multi-asset

Multi asset: steering an all-terrain investment vehicle

Delivering quality returns through various types of market conditions requires maintaining a laser focus on the core elements that drive risk and returns. That means avoiding distractions and resisting the temptation to follow the latest investment fads. In the Q3 issue of Simply put, we explore the fundamental aspects of our strategy – the primary sources of long-term value. Fashions come and go, but they have potentially little impact on the long-term performance of our portfolios. Topics covered include:

- The CIO’s perspective. While some may focus on more `fashionable’ topics, we like to focus on the 'boring' parts of our investment process. These are essential to achieving consistent, long-term performance.

- Portfolio positioning. Based on our indicators, we believe market nervousness remains in the fixed income space. We see reasons to stay overweight cyclical assets and exposed decently to markets. However, hedges are required.

- Macro. As central banks lower key rates, any redirection of proceeds from money market funds will depend on whether rates are cut for demand or inflation reasons. The former would support bonds, and the latter would support equities.

- Special focus. The Dynamic Drawdown Management (DDM) process we have developed seems particularly well-suited to mitigating tail risks. We outline some of the intriguing findings from a recent review of our DDM overlay.

- New research. A recent improvement in performance of trend strategies has reignited investor interest following a lost decade. Switching between long- and short-term trend signals as risk aversion ebbs and flows could enhance the opportunities.

You can read the latest quarterly edition of Simply put by exploring the sections below.

-

Section 1 – The CIO’s perspective

Concentrate on what matters most, most of the timeAlain Forclaz

Deputy CIO, Multi AssetNeed to know

- The temptation to focus on the most fashionable parts of an investment portfolio is understandable but not advisable

- Trends in investing come and go, but delivering quality returns through both known and unknown regimes requires maintaining focus on the right areas

- We delve into the fundamental elements of our strategy – the primary source of our realised returns over the past decade and more

Fashion trends are prevalent in nearly every industry but hold little sway in our All Roads franchise. The name of our strategy implies a broad-based approach; building an all-terrain investment vehicle requires versatility rather than a narrow focus on select trends. Our latest Quarterly Simply Put explores this idea by looking at key steps in our journey to delivering quality returns for our investors. Drawing inspiration from Vilfredo Pareto's time-management principle, we stress the importance of focusing on the core elements that influence risk and returns meaningfully. We examine these crucial aspects within the context of our investment process, highlighting our commitment to a disciplined and comprehensive approach that avoids the fleeting distractions of fads to focus on the sources of long-term value.

80 or 20?

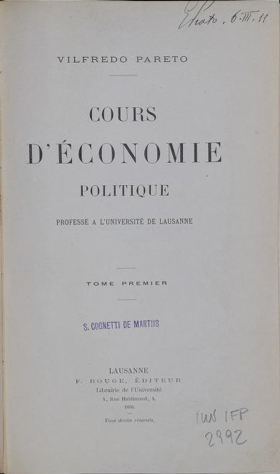

In his seminal work ‘Cours d'Économie Politique’, which he taught at the University of Lausanne (fittingly, the city where I live today), Vilfredo Pareto laid the groundwork for a concept that continues to echo through the ages: the 80/20 principle. Initially, Pareto merely studied the distribution of wealth within an economy, remarking that in Italy, "80% of the property is owned by 20% of the population".

FIG 1. Cover page of Vilfredo Pareto’s ‘Cours d’Economie Politique’

This insight into disproportionate wealth distribution gradually permeated social and business sciences, ultimately achieving widespread recognition through the management consultant Joseph Juran. Simply put, the Pareto Principle states that 20% of causes are responsible for 80% of effects, and advocates for a strategic focus on impactful causes. In traditional Pareto parlance, it is the 20% “vital few” – or the high-value stuff – that generates 80% of outcomes. Alongside this is the 80% “useful many”, responsible for 20% of outcomes.

Within an investment portfolio, it is generally not the case that 20% of the portfolio generates 80% of returns. Figure 2 details some simple numbers. Assuming some extraordinary assets (the vital few material) generate a 20% p.a. return, while the useful many merely generate 5% p.a. Even in this case, half of the portfolio’s returns will stem from the latter. Of course, a 50% return contribution from 20% of the portfolio is not to be frowned upon, but that still leaves the majority of returns coming from the bulk of the portfolio.

FIG 2. Portfolios under the Pareto lensAllocation Expected Return Contribution (%)

ContributionVital Few 20% 20% 4.0% 50% Useful Many 80% 5% 4.0% 50% Total Return 8.0%

Source: Bloomberg, LOIM. For illustrative purposes only. Target performance is an estimate of future performance based on current market conditions and not an exact indicator. What you will get will vary depending on how the market performs and how long you keep the product.

There is a tendency to spend a considerable amount of time on ‘glamorous’ 20% assets and overlook ‘boring’ 80% assets, even though these represent the bulk of the portfolio. To be sure, the rising popularity of private assets and other alternatives among institutional and, more recently, retail investors is a testament to this. Our conviction, however, is that there is considerable value in developing a consistent, reliable and efficient process for a portfolio’s ‘mundane’ components, which are the bedrock of long-term value creation. While fashions change, principles remain constant.

