global perspectives

Simply put: energy inflation is transitory, unlike shelter costs

In our latest multi-asset macro update, we share the following views:

- The recent US inflation report highlights several key contributors to rising inflation, not just energy.

- The cost of shelter has risen and is likely to continue to drive inflation over the medium term, reflecting the rapid rise in house prices and the lagging impact this can have on inflation measures.

- Both the Federal Reserve and investors will need to pay close attention to this factor in the months ahead.

Markets and central banks have been discussing the supposedly ‘transitory’ nature of inflation. The factors being heavily scrutinised include energy prices, supply-chain bottlenecks and labour-supply shortages (notably in the US). Most of these factors have impacts that are lagging and vary in size and duration, which combine into a temporary elevation of inflation that is pushing central bankers out of their comfort zone.

The latest US monthly inflation report is no exception and once more confirms the importance of the inflation theme to market activity. We think the key takeaway from this report is that energy inflation is less likely to surprise on the upside than ‘service’ inflation – an inflation source that is slow to take effect yet is strongly tied to the good economic conditions we are experiencing today.

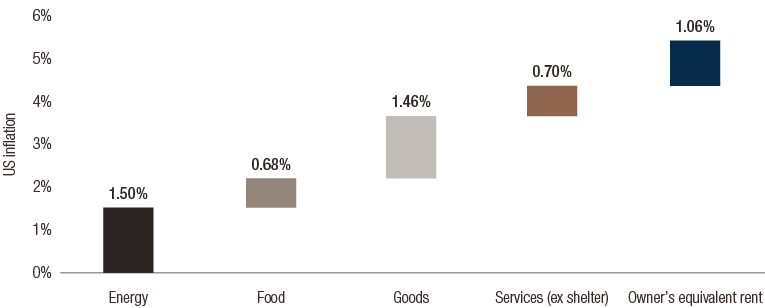

US headline inflation reached 5.4% in September and its core reading rose to 4%. In our view, there are three factors behind this:

- Energy continues to be the largest contributor to inflation, adding 1.5% year-on-year. This shouldn’t be surprising given oil prices have risen by around 100% year-on-year. Such base effects have material consequences on inflation numbers, but oil prices would need to reach $160 per barrel over the next 12 months to maintain this high level of contribution.

- Food and goods inflation added around 2% to inflation. Over the longer run, food inflation should evolve around 2% while goods inflation will be roughly zero, meaning this should also be a source of temporary headline inflation.

- The final element – service inflation – is our key focus here. This has contributed roughly 1.7% to inflation, two thirds of which has been the outcome of an element which is technically not even a service: the cost of shelter. The cost of shelter has risen 3.2% year-on-year and represents a 30% weight in the inflation basket.

FIG. 1. Year-on-year US Inflation Decomposition

Source: Bloomberg, LOIM at October 2021. For illustrative purposes only.

Within the “shelter” component, one particular element has a sizeable weight on its own: the owner’s equivalent rent of primary residence (OER). The OER’s weight in the headline CPI is 23.6%, accounts for 29.9% in the core CPI, and in the personal consumption expenditure (PCE) basket, its weight stands at 11.4% for headline and 12.9% for core. The OER therefore considerably affects the evolution of prices and monetary policy. In our eyes, this component needs to be monitored closely to anticipate the evolution of inflation.

In order to understand how this number might evolve, understanding how it is calculated is crucial. The Bureau of Labor Statistics (BLS) measures the OER using a survey, where primary residence owners are asked how much rent they think they would be charged if they were to rent their home instead of owning it. This component is therefore derived from the perceived value of property owners’ homes and multiple factors can affect it.

Research from the Federal Reserve (Fed) Bank of Cleveland finds that the strongest driver of OER inflation is lagged house-price appreciation – if owners perceive their house prices have risen, then their answer to the survey is likely to increase. So what are house prices doing right now? The US Case-Shiller index is currently showing a 20% year-on-year increase in house prices, a growth rate that has not been seen during the 1988-2021 period. As illustrated in figure 2, the historical relationship between house prices and OER increases highlights two key elements:

- Firstly, their relationship tends to lag by 18-months – it takes a long time for OER inflation to materialise and then remains on a rising trajectory for a long time.

- Secondly, having already seen a significant rise in house prices, a linear regression forecasts the OER to grow at a 4.5% rate in 18 months’ time.

This projection should yield an inflation contribution of 1.3% to core inflation during the medium term and 0.5% to the PCE aggregates.

FIG. 2. OER year-on-year inflation versus house prices relative variations

Source: Bloomberg at October 2021. For illustrative purposes only.

