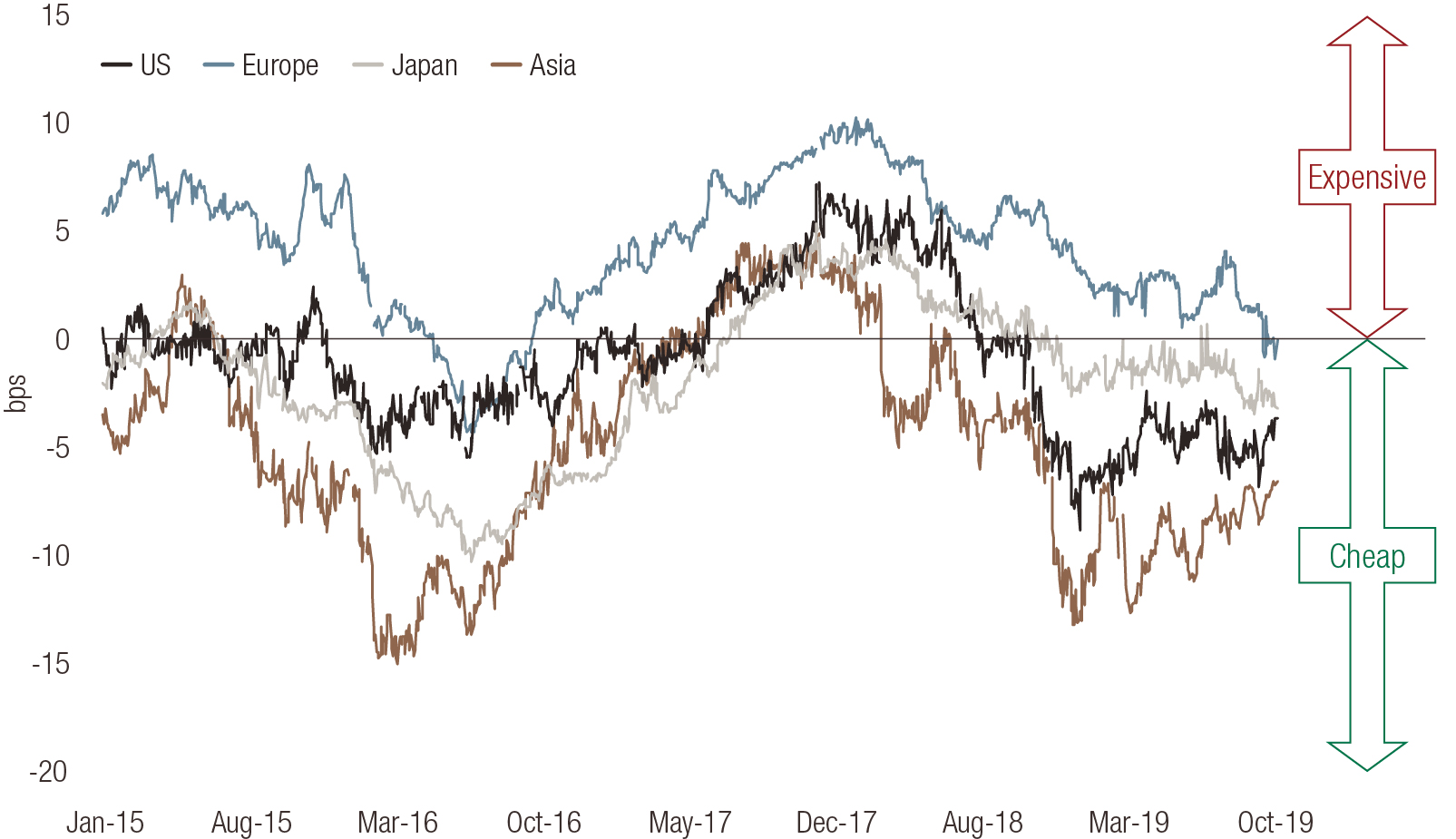

The current valuation of convertibles could also prove appealing to investors as the optionality in the bonds appears cheap, in our view, and could stand to benefit if equity volatility rises. A comparison of the implied volatility and realised volatility within the convertible bond universe shows the asset class looking good value from the optionality point of view, as shown in the figure below. The asset class has benefited historically from rising equity volatility2.

Source: LOIM. Spread (difference in percentage points) by region between IV (Implied volatility) and RV (260 days Realised volatility). Past performance is not a guarantee of future results.

Fixed income investors could find an additional performance engine from the embedded option in convertible bonds. At present, the two usual bond performance drivers (the tightening of credit spreads and the carry trade) face relatively gloomy prospects, in our opinion. Thus, including convertible bonds could provide additional growth potential through the revaluation of the optional share in the context of turbulent financial markets.

In summary, convertible bonds are an attractive alternative for investors concerned by the high valuations of equity markets and facing many uncertainties in the coming months.

Key views

- Balanced, global convertible bond strategies stand to benefit from an expected return of equity volatility and risk assets in 2020

- A focus on the better-quality credit instruments could provide superior shelter from corrections