Sailing through fashionA neat way to visualise financial market fads is to observe the mentions of such trends in the media, and this data is readily accessible through Google Trends. Figure 3 charts the popularity of high-profile stocks, such as Nvidia and Alphabet1, and their broader ecosystem, the Nasdaq. For comparative purposes, the same analysis is applied to the pillars of our investment approach: asset allocation and diversification. Despite their lack of sensational appeal, the fundamental elements of our strategies have never been sidelined by the media and continue to receive consistent attention. However, recently the more glamorous tech sector has captured markedly more interest – approximately 4 to 5 times more – showcasing the significant volatility of public attention. Notably, Alphabet has declined in popularity recently, overtaken by Nvidia, the poster child of the AI craze.

Our point here is that fame is transient, and we expect it to have little long-term impact on the performance of our portfolios. We believe returns stem predominantly from asset allocation, dynamic overlays and risk management; therefore, we remain focused on these fundamental elements rather than being swayed by the latest trends. We aim to navigate through market fads and not be distracted by them, ensuring our investment strategies remain robust and focused on long-term value.

FIG 3. Google Trend searches for financial terms

Source: Google Trends, LOIM. As at June 2024. For illustrative purposes only1.

Focus on what is valuableReturning to the Pareto principle, we could not resist also looking at it through a risk lens. For a real-world example, we considered the asset allocation of the average large pension fund. Figure 4 shows that large pension funds currently hold around 45% of their portfolios in fixed income (incl cash), 30% in publicly traded equities and 25% in alternatives (including real estate and land, hedge funds, private equity, private debt and infrastructure, etc).

FIG 4. Asset allocation of OECD large pension funds2

Source: Bloomberg, LOIM. For illustrative purposes only.

If all of the alternatives are added together under the proxy term ‘private capital’, we can work out the return and risk decomposition that would have been associated with this portfolio allocation over the 2007-2023 period – see figure 5. To note, the historical asset allocation of pension funds (and other institutional investors) has in practice been quite different as the proportion of `alternatives’ has meaningfully increased over the period (and even tripled by some estimates3).

FIG 5. Performance and risk attribution of a portfolio composed of 45% bonds, 30% listed equities and 25% alternatives

Source: Bloomberg, LOIM. Alternatives are proxied by the Bloomberg Private Capital Index. Public equities are represented by MSCI World Net Total Return Index and fixed income by the Bloomberg Barclays Global Aggregate Index hedged in USD. For illustrative purposes only.

While the return contribution from alternatives (the vital few in Pareto’s parlance) is indeed meaningful at 38% (although far from the settings typically associated with the principle), we note that the bulk of the returns (62%) and of the total portfolio risk (80%) stem from the useful many (i.e., public equities and fixed income)4. Another management consultant, Richard Koch5, dedicated a book to the Pareto Principle, which contains a noteworthy quote: "Most of what we do is of low value, but some of what we do is of high value. The key to success is to do more of what is valuable and less of what is not". We abide by this idea, in that we focus on continuously building robust, time-tested risk models, drawdown management processes, and market and macro indicators, for it is these elements that have driven most of the value investors have extracted from markets over the past 20 or so years.

Our latest quarterly edition of Simply Put zeroes in on some important facets of our investment process, examining how they have adapted and performed through fluctuating markets and economic landscapes since the onset of the pandemic – because it is these elements that we believe are pivotal to delivering quality returns to our investors. Our focus remains steadfast on refining and enhancing our processes. Key insights can be drawn from the regular evaluation of our performance to help identify areas ripe for further research. We have committed to this for the past 12 years, and we continue to dedicate ourselves to doing what is most valuable for our portfolios. In this, we follow Pareto’s Principle.We hope you enjoy this latest edition and, as always, remain available for further debates – we are only one call or email away! -

Section 2 – Portfolio positioning

Exposed and hedgedAurèle Storno

Chief Investment Officer, Multi AssetNeed to know

- Our signals continue to advocate for risk-on exposure and increased market participation

- Our core stance of being underweight duration remains unchanged. The high-volatility regime of the past two years keeps normalising, but trends are not yet turning positive

- Sentiment continues to favour cyclical assets, yet the macroeconomic landscape is fraught with risks, from a perceived slowdown to rising inflation. Approaching Q3 without appropriate hedges would be imprudent

Last quarter, we discussed how risk remained elevated in fixed income, prompting us to steer clear of duration – a theme we have repeatedly highlighted since the major regime change regarding inflation and rates policy in 2022. As we enter the third quarter of 2024, our cautious stance regarding duration persists. While risks in the fixed income sector keep normalising progressively from a high level, trends have remained weak – with a new, tentative stabilisation in June, but no outright positive signals yet. The anticipated great normalisation is indeed unfolding, albeit at a slower pace than initially thought. After a very solid first quarter, driven by the leadership of developed markets equities, the second quarter has seen significant market hesitations, marked by a more erratic series of market movements and leadership changes. As a consequence, our investment signals have slowed and stabilised the redeployment of risk, without yet turning negative. However, the relatively low cost of hedging argues for an increased level of hedges. At this juncture, it makes sense to overweight cyclical assets, but in a hedged manner and within a robust drawdown management system. Q3 promises to be positive yet accompanied by heightened tail risks.

Duration risk keeps declining

As is customary, our quarterly portfolio review for the All Roads strategies begins with an examination of our risk dashboard. The current dashboard primarily mirrors the situation observed at the end of Q2, but now includes one significant update that greatly impacts our asset allocation strategy. This development has emerged from the bond market, where the previously high and persistent risk of duration has started to show signs of continued abatement, as highlighted in figure 6. This change was likely influenced by the June central bank meetings – especially those of the Federal Reserve and the European Central Bank (ECB). These meetings provided greater clarity on the future direction of interest rates, thus reducing associated risks. Moreover, the ECB's initial rate cut set the expectation that interest rate moderation will continue, albeit more gradually than anticipated. This clearer outlook has led to a reduced sense of uncertainty, a change that is captured by our volatility measures and, while declining progressively, duration risk continues to be measured in the highest quartile.

