investment viewpoints

Convertible bonds: the best of both worlds

Convertible bonds are a distinctive asset class with the potential to capture the best of both worlds in equity and fixed income.

On the one hand, convertibles enable investors to partake in positive equity returns, capturing a portion of stock rallies, but with lower volatility than simply investing in shares. On the other hand, convertibles offer protection1 if stocks weaken because convertibles have a fixed income component. As such, convertibles participate in equity upside but are protected from some of its downside due to the bond features. This profile can offer investors higher risk-adjusted returns.

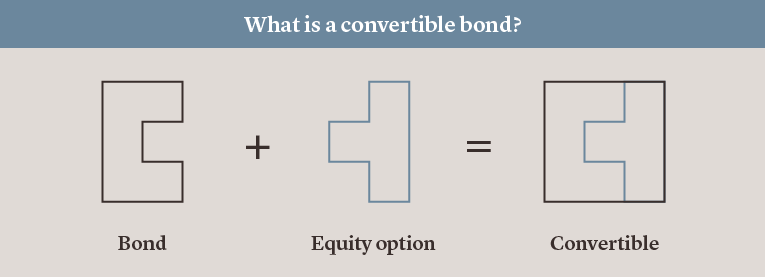

A convertible bond contains a corporate bond with a fixed coupon and a set maturity date. In this regard, it is like any typical bond instrument. Convertibles, however, also contain an equity call option. This option allows the holder to convert the bond into the common stock of the issuing company at some point in the future, if certain conditions are met. The details of the option - namely the number of shares into which each bond can be converted, and the conversion price - are set at the time of issuance.

Because of their dual structure, convertible bonds generally exhibit both equity and fixed income characteristics. Depending on valuations and market conditions, a convertible bond may act more like a stock or more like a bond at any given time.

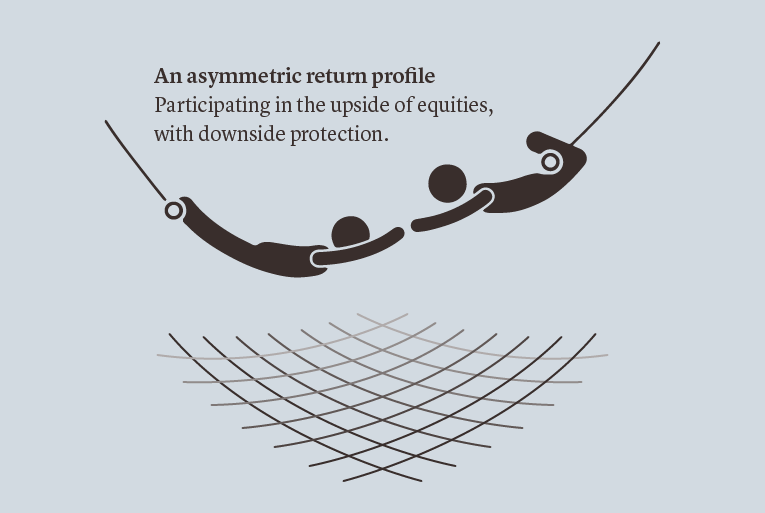

Convertible bonds are described as balanced when they combine a relatively large bond component (or bond floor) and meaningful equity sensitivity (or delta). Balanced convertible bonds are particularly attractive to investors because balanced bonds maximise a crucial factor in convertibles: their asymmetric return profile.

The asymmetric return profile of convertible bonds is sometimes referred to as convexity. It describes the resilience of an instrument to different outcomes. This return profile means that, since convertible bonds are correlated to the underlying share through the embedded option, they offer investors the potential to gradually participate in the upside of the underlying equity. The upside potential is not restricted - the owner of the convertible even has the choice to convert into the underlying share when the strike price is met. The downside, however, assuming the credit remains solid, is limited to the value of the embedded option.

This means that convertible bondholders are much less exposed to falls in share prices than a traditional equity holder - the bond element enables them to effectively dampen the equity downturn.

Over various market cycles, convertible bonds have therefore captured most of the equity market upside due to their embedded options, while providing a measure of downside protection due to their bond like characteristics2. This unique structure, combining participation in rising equities but protection when equity markets are declining, has led to attractive risk-adjusted returns for convertible bonds over the long term.

Performance engines and uses

Convertible bonds can play a valuable role in a portfolio for investors because they have multiple performance engines. These can develop in different ways and give investors the potential to generate value in a variety of market conditions.

From a fixed income point of view, adding convertible bonds to a diversified portfolio can lower the interest rate sensitivity of the overall allocation. The asset class is less sensitive to interest rates than other types of bonds, partly because of its shorter maturities (averaging four years), but mostly because of the option component, which typically gains value in times of rising interest rates.

Over the long-term, the convertible bond asset class has generated similar returns to equities but with lower volatility, resulting in higher risk-adjusted returns (as measured by the Sharpe ratio)3. We believe this asymmetric return profile makes convertible bonds attractive to investors in need of the growth potential of the equity market, but wanting to reduce their exposure to equity-market drawdowns and volatility.

In addition, adding convertible bonds may broaden exposure to parts of the market that might be underrepresented in an investor’s portfolio. Although the convertible bond market contains issues from companies of all sectors, regions and market capitalisations, the asset class has a heavier weighting to growth and mid-cap companies than most traditional equity and bond strategies. With significant allocations to sectors such as technology, healthcare or industrials, convertible strategies may be particularly attractive to complement a traditional dividend strategy focused on large-cap value stocks, for example.

There are, of course, risks also associated with convertible bonds. These include the typical risks associated with corporate debt (e.g. default risk or interest rate risk), as well as risks associated with equity call options (e.g. an equity correction leading to the devaluation of the option).

Featuring a distinctive profile that can offer the best of both equity and bond worlds, convertibles can play a valuable role in a portfolio for investors.

Please find key terms in the glossary.