Two additional variables that could also directly or indirectly influence OER are financial conditions and wages. Financial conditions are driven by return expectations from an asset-owner’s perspective, while wages tend to represent a measure of affordability. In the current environment, both of these factors could further fuel OER as being an essential source of durable inflation in the US.

If the Fed wants to meet its medium-term inflation goal, it should regard these prospects with a friendly eye. However, rapidly rising housing prices could well create an upside inflation risk that requires a more rapid monetary policy adjustment than initially expected. In our view, this is where the inflation risk lies today, not with commodities.

| Simply put, inflation should remain elevated for some time – not because of the increasing price of commodities, but due to rising shelter costs. We believe this factor could affect longer term rates and Fed policy, and will require close scrutiny by investors. |

Informazioni importanti.

RISERVATO AGLI INVESTITORI PROFESSIONISTI

Il presente documento è stato pubblicato da Lombard Odier Funds (Europe) S.A., una società per azioni di diritto lussemburghese avente sede legale a 291, route d’Arlon, 1150 Lussemburgo, autorizzata e regolamentata dalla CSSF quale Società di gestione ai sensi della direttiva europea 2009/65/CE e successive modifiche e della direttiva europea 2011/61/UE sui gestori di fondi di investimento alternativi (direttiva AIFM). Scopo della Società di gestione è la creazione, promozione, amministrazione, gestione e il marketing di OICVM lussemburghesi ed esteri, fondi d’investimento alternativi ("AIF") e altri fondi regolamentati, strumenti di investimento collettivo e altri strumenti di investimento, nonché l’offerta di servizi di gestione di portafoglio e consulenza per gli investimenti.

Lombard Odier Investment Managers (“LOIM”) è un marchio commerciale.

Questo documento è fornito esclusivamente a scopo informativo e non costituisce un’offerta o una raccomandazione di acquisto o vendita di titoli o servizi. Il presente documento non è destinato a essere distribuito, pubblicato o utilizzato in qualunque giurisdizione in cui tale distribuzione, pubblicazione o utilizzo fossero illeciti. Il presente documento non contiene raccomandazioni o consigli personalizzati e non intende sostituire un'assistenza professionale in materia di investimenti in prodotti finanziari. Prima di effettuare una transazione qualsiasi, l’investitore dovrebbe valutare attentamente se l’operazione è idonea alla propria situazione personale e, ove necessario, richiedere una consulenza professionale indipendente riguardo ai rischi e a eventuali conseguenze legali, normative, creditizie, fiscali e contabili. Il presente documento è proprietà di LOIM ed è rivolto al destinatario esclusivamente per uso personale. Il presente documento non può essere riprodotto (in tutto o in parte), trasmesso, modificato o utilizzato per altri fini senza la previa autorizzazione scritta di LOIM. Questo documento riporta le opinioni di LOIM alla data di pubblicazione.

Né il presente documento né copie di esso possono essere inviati, portati o distribuiti negli Stati Uniti d’America, nei loro territori e domini o in aree soggette alla loro giurisdizione, oppure a o a favore di US Person. A tale proposito, con l’espressione “US Person” s’intende un soggetto avente cittadinanza, nazionalità o residenza negli Stati Uniti d’America, una società di persone costituita o esistente in uno qualsiasi degli stati, dei territori, o dei domini degli Stati Uniti d’America, o una società di capitali disciplinata dalle leggi degli Stati Uniti o di un qualsiasi loro stato, territorio o dominio, o ogni patrimonio o trust il cui reddito sia soggetto alle imposte federali statunitensi, indipendentemente dal luogo di provenienza.

Fonte dei dati: se non indicato diversamente, i dati sono elaborati da LOIM.

Alcune informazioni sono state ottenute da fonti pubbliche ritenute attendibili, ma in assenza di una verifica indipendente non possiamo garantire la loro correttezza e completezza.

I giudizi e le opinioni qui espresse hanno esclusivamente scopo informativo e non costituiscono una raccomandazione di LOIM a comprare, vendere o conservare un titolo. I giudizi e le opinioni sono validi alla data della presentazione, possono essere soggetti a modifiche e non devono essere intesi come una consulenza di investimento. Non dovrebbero essere intesi come una consulenza di investimento.

Il presente documento non può essere (i) riprodotto, fotocopiato o duplicato, in alcuna forma o maniera, né (ii) distribuito a persone che non siano dipendenti, funzionari, amministratori o agenti autorizzati del destinatario, senza il previo consenso di Lombard Odier Funds (Europe) S.A. ©2021 Lombard Odier IM. Tutti i diritti riservati.