FIG 6. Risk premia volatilities

This chart shows the time series evolution of our proprietary volatility models per risk premia. Dotted line represents historical median and red zone shows the 4th quartile of volatilities.

Source: Bloomberg, LOIM as at 17/06/2024. For illustrative purposes only.

Duration trend tentative stabilisationThe diminished risk associated with duration has been accompanied by weak trend signals throughout most of 2024. In early Q2, major government bond markets were still showing signs of weakness, which started during Q1 after the relief rally of late 2023. Cyclical assets, which were on an upward trajectory at the close of Q1 – a point noted previously – continue to maintain their upward trend as Q3 progresses. However, the fixed income asset class has experienced a downturn since the start of the year, leading our trend indicators to shift from positive to negative, with particular weakness in April and May. This shift resulted in our trend scorecard contrasting risky (solid trend) and defensive (weak trend) risk premia in April and May, as illustrated in figure 7. This representation vividly captures a prevailing market bullishness during Q2, which is also confirmed by our Risk Appetite indicator. However, we have observed another possible shift since mid-June, with government bond trends stabilising tentatively with a possible improvement to come.

FIG 7. Trend following signals

Source: Bloomberg, LOIM as at 17/06/2024. For illustrative purposes only.

Exposed but not unhedgedAt the end of Q1, our risk appetite metrics indicated an all-time high in market bullishness. Q2 presented a different scenario with markets stalling, as some metrics began to exhibit increased volatility. As illustrated in figure 8, this heightened volatility of indicators doesn't imply a full reversal of risk appetite, but rather suggests a diminishing probability that cyclical assets will continue to benefit from strong tailwinds. Currently, when focusing solely on our market-based risk appetite component – which integrates the cost of hedging from various derivative markets – only 20% of underlying indicators show an improvement. As we approach Q3, it's evident that the market’s `risk on’ mood will be challenged, eventually casting doubt on the robust trend-following momentum previously discussed. With this in mind, while maintaining exposure to cyclical assets remains attractive, it is prudent to do so in a hedged manner. Consequently, we have increased exposure to long volatility strategies, aiming to safeguard the performance accumulated so far this year. This adjustment underscores our commitment to risk management amid an increasingly uncertain market environment.

FIG 8. LOIM global risk appetite and components

Source: Bloomberg, LOIM as at 17/06/2024. For illustrative purposes only.

Inflation means duration still a riskTurning to our nowcasting signals, the outlook appears less supportive for markets. Firstly, in terms of growth, our global indicators continue to align with the ‘low growth’ narrative suggested by most soft data. Currently operating at levels below 45%, the percentage of improving data sets the stage for potential further deterioration in growth. This does not bode well for cyclical assets, even if the market rhetoric for some time has been to welcome deteriorating growth (but not too much), which confirms central banks’ `control’ by boosting exposure to risky assets. From a purely fundamental point of view, the deterioration of growth is casting doubt about cyclical assets’ potential for further strength. Secondly, our inflation signals indicate a persistent recovery, which is now notably affecting European economies – an effect acknowledged by the ECB during its recent revision of staff forecasts. Thirdly, monetary policy is expected to remain on hold in the upcoming quarter, with no aggressive dovish cuts anticipated; after all, the recent ECB rate cut was notably hawkish in nature.

These factors collectively help to explain some of the trends we're seeing: inflation remains a source of uncertainty that continues to pressure bond performance. The critical question now is whether this growth deterioration will trigger more positive sentiment, potentially helping to alleviate inflation pressures, or incite negative sentiment, possibly weighing on earnings in Q3 and Q4. For now, our macro overlay remains defensively positioned. The recently implemented valuation overlay (discussed in a prior quarterly review) remains muted globally, with a positive bias for bonds and a negative bias for equities, but not significant enough at this stage to alter exposures.

FIG 9. Macro nowcasting signals

Source: LOIM, as at June 2024. For illustrative purposes only.

Cautiously optimisticFinally, turning to our asset allocation, the message is that little has changed from the previous quarter. While we dislike the expression, our exposures can be interpreted as ‘cautiously optimistic’. This can often reflect a lack of conviction; however, in this instance, it states that conditions remain bullish overall, but some indicators warrant caution. Three months ago, our asset allocation strategy favoured equities, credit spreads and commodities over bonds, and this positioning remains firmly in place. On a relative basis, we have marginally increased our exposure to credit, both corporate and emerging sovereigns, while our commodities exposure has decreased slightly but remains significant compared to the long-term average.

Additionally, our total exposure has risen somewhat, although at a slower pace than earlier this year, reflecting some of the stabilising patterns previously discussed. This comes with a commensurate upward adjustment to our long volatility strategies as a hedge, should something go awry in the next quarter – from political risk to earnings and inflation risks. This cautious yet proactive approach aims to maximise our capacity to harvest returns, while managing potential downside risks effectively.

