investment viewpoints

Megatrends strengthen prestige brands.

Established companies with a prestigious brand have significant and sustainable competitive advantages. Especially in uncertain market phases, they have the potential to generate sustainable returns.

While we at Lombard Odier Investment Managers (LOIM) don’t believe a recession is on the cards for 2019, we do see the environment for the year ahead as more tricky. In particular, global growth momentum is likely to lose speed, especially in the US, and markets are likely to be more volatile. This makes the question of how investors should position themselves against this background all the more pressing.

A look at recent financial history shows that economic excess returns can be achieved by investing in prestige brands in times of volatility and market uncertainty. Interbrand research, for example, has shown that the top 100 global brands have significantly outperformed the MSCI World Index over the past decade. The consulting firm also evaluated brand equity, which takes into account financial metrics, the brand's role in purchasing decisions and its competitive strength. The result: over the past ten years, the brand value of the 100 companies surveyed has increased by 54 percent.

The success of quality companies with prestige brands is based on a number of common characteristics, most importantly: diversified and consistent earnings, price power with high margins and the sustainable generation of free cash flows. In addition, they can translate their strong organic sales growth into higher profitability. The most promising brands are found primarily in the three core sectors of consumer discretionary, consumer durables and technology.

Sustainability as a driver of returns

Sustainability is also a key consideration for prestige brands. At LOIM, we believe five sustainability megatrends will drive returns in the future. These trends are transforming our economies, and the companies that drive them. They include: changing demographics, the digital revolution, climate change, scarcity of natural resources and rising inequality.

Companies in all regions and sectors are having to adapt in the face of the transition to a more sustainable economic model, which we at LOIM think of as the Sustainability Revolution. We believe it is critical