investment viewpoints

Global trends form powerful forces

A series of powerful forces are transforming our world and underlying economies. Capturing the opportunities presented by the resulting structural shifts is best achieved through a trends-based approach to investment, in our view.

History is littered with the remains of companies that were unable or unwilling to adapt to large-scale structural change. It is important to note how infrequently US companies, for example, have outperformed Treasuries over the long term. The overall market may have outperformed but this was not the case for the large majority of individual stocks, according to a recent US study.

The world changed and the majority failed to keep pace.

We believe we are on the cusp of more upheaval that is set to define the global economy in the coming years. A series of trends and challenges are poised to transform almost every aspect of society. Given their scale and scope, they will inevitably influence consumers, investors and boardrooms.

We divide these forces into mega-trends and mega-challenges. A mega-trend is irreversible, meaning that companies which are unwilling or unable to adapt will be left behind. A mega-challenge represents a sizable obstacle which needs to be overcome. As these forces unfold, they are generating a new set of investment prospects.

Demographic change

An example of an important mega-trend is the ongoing change to human development. There is clear evidence that the global population will continue to expand as whole, but with regional disparities. In emerging markets, numbers are expected to grow, whereas the population will shrink and age quite dramatically in the western world, as well as some Asian countries such as South Korea and China which now are on the same path as Japan towards an ageing society.

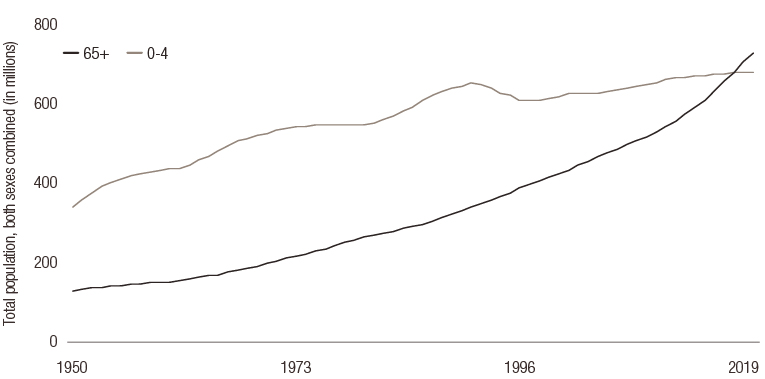

The ageing population theme is an important one. We have recently reached the point where there are now more people aged 65 or over than there are children under 5, worldwide. An ageing population on this scale will affect nearly every aspect of society, but some sectors will be more impacted than others, such as healthcare, technology, and financial services. Our golden age strategy is based around this theme, and selects companies catering to the needs of this rapidly growing market.

Figure 1. Globally, more people are aged over 65 than under 5

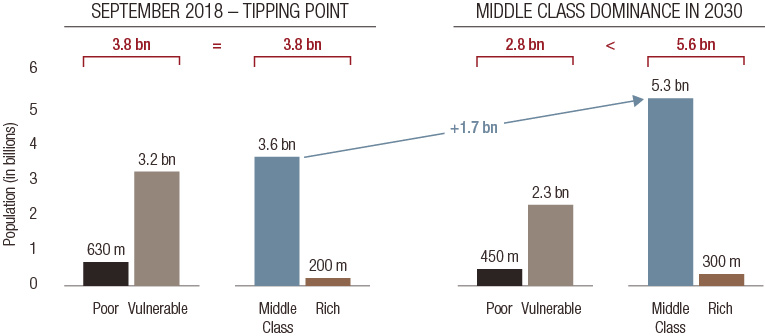

Demographics are also changing in terms of social grouping according to income. The global middle class is increasing at a sizable rate and is on track to become the dominant group by 2030. This development also points to higher spending power: Asia will account for 59% of global middle class consumption by 2030. China’s middle class spending power alone is expected to double over the next decade, which is the equivalent to middle class spending today in North America and Western Europe combined. This represents an enormous market with its own set of needs and wants that can be used as the basis for a powerful thematic investment strategy. Our world brands equity strategy has a core focus on the rising middle class and the implications for both leading and new brands.

Figure 2. The middle class will continue to grow while poverty will shrink

Investing in digitalisation

Digitalisation is another overarching and irreversible trend. New digital technologies are providing better and cheaper products and services, and in turn changing consumer habits and expectations. Digital consumption is on track to become bigger than offline consumption.

Gaining exposure to digitalisation is possible through a number of means. Our Fintech equity strategy, for example, is dedicated to the opportunities presented in financial services technology, identifying the companies set to shape the future trajectory of the industry. Our world brands equity strategy invests in the world’s leading, upcoming and digital brand names. Our golden age strategy, meanwhile, is more focused on the role digitalisation will play in healthcare. Technological innovations such as eHealth and telemedicine are helping to make healthcare cheaper and more effective.

Fair society: a mega-challenge

We have also developed a series of strategies designed to address the effects of mega-challenges. A mega-challenge is a phenomenon that our society collectively recognises as one that needs to be tackled and reversed. An important mega-challenge is the growing inequality inherent in our socio-economic systems. The growing gap between the haves and have-nots in developed and developing markets is unsustainable.

At its most basic level, inequality can be addressed through financial inclusion. Before FinTech it was not possible to serve most people in rural emerging markets because the costs were too high relative to the limited services these people would consume. FinTech changed the economics, however, and made it possible to service previously unserved people. For instance, more than 350 million Indian households obtained a bank account over just 5 years, thanks to a combination of software, and hardware like finger print and iris scanners.

The transition to net zero

Climate change represent another very pressing mega-challenge. Such is the breadth and scale of this threat that we have seen an unprecedented confluence of powerful market forces: policy, investor pressure, consumer pressure and technology advancement in recent years, with the united purpose of developing solutions to mitigate and adapt.

Our pioneering climate transition strategy has been created to capture opportunities across all sectors created by the urgent need to transition to net zero emissions. We believe the transition to net zero will affect every single sector, creating significant growth prospects and competitive advantages for some companies and destruction for others.

Mega-trends and mega-challenges are profoundly reshaping our world, and stand to make the traditional index-based sectoral or regional focus outdated, in our opinion. As these trends continue to unfold, they will continue to generate new investment openings. People’s habits are changing, but not all companies are keeping pace. This will inevitably create winners and losers.

Trends investing enables investors to capture the opportunities presented by these forces, in the form of sustainable long-term returns. Not all trends lead to long-term return opportunities, however, which is why LOIM is dedicated to connecting investors with our trends experts that have the experience and expertise required. Lombard Odier has been established for 220 years and we understand the inevitability of change and how to adapt. The principle of sustainability is part of our DNA which makes us leaders when it comes to the subject of long-term trends.