FIG 10. All Roads allocation decomposed

Source: Bloomberg, LOIM, as at 17/06/2024. Holdings and/or allocations are subject to change. For illustrative purposes only.Simply put, our signals continue to push for a decent market exposure, with a preference for cyclical assets – but not without hedges. -

Section 3 – Macro

The reason why central banks cut ratesFlorian Ielpo

Head of Macro, Multi AssetNeed to know:

- As world growth moderates, and while our inflation indicators rise, central banks could see a window of opportunity to cut rates, mostly due to the first rather than the second reason

- An unusually high portion of investors’ portfolios is currently invested in money market funds, attracted by the high short-term rates. Lower central bank rates could make these investments less appealing, triggering exits in the coming quarters

- As central banks normalise their key rates, the redirection of these proceeds will depend on whether rates are cut for demand or inflation reasons: demand would support bonds while inflation would favour equities

The pivotal macroeconomic question for the third quarter of 2024 centres on the trajectory of monetary policy. Following the Federal Reserve's December 2023 announcement of a policy pivot, markets have been anticipating rate cuts from central banks. However, the response from central banks has been varied: while a few have indeed reduced interest rates, many others have opted to keep them on hold. This divergence raises critical questions about the factors driving these differing monetary responses and the potential impacts on global financial markets. What motivates these varied reactions, and what are the likely consequences for market dynamics?

Stabilising growth, rising inflation risksBefore delving into the market implications of central bank pivots, it's crucial to assess two other significant macroeconomic factors: growth and inflation. These elements are fundamental to any robust Taylor rule construction. Figure 11 presents our country-level nowcasting indicators – their consistency, or lack thereof, matters when extracting trends and messages from their readings. Our current analysis yields the following conclusions:

- These regional-level indicators highlight several forces at play. Initially, in terms of growth, the countries depicted in the left-hand chart of figure 11 exhibit a range of readings, from low to close to 50% levels – but no country is currently below the recession threshold. Notably, a majority of countries, including the US, Switzerland and China, register growth readings of around 40%. The Eurozone presents a more elevated figure, nearing 50%. This diversity is likely contributing to the prevailing confusion regarding misplaced recession expectations over the past 18 months. On average, our growth signal indicates that world growth remains at a low and stable level, providing central banks with a prime argument for rate cuts.

- Conversely, the right-hand chart reveals trends in inflation surprises – where positive readings indicate a heightened risk of inflationary surprises. Here too, discrepancies exist across countries, yet the trend of the indicators is more definitive: all are trending upward, whether in the case of the US, the Eurozone, China or Switzerland. This widespread increase in inflation pressures challenges central banks' capacity to cut rates.

It is the clash between these two dynamics – stalling growth yet rising inflation pressures – that underpins the crux of the question we pose: in this context, should we expect central banks to cut rates and, if so, what would be the justification? In addition, will the trajectory of rate declines be significant for investors?

FIG 11. World growth (left) and inflation (right) nowcasting indicators

Source: Bloomberg, LOIM as at 21/06/2024. For illustrative purposes only.

The money market stashThe significance of the rate-cutting question for financial markets is deeply intertwined with the current prominence of money amassed in money market funds. Historically, investors have endured a prolonged era of declining interest rates, which resulted in a decade of near-zero to negative returns from money market funds. Consequently, the only avenues for generating meaningful performance were investments in bonds and equities. However, the landscape shifted with the initial rate hikes in 2021, which rekindled interest in money market funds. These began to attract substantial inflows as they offered investors risk-free positive returns – a stark contrast to the known negative returns in CHF and EUR. This shift marked a significant turning point, as illustrated in figure 12, which underscores the cyclical nature of this phenomenon.

Traditionally, large holdings in money market funds have been indicative of risk aversion, as seen during the financial crises of 2001 and 2008, when such holdings exceeded 20% of US GDP. During the zero-rate period, these holdings dipped to about 15% of US GDP. Yet, with the recent uptick in interest rates, a trend towards ‘lazy investment’ has emerged, pushing the proportion of money market proceeds to approximately 22% of US GDP6. This surge in demand for short-term investment vehicles might reflect a cautious stance among investors, but it also highlights the attraction of earning roughly 5% annually without significant concern for market volatility. When central banks opt to reduce rates, a substantial portion of the funds currently held in these investment vehicles might migrate to other options such as bonds or equities. Deciding between these two investment avenues depends on a variety of factors, including the economic outlook, investor risk tolerance and market conditions at the time of any rate cuts.

FIG 12 & 13. Ratio between world money market funds’ assets under management and US nominal GDP and US and Eurozone monetary policy nowcasting signals decomposed

Source: Bloomberg, LOIM. As at 21/06/2024. For illustrative purposes only.

It’s all about central bank motivationsOne of the key triggers that will determine whether investment flows favour bonds or equities is deeply rooted in the economic situation at that time. Central banks have maintained high interest rates to combat inflation, but the rationale for rate cuts can vary – either stemming directly from inflation concerns or worries about economic growth. As high rates persist, the logic of the Phillips curve unfolds: inflation tends to moderate as the job market weakens. It's essential to note that not all central banks will react similarly. The Fed, for example, operates under a dual mandate concerning inflation and employment, whereas the European Central Bank (ECB) is traditionally focused solely on inflation. However, a precedent was set at the June ECB meeting, where rates were cut even as inflation forecasts increased, driven largely by concerns over long-term growth prospects and the suspicion that these might deteriorate.

