world in transition

Investing in the most fundamental building block of our economy: Natural Capital

The economy today has run wild and is out of balance. Although this is readily apparent from escalating problems such as climate change and the plastics crisis, at a more fundamental level, our relationship with nature has grown increasingly unsustainable.

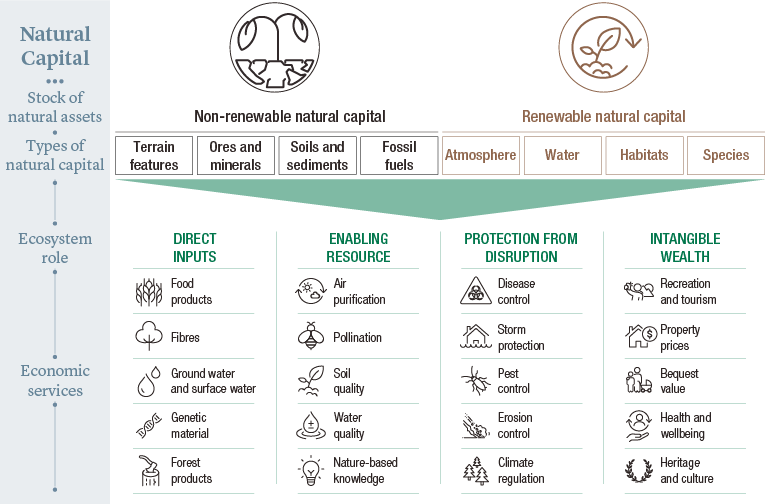

Over 50% of our economy, today, is moderately or highly dependent on natural capital1. Natural capital includes all of the earth’s natural resources such as our soils, forests, water reserves, ores and minerals. These also forms the basis for various ecosystem services, such as pollination – a service supporting up to USD 577 billion in crops, but which is now threatened by declining insect populations2. Similarly, in the USD 1 trillion pharmaceutical industry, as many as 63% of new drugs rely on natural products, but are put at risk by declining biodiversity3. Natural capital also protects our cities, forms the bedrock of our tourism industry and supports the value of our real estate.

While many industries vitally depend on nature, they also have a propensity to destroy it. We are living in a linear, ‘take-make-waste’ economy that depends on the extraction of vast amounts of natural capital. We extract around 92 billion tonnes of natural resources every year – this is roughly equivalent to two-thirds the weight of Mount Everest – to support our industries and consumption-based lifestyles4. Much of this material is either burned as fossil fuels, lost to the system through inefficiencies, or is wasted; less than 9% of material is cycled back into the economy5.

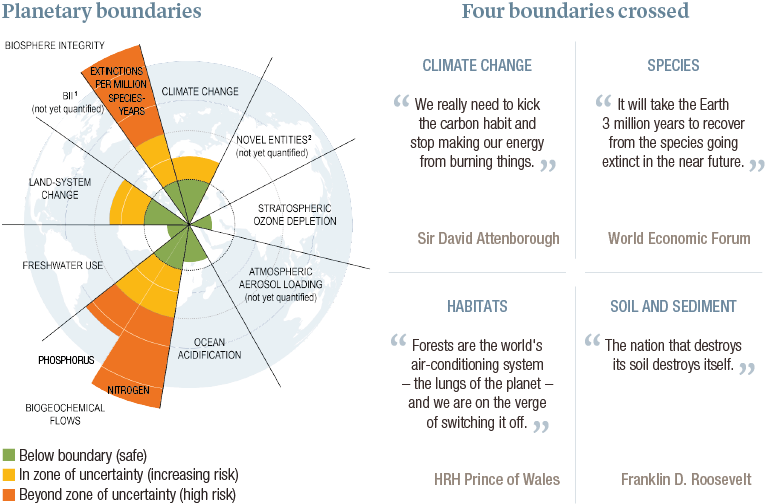

Through this economic model, we have crossed four key planetary boundaries. Much like a health check tells us whether we have exceeded safe blood pressure, cholesterol or body weight limits, these planetary boundaries define the safe limits within which society can operate. Today, our economic model has pushed us into uncertain, dangerous territory with respect to climate change, species and habitat loss, and chemical cycles. Left untreated, much like a diagnosis of high blood pressure or cholesterol, the prognosis for our collective well-being is not good, unless we manage to shake many of our poor habits.

