media releases

Natural Capital Investment Alliance: joining forces

HSBC Pollination Climate Asset Management, Lombard Odier and Mirova announced as Founding Partners of the Sustainable Markets Initiative’s Natural Capital Investment Alliance.

HSBC Pollination Climate Asset Management, Lombard Odier and Mirova, an affiliate of Natixis Investment Managers, are the three founding partners of the Natural Capital Investment Alliance (‘The Alliance’), established by His Royal Highness The Prince of Wales under his Sustainable Markets Initiative. The Alliance aims to accelerate the development of Natural Capital as an investment theme and to engage the USD 120 trillion investment management industry and mobilise this private capital efficiently and effectively for Natural Capital opportunities.

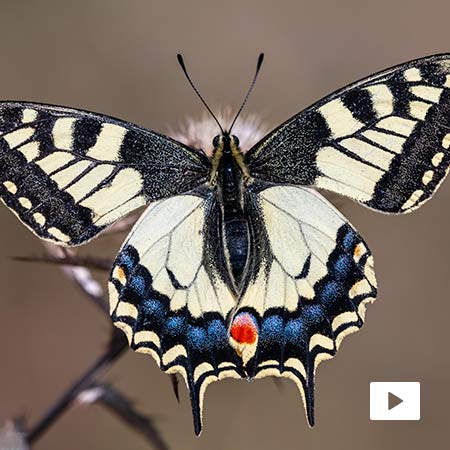

As the world continues to tackle the twin climate and biodiversity crises, there is growing interest in investing in harnessing and preserving Natural Capital as a solution to reducing emissions, restoring biodiversity, and boosting sustainable economic growth and job creation. However, despite the fact that half of global GDP depends on Natural Capital, there are currently only a limited number of initiatives to promote Nature as an investment opportunity. To seize the scale of this opportunity, a finance-led approach is needed to integrate Natural Capital as an investment theme across different asset classes, as well as improved investor-centric descriptions of Natural Capital investment opportunities. That is the purpose of this newly formed Alliance.

The three founding partners - HSBC Pollination Climate Asset Management, Lombard Odier and Mirova - are established pioneers in Natural Capital investing that have launched or developed specific vehicles or strategies for investments in Natural Capital.

HSBC Pollination Climate Asset Management, a joint venture between HSBC Global Asset Management and specialist climate change advisory and investment firm Pollination, is establishing a series of Natural Capital funds, directly investing in the preservation, protection and enhancement of nature. Lombard Odier launched a first-of-its-kind global equities investment strategy for Natural Capital last year, directly inspired by His Royal Highness the Prince of Wales and developed in partnership with the Circular Bioeconomy Alliance, established under his Sustainable Markets Initiative. Mirova has established a Natural Capital platform proposing strategies in the field of land restoration, blue economy and forest protection with more than 30 experts.

The Alliance aims to attract members from the finance community to create scale, and synergistic bridges between mainstream asset owners and asset managers, underpinned by the following goals:

-

To mobilise USD 10 billion towards Natural Capital themes across asset classes by 2022.

-

To serve as a central hub for global corporations and financial institutions seeking to scale-up their investments into Natural Capital, in support of biodiversity restoration, including through Carbon Offsets.

-

To share investment knowledge and expertise to help mainstream the Natural Capital investment theme and demonstrate scalability of appropriate vehicles and the multiple opportunities across asset classes.

Speaking at the One Planet Summit, His Royal Highness The Prince of Wales said: “The interdependence between human health and planetary health has never been more clear. For so many of the problems we face, Nature, with the benefit of billions of years of evolution, has already provided us with the solutions. But time is fast running out and we are rapidly wiping out, through mass extinctions, many of Nature’s unique treasure trove of species from which we can develop innovative and sustainable products for the future. As we urgently seek to rescue the situation, we must now look to invest in Natural Capital as the engine of our economy.

“It is also why I have created a Natural Capital Investment Alliance to help us arrive at a common language on Natural Capital Investment so that we can start putting money to work and improve the flow of capital.”

Christof Kutscher, Executive Chairman of HSBC Pollination Climate Asset Management said: “We recognise nature is capital. Over the century, we have depleted nature creating possibly our biggest challenge to date. It is high time to take action at an unprecedented speed and scale. Investing in nature is a major investment opportunity, and the one action we must urgently take to protect our future.”

Hubert Keller, Managing Partner of Lombard Odier Group said: “The investment industry seeks returns as its primary objective and today some of the most convincing opportunities for growth and returns come from a transition to a more sustainable economic model that both harnesses and preserves Nature. At Lombard Odier, we develop solutions that allow mainstream investors to position capital to benefit from this untapped investment opportunity. We are proud to be founding members of this important Alliance, inspired by His Royal Highness’ vision, and to contribute to mobilising capital at a scale commensurate with the opportunity and challenges.”