This divergence in central bank motivation is crucial for the vast sums currently held in money market funds. If inflation continues its gradual moderation, central banks may be in a position to cut rates progressively, benefiting longer-term growth. This scenario should encourage investors to shift back into equities, which are well-positioned to capitalise on growth through earnings. Conversely, if central banks are forced to cut rates due to explicit concerns about declining growth, the investment landscape could look markedly different. In such a scenario, with deteriorating growth prospects, long-term bonds might become more attractive compared to equities and to the significantly lower cash rates needed to counteract recessionary pressures.

Figure 13 shows what our monetary policy nowcasting signal indicates about this situation in Europe and the US. From this, we can conclude that cost pressures, as a proxy for pure inflation, are normalising globally, suggesting the possibility of a progressive series of rate cuts. Demand, as a driving factor for monetary policy, argues for more aggressive cuts, particularly in the US, given the ongoing recovery in Europe. It will be crucial to monitor these metrics in the coming months, as their emerging trends will assist in determining where current excessive levels of cash reserves will ultimately be allocated.

An uneven upsideA lingering question pertains to the asymmetry of expected returns between bonds and equities. If resources from the money markets are allocated to one of these asset classes, which is likely to yield greater returns? This is a pivotal question, as the return profiles for each asset class are expected to differ significantly. Figure 14 attempts to shed light on this issue using our cross-asset valuation signal, which illustrates the necessary adjustments for each asset class to revert to its ‘fundamental value’ as determined by our trend-based models. Expressed simply, a mere mean-reversion to long-term value levels would result in long-term bonds generating an approximate 9% performance, whereas equities, which are currently well above their long-term values, would see a decline of about 13%. The asymmetry here is stark: the upside potential for equities appears limited, while the potential for bonds is considerably greater. European assets, as represented by the Euro Stoxx 50, appear even more stretched at present, despite a premium following the recent European parliamentary elections.

Consequently, from a demand perspective, bonds could see significant gains, while, due to reasons of inflation moderation, the progression in equities could be more marginal.

FIG 14. Performance needed by various markets to return to their fundamental valuations, as per our cross-asset valuation model

Source: Bloomberg, LOIM. For illustrative purposes only.

Simply put, anticipating the course of asset prices during Q3 is tied, in part, to understanding whether central banks will cut rates due to growth or inflation. Growth would mainly favour bonds, while inflation would marginally favour equities. -

Section 4 – Special focus

The hedge that did not costSui Kai Wong

Senior Portfolio Manager, Multi AssetJulien Royer

Quantitative Analyst, Multi AssetNeed to know:

- Risk-targeting solutions are not immune to fast market declines, making them natural candidates for tail-risk overlays

- Option-based insurance and portfolio insurance techniques provide convexity to mitigate tail risks but come with a cost of carry that can be difficult to sustain

- The drawdown management technique we developed in our All Roads strategies was particularly efficient in the recent tumultuous period, with an attractive balance between convexity and the cost of insurance

The concept of diversification is central to portfolio construction. With a well-balanced asset allocation, we can eliminate risks that are specific to some assets, thus only keeping exposures to systematic risks in the asset universe. Risk-based portfolios are particularly adept in capturing diversification, often resulting in low-risk solutions that present an appealing return-to-risk ratio. At the same time, the volatility of such portfolios may be limited by diversification effects. Thus, investors usually use risk-management techniques to deliver a target risk level. While these techniques can help deliver stable returns, they may overlook tail risks and give a false sense of security. The Dynamic Drawdown Management (DDM) process we have developed within our All Roads strategies appears particularly well-suited to mitigating tail risks. This quarter, we undertook a review of our DDM overlay, and the following outlines some of our intriguing findings.

Risk management is not always risk-free

Volatility targeting is a standard and very popular risk-management tool. This is where the exposure of a portfolio dynamically adapts, in a reciprocal fashion, to the evolution of the portfolio’s overall risk in order to target a constant ex-post volatility. In a low-risk environment, a portfolio leverages its exposure to harvest more risk premium. Conversely, as volatility tends to be higher in adverse scenarios, this technique lowers portfolio exposure as market conditions deteriorate. However, as drawdowns may occur in short, abrupt periods of time, the dynamic of deleveraging is often too slow to efficiently avoid drawdowns.

FIG 15. Large returns of a multi-asset risk-based portfolio as a function of the exposure derived from a 10%-volatility target

Source: Bloomberg, LOIM. Data from January 2004 to May 2024. For illustrative purposes only.

Let us consider a multi-asset risk-based strategy that allocates risk equally among equity, fixed income and commodities futures contracts, with a constant exposure of 100%. Figure 15 shows the 10-day performance of the strategy, as a function of its exposure scaled to a 10% target volatility. The green dots represent large negative returns that would have been mitigated by the volatility targeting technique (colloquially referred to here as ‘Grateful’). The red dots correspond to negative returns that would either be amplified or not properly hedged by the volatility targeting process (‘Hurtful’). The blue dots correspond to large positive returns that occur when exposure is low, which contributes to the negative carry of volatility targeting (‘Shameful’). Although volatility targeting helps stabilise returns over time, it is evident from this analysis that it is not foolproof against tail events, nor does it come cheaply, suggesting that hedging tail events requires more involved techniques.