At Lombard Odier, we believe that we must transition from a wasteful, idle, lopsided and dirty economy to one that is more Circular, Lean, Inclusive and Clean (CLIC™) economy. And to do so, we must begin by rethinking our approach to natural capital.

Firstly, to better harness nature’s regenerative ability, we must recognise the untapped potential of the circular bio-economy. In the construction industry, for instance, as much as 20% of steel and concrete can be substituted by timber, a fully renewable resource6. While nature already provides us with food, textiles and construction materials, more sustainable forms of agriculture, fisheries and forestry are necessary to ensure we leverage their full potential and prevent these industries from cannibalising the natural capital they rely on. New business models are also emerging around new nature-based products, such as bio-based polymers and composites, for use in everyday products, as well as for the production of carbon-neutral forms of bio-energy.

Secondly, we must invest in a leaner form of industry to better preserve natural capital and mitigate adverse impact. Today, 26% of steel and 41% of aluminium is lost during manufacturing processes7. New production processes, such as additive manufacturing, may eradicate such losses. Similarly, a transition to an economy that emphasises outcomes via the sharing economy (such as transport from A to B) over personal possessions (like a vehicle), can radically reduce material requirements, and mobilise as much as USD 4.5 trillion in assets that are today sitting idle, in our driveways, office buildings and drawers8. These revolutions, alongside improved waste management and recycling, not only help preserve natural capital, but also offer investable opportunities across all sectors.

Digitalisation and technological innovation are providing many of the ingredients for better solutions and new nature-based applications. Meanwhile, the transition to net zero will drive a further re-assessment of the importance of natural capital, providing carbon-neutral materials and opportunities linked to carbon sequestration (the removal of carbon from the atmosphere through reforestation, bioenergy, land management practices and otherwise).

Natural capital is an extraordinarily productive asset, with biomass on the planet regenerating at a rate of around 19% per year9. Harnessing and preserving this unique capacity is vital to the health of our economy as well as a rich source of innovative investment opportunities.

sources.

important information.

This document has been issued by Lombard Odier Funds (Europe) S.A. a Luxembourg based public limited company (SA), having its registered office at 291, route d’Arlon, 1150 Luxembourg, authorised and regulated by the CSSF as a Management Company within the meaning of EU Directive 2009/65/EC, as amended; and within the meaning of the EU Directive 2011/61/EU on Alternative Investment Fund Managers (AIFMD). The purpose of the Management Company is the creation, promotion, administration, management and the marketing of Luxembourg and foreign UCITS, alternative investment funds ("AIFs") and other regulated funds, collective investment vehicles or other investment vehicles, as well as the offering of portfolio management and investment advisory services.

Lombard Odier Investment Managers (“LOIM”) is a trade name.

This document is provided for information purposes only and does not constitute an offer or a recommendation to purchase or sell any security or service. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful. This material does not contain personalized recommendations or advice and is not intended to substitute any professional advice on investment in financial products. Before entering into any transaction, an investor should consider carefully the suitability of a transaction to his/her particular circumstances and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. This document is the property of LOIM and is addressed to its recipient exclusively for their personal use. It may not be reproduced (in whole or in part), transmitted, modified, or used for any other purpose without the prior written permission of LOIM. This material contains the opinions of LOIM, as at the date of issue.

Neither this document nor any copy thereof may be sent, taken into, or distributed in the United States of America, any of its territories or possessions or areas subject to its jurisdiction, or to or for the benefit of a United States Person. For this purpose, the term "United States Person" shall mean any citizen, national or resident of the United States of America, partnership organized or existing in any state, territory or possession of the United States of America, a corporation organized under the laws of the United States or of any state, territory or possession thereof, or any estate or trust that is subject to United States Federal income tax regardless of the source of its income.

Source of the figures: Unless otherwise stated, figures are prepared by LOIM.

Although certain information has been obtained from public sources believed to be reliable, without independent verification, we cannot guarantee its accuracy or the completeness of all information available from public sources.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by LOIM to buy, sell or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change. They should not be construed as investment advice.

No part of this material may be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorised agent of the recipient, without Lombard Odier Funds (Europe) S.A prior consent. ©2020 Lombard Odier IM. All rights reserved.