Philippe Zaouati, CEO of Mirova said: “Natural capital protection and restoration represent a global challenge but also a real opportunity. By joining forces with pioneering financial partners under the leadership of HRH The Prince of Wales, Mirova’s ambition is to continue the growth of the Natural Capital investment thematic and support the development of a nature positive economy. By mobilizing more investors, including pension funds and insurance companies, significant financial assets can be deployed to support those businesses able to generate both attractive returns and tangible environmental and social impacts. Through this approach, the Sustainable Development Goals can be within reach.”

About the Sustainable Markets Initiative

The Sustainable Markets Initiative (SMI) aims to lead and accelerate the world’s transition to a sustainable future by putting Nature, People and Planet at the heart of our global value creation. His Royal Highness The Prince of Wales launched the SMI at the World Economic Forum 2020 Annual Meeting in Davos and has convened global leaders from across public, private and philanthropic sectors, challenging them to identify ways to accelerate and bring economic value int harmony with social and environmental sustainability.

Since its launch last year, with HRH’s leadership, the SMI has hosted more than two dozen industry roundtable discussions, bringing hundreds of business leaders together. The SMI has also: engaged with country leaders to support their transition efforts; launched a network of Chief Sustainability Officers; supported the launch of a Natural Capital Fund; and, has launched RE:TV, a content platform showcasing the most inspiring business innovations and ideas for a sustainable future through films curated by editor-in-chief, HRH The Prince of Wales. The Terra Carta will serve as the guiding mandate for the Sustainable Markets Initiative.

About Lombard Odier

Lombard Odier is a leading global wealth and asset manager. For over 220 years and through 40 financial crises the Group has combined innovation and prudence to align itself with the long-term interests of private and institutional clients. The Group is solely owned by its Managing Partners, has a highly liquid balance sheet and is well capitalised with a CET1 ratio of 29.7% and a Fitch rating of AA-.

Lombard Odier provides a complete offering of wealth services, including succession planning, discretionary and advisory portfolio management, and custody.

Lombard Odier Investment Managers (LOIM) is the asset management division of Lombard Odier. Its investment capabilities span Fixed Income, Convertible Bonds, Equities, Multi-Asset and Alternatives.

We believe that the next economic revolution has already begun and that sustainability will be a major driver of returns for the foreseeable future and beyond. For those with the skills to adapt to this new reality, sustainability will create new sources of alpha, open up new investment opportunities and lead to enhanced return and reduced portfolio risk.

The Group had total client assets of CHF 290 billion at 30 June 2020. Headquartered in Geneva since 1796, at end-June the Group had 29 offices in 23 jurisdictions and employed 2,535 people.

For more information: www.lombardodier.com

Contact

important information.

For Professional investor Use Only

This document has been issued by Lombard Odier Funds (Europe) S.A. a Luxembourg based public limited company (SA), having its registered office at 291, route d’Arlon, 1150 Luxembourg, authorised and regulated by the CSSF as a Management Company within the meaning of EU Directive 2009/65/EC, as amended; and within the meaning of the EU Directive 2011/61/EU on Alternative Investment Fund Managers (AIFMD). The purpose of the Management Company is the creation, promotion, administration, management and the marketing of Luxembourg and foreign UCITS, alternative investment funds ("AIFs") and other regulated funds, collective investment vehicles or other investment vehicles, as well as the offering of portfolio management and investment advisory services.

Lombard Odier Investment Managers (“LOIM”) is a trade name.

This document is provided for information purposes only and is intended only for PROFESSIONAL CLIENTS. It does not constitute an offer or a recommendation to purchase or sell any security or service. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful. This material does not contain personalized recommendations or advice and is not intended to substitute any professional advice on investment in financial products. Before entering into any transaction, an investor should consider carefully the suitability of a transaction to his/her particular circumstances and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. This document is the property of LOIM and is addressed to its recipient exclusively for their personal use. It may not be reproduced (in whole or in part), transmitted, modified, or used for any other purpose without the prior written permission of LOIM. This material contains the opinions of LOIM, as at the date of issue.

Please be aware that the key risks of investing in this strategy are:

Neither this document nor any copy thereof may be sent, taken into, or distributed in the United States of America, any of its territories or possessions or areas subject to its jurisdiction, or to or for the benefit of a United States Person. For this purpose, the term "United States Person" shall mean any citizen, national or resident of the United States of America, partnership organized or existing in any state, territory or possession of the United States of America, a corporation organized under the laws of the United States or of any state, territory or possession thereof, or any estate or trust that is subject to United States Federal income tax regardless of the source of its income.

Although certain information has been obtained from public sources believed to be reliable, without independent verification, we cannot guarantee its accuracy or the completeness of all information available from public sources.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by LOIM to buy, sell or hold any security. Views and opinions are current as of the date of this presentation and may be subject to change. They should not be construed as investment advice. There can be no guarantee that the investment objectives of the strategy will be met.

No part of this material may be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorised agent of the recipient, without Lombard Odier Funds (Europe) S.A prior consent. ©2021 Lombard Odier IM. All rights reserved.