Balancing convexity and negative carryPortfolio insurance is often split between two categories of strategies: option-based techniques that involve building derivatives portfolios that mimic a long put position, or constant proportion portfolio insurance (CPPI) techniques and their various extensions that dynamically manage portfolio exposures, turning to cash as a last-resort hedging asset. Although different, both techniques suffer from the same pitfall: they come with a cost of carry that may be unsustainably high. Indeed, in the case of option-based strategies, systematically buying options may induce a high premium, while deleveraging may lead to a diminished ability to capture market rebounds. Within our All Roads, we combine the two approaches, focusing on option-based strategies with a good balance between convexity and negative carry, while we have also developed an innovative drawdown management technique to dynamically adjust the target risk of the portfolio (expressed as a tail-risk measure rather than volatility). This approach – introduced into our funds more than 12 years ago – builds upon the time-invariant portfolio protection (TIPP) technology to ensure a contained drawdown over time.

Both TIPP and CPPI are, however, known to lack reactivity in market rebounds, delivering low-risk portfolios that are unable to provide upside convexity, translating into an implicit negative carry compared to an unhedged portfolio. Our drawdown management technique carefully controls for this bias by measuring the cost of not being fully invested. Figure 16 presents the convexity profile of our approach and compares it to a plain roll of 5% put on the S&P 500 (also known as the ‘P-put index’). The chart shows the cumulative returns of the two strategies, expressed in units of the volatility of their respective assets, when returns are ordered from the most negative to the most positive.

FIG 16. Convexity profile of our drawdown management strategy vs a standard option-based strategy

Source: Bloomberg, LOIM. Data from February 2012 to May 2024. Systematic put roll shows results obtained from the ‘P-put index’. For illustrative purposes only.

From this illustration, we can draw two conclusions. First, from February 2012 to May 2024, both strategies returned a negative performance, which is not surprising for hedging strategies. However, it is noticeable that the drawdown management strategy captured enough convexity to almost remain flat. Second and more importantly, while the systematically rolling puts strategy does provide convexity, positive returns only corresponded to 18% of the sample period, while they represented 40% of the sample period for the drawdown management strategy, proving a good symmetry in the convexity profile4.

Convexity when it matters: the case of the inflationary regime

The recent period has been particularly challenging for multi-asset portfolios. The return of high interest rates to fight inflation in developed economies has hurt bonds and equities alike, muting diversification and scarring long-only investors. In this context, not all hedges have behaved the same. As mentioned in a previous quarterly Simply Put, option-based strategies struggled as both prices and volatilities waned in a synchronous manner.

Since December 2021, however, our drawdown management process was able to sizably deleverage our multi-asset risk premia exposure to favour cash as a last resort. Our technique was able to efficiently cut the drawdown in 2022, providing good convexity and returning a 5% relative performance in 2022. As markets rebounded, this outperformance decreased as the negative carry started to materialise – a general shortcoming of TIPP-like approaches. As the adage goes, timing the bottom of the market is akin to catching a falling knife. While we may accept a cost during the initial phase of a rebound as being inevitable, our drawdown management technique actively pilots its own cost thereafter.

In the 12 months from November 2022, the relative performance between our All Roads strategy with and without drawdown management was -0.5% – in line with the long-term average cost of employing this technique. In the last quarter of 2023, the stars aligned to revert the strategy to a full-risk budget. The improving investor sentiment, coupled with sustained positive market returns and receding risks all prompted a swift re-risking of the portfolio. Altogether they resulted in a good upside convexity capture, locking in a positive contribution of around 2% over the period4.

Figure 17: Scenario-based cumulative relative performance and drawdown of illustrative All Roads strategy with and without drawdown management technique.

Source: LOIM. For illustrative purposes only. Based on a scenario analysis, which may not reflect the performance of actual investments products. Simulated performance results do not reflect actual trading and have inherent limitations. Data from December 2021 to May 2024.Simply put, portfolio insurance is useful when building multi-asset portfolios as standard risk management techniques may hide tail risks. However, these insurance techniques often present an implicit negative carry as they lack upside capture. We have improved our drawdown management technique to mitigate this shortcoming, balancing the cost of insurance with convexity. -

Section 5 – Research update

Making friends with your trendJoshua Voelkel

Quantitative Analyst, Multi AssetNeed to know:

- Trend strategies have recently performed better than in the preceding decade, prompting a resurgence of investor interest in such solutions – and sparking a natural time to reassess what we have

- Over the past two decades, short- and long-term trend strategies have provided different return profiles, with short-term trends generally outperforming

- Despite this outperformance, implementing a switching mechanism between short- and long-term trend signals as risk aversion ebbs and flows can further enhance the benefits derived from these strategies

In our ongoing effort to enhance our process through both experience and research, we dedicated part of the last quarter to a comprehensive review of our trend strategies. This review focused on two main objectives: (1) evaluating whether these strategies have contributed to delivering consistent, quality returns over time, and (2) exploring potential improvements within the context of a dynamic overlay combined with a multi-asset portfolio. Since the seminal Moskowitz (2012) paper, trend strategies have evolved from being predominantly employed by quantitative hedge funds to being widely adopted in the broader asset management industry. However, they have somewhat struggled to live up to the expectations formed by their past performance track record. More recently, there appears to be a marked improvement in the performance of cross-asset trend strategies, triggering a renewed interest in them. The goal of our research was firstly to measure how the current performance of trend strategies differs from the past, and secondly to analyse why short- and long-term strategies might differ. As serendipity would have it, our assessment process revealed that short- and long-term trend strategies exhibit differing performances during periods of increased risk aversion. This discovery leads us to consider how we might leverage this characteristic to benefit our strategies. While this research is ongoing, this section aims to provide a deeper understanding of our research process and how it continually helps us refine our investment approach, ultimately enhancing the stability of our strategies’ returns. Let’s take a deep dive into the world of trend signals...

The end of disappointment?

In 2013, the publication of 'Time Series Momentum' by Moskowitz et al. (2012) in the Journal of Financial Economics marked a renewed interest from the asset management industry in dynamic overlays. Before 2008, market timing was considered impossible, largely due to influential works like 'A Random Walk Down Wall Street' by Malkiel (1973), combined with several hedge fund crises and disappointing returns. This led the investment and academic communities to largely abandon attempts to forecast future market returns, epitomising Fama’s efficiency hypothesis.

However, a shift unexpectedly occurred from within the investment community itself and the academic researchers associated with it. The consensus moved to acknowledge that while precise market timing may not be feasible, there could be value in dynamic transformations of market signals to identify uncorrelated sources of returns through strategies later termed 'alternative risk premia.' Utilising, for instance, carry measures or trend signals, numerous papers demonstrated that dynamic signals could lead to recurring and positive return patterns. Moskowitz and his co-authors made significant contributions to trend-following strategies by showing how recent returns could forecast future performance, both from single and cross-asset perspectives.

Figure 18 illustrates the performance of such strategies from 2006 to 2024, clearly showing the trend. What is also evident is how these strategies have experienced great success in the past but have recently experienced a less pronounced upturn. When dissecting the chart’s history into two sub-periods, from 2006-2015 the Sharpe ratio was 0.74, but from 2016-2024 the ratio halved to 0.36 – some might suggest a typical long-term Sharpe ratio for most risk premia. The dotted line on the chart underscores this changing trend and the accompanying disappointment across the second period of the sample – alongside a 2022-2023 improvement. The chart also shows the performance of short- and long-term trend strategies, which focus on recent versus long-term returns to predict future trends. The conclusion is clear: the latter period delivered more disappointing returns, but it highlights that short-term trends have outperformed long-term strategies, especially when the overall strategy’s performance was most disappointing – suggesting potential opportunities for strategic adjustments.

FIG 18. Historical performance of cross-asset trend-following strategies per signal frequency

Source: Bloomberg, LOIM, as at April 2024. ‘Poly’ stands for a polynomial approximation of the trend animating the ‘Combination of short- and long-term trends’ line. Past performance is not a guarantee of future results. For illustrative purposes only.

Follow the trend – but which one?Figure 18 illustrates the situation quite clearly: until 2018, both long-term and short-term trend strategies delivered roughly equivalent performance. Since then, shorter-term strategies appear to have taken the lead, outperforming both the blended strategy and the long-term strategy by 7% and 17%, respectively.

However, what the chart does not reveal is whether long-term strategies occasionally outperform their short-term counterparts, and under what circumstances this occurs. Figure 19 addresses this crucial question by ranking the performance of strategies with various lookback windows, split between short, medium and longer ones. The chart reveals a fascinating pattern: short-term strategies dominate at certain times, while long-term strategies excel during others. Importantly, these periods are noticeably persistent – they last more than just a few days, creating distinct colour patterns on the chart.

In essence, all 'frequencies' of trend strategies have their moments of usefulness, and these periods seem to endure long enough that we might attempt to identify them. Periods of underperformance for long-term trends typically occur around significant market events such as 2008-2009, 2011, 2015, late 2018, early 2020 and 2022 – times associated with surges in risk aversion. These are precisely the moments when short-term trends tend to outperform. Intuitively, this seems to make sense as short-term trend signals can capture fast directional changes/trends (which is usually the case in high-risk regimes) while it takes time for long-term trend signals to switch direction and thus, are more suitable for periods of long-term trends (i.e., low-risk regimes). Notably, these periods are concentrated between 2016 and 2024, aligning with the broader trend strategies’ underperformance. This observation raises the thought: what should we do with this information?

FIG 19. Ranked performance of short-, medium- and long-term window trend strategies

Source: Bloomberg, LOIM, as at April 2024. Monthly ranking of trend strategies based on their historical 1-year Sharpe ratio. The 28 trend strategies are equally split into 3 buckets according to the lookback windows used to calculate their trading signal. The pattern shows that both long- and short-term window strategies have persistent periods where they outperform the other. For illustrative purposes only.

Switch on, switch offThe simplest way to utilise this information would be to switch between trend strategies based on a metric of risk aversion. In our case, two options could be considered: either our Global Risk Appetite Index, which Section 2 details as currently indicating a downtrend, or something simpler, such as the VIX Index. Figure 20 displays the detailed performance of different trend strategies, ranging from short- to long-term trend signals, their blend and a 'switching' strategy. This latter strategy toggles from short- to long-term trend signals depending on the VIX level. When the VIX is high, the strategy follows short-term momentum; when the VIX is low, it prefers longer-term windows as an investment signal. Ultimately, this 'regime activation' strategy, as labelled in the table, offers an intriguing feature:

- Combining short- and long-term trends without this switching feature essentially merges a strategy that has been performing better (short-term) with one that has delivered poorer returns (long-term). This results in a strategy with a Sharpe ratio that is lower than the best of the two.

- However, when we switch from short to long based on the VIX, the final Sharpe ratio improves by about 30%, rising from 0.65 to 0.84. More importantly, this Sharpe ratio (and Calmar ratio) surpasses that of the short-term trend strategy, our best candidate so far.

In summary, while combining signals is usually a method to improve Sharpe ratios, it doesn’t always work. Timing the market timing strategy in this specific case appears quite logical: as risk aversion increases, it alters the direction of trends, making long lookback windows unreliable. Conversely, when risk appetite is low, adhering to shorter-term trends can lead to disappointing returns, making long-term signals more reliable. This provides considerable food for thought when constructing a trend strategy, in our opinion.

FIG 20. Performance and risk of different simulated trend-following strategies

Short-term trends Long-term trends Combination of short-

and long-term trendsRegime activation between

short- and long-term trendsAv. annualised return 6.60% 6.00% 6.50% 9.24% Ann. volatility 10.00% 10.00% 10.00% 11.00% Max. drawdown -27% -36% -31% -23% Sharpe ratio 0.66 0.6 0.65 0.84 Calmar ratio 0.26 0.17 0.19 0.39

Source: Bloomberg, LOIM, as at April 2024. For illustrative purposes only.Simply put, while trend signals have recently delivered better returns, we can likely gain more insight from their periods of underperformance than from their successful phases. Switching between long- and short-term trend signals as risk appetite fluctuates could present promising opportunities.

Sources.

2 Report On Long Term Investing Of Large Pension Funds And Public Pension Reserve Funds 2023, OECD.

3 State of Pensions 2023, Equable Institute’s Annual Report

4 Past performance is not a guarantee of future results.

5 Koch, R (1997), “The 80/20 Principle: The Secret to Achieving More with Less”, New York, NY, Crown Business

important information.

For professional investors use only

This document is a Corporate Communication and is intended for Professional Investors only.

This document is a Corporate Communication for Professional Investors only and is not a marketing communication related to a fund, an investment product or investment services in your country. This document is not intended to provide investment, tax, accounting, professional or legal advice.

This document is issued by :

Lombard Odier Asset Management (Europe) Limited (hereinafter the “Company”). The Company is authorised and regulated by the Financial Conduct Authority (the “FCA”), entered on the FCA register with registration number 515393.

This document is approved at the date of the publishing. The Company is clustered within the Lombard Odier Investment Management Division (“LOIM”) of Lombard Odier Group which support in the preparation of this document and LOIM is a trade name.

Any opinions or forecasts provided are as of the date specified, may change without notice, do not predict future results and do not constitute a recommendation or offer of any investment product or investment services.

This document is the property of LOIM, is provided for information purposes only and is addressed for the recipient exclusively for its personal use. It may not be reproduced (in whole or in part), transmitted, modified, or used for any other purpose without the prior written permission of LOIM. It is not intended for distribution, publication, or used for any other purpose without the prior written permission of LOIM.

The contents of this document are intended for persons who are professionals and who have been vetted by LOIM and assessed as suitable to the investment matters set out in this document and in respect of whom LOIM has received an assurance that they are capable of making their own investment decisions and understanding the risks involved in making investments of the type included in this document or other persons that LOIM has expressly confirmed as being appropriate recipients of this document. If you are not a person falling within the above categories, you are kindly asked to either return this document to LOIM or to destroy it and are expressly warned that you must not rely upon its contents or have regard to any of the matters set out in this document in relation to investment matters and must not transmit this document to any other person. This document contains the opinions of LOIM, as at the date of issue or completeness of the information contained in this document, nor does it accept any liability for any loss or damage resulting from its use. All information and opinions as well as the prices indicated may change without notice.

The contents of this document has not been reviewed by any regulatory authority in any jurisdictions and does not constitute an offer or a recommendation to subscribe for any securities or other financial instruments or products.

It contains opinions of LOIM, as at the date of issue. These opinions and information contained herein in this document does not take into account all the specific circumstances of the addressee. Therefore, no representation is made that the information presented in this document are suitable or appropriate to the individual circumstances of any investors. Tax treatment depends on the individual circumstance of the investor and may be subject to change in the future. LOIM does not provide tax advice.

The information and analysis contained herein are based on sources believed to be reliable. While LOIM uses its best efforts to ensure that the content is created in good faith and with greatest care, it does not guarantee the timeliness, accuracy, validity, reliability or completeness of the information contained in this document, neither does it warrant that the information is free from errors and omission not does it accept any liability for any loss or damage resulting from its use. All information and opinions as well as the prices indicated may change without notice. Particular contents of third parties are marked as such. LOIM assumes no liability for any indirect, incidental or consequential damages that are caused by or in connection with the use of such content.

The Source of the data has been mentioned wherever it was available. Unless otherwise stated, the data is prepared by LOIM.

Not for US Person: This corporate communication is not intended for any "U.S. Person" as defined in Regulation S of the Act, as amended or pursuant to the 1940 United States Investment Company Act as amended and will not be registered pursuant to the 1940 United States Investment Company Act as amended, or pursuant to other US federal laws. Neither this document nor any copy thereof may be sent, taken into, or distributed in the United States of America, any of its territories or possessions or areas subject to its jurisdiction, or to or for the benefit of a United States Person. For this purpose, the term "United States Person" shall mean any citizen, national or resident of the United States of America, partnership organized or existing in any state, territory or possession of the United States of America, a corporation organized under the laws of the United States or of any state, territory or possession thereof, or any estate or trust that is subject to United States Federal income tax regardless of the source of its income.

Data Protection: You may be receiving this Communication because you have provided us your contact details. If this is the case, note that we may process your personal data for direct marketing purposes. For more information on Lombard Odier’s data protection policy, please refer to www.lombardodier.com/privacy-policy

©2024 Lombard Odier IM. All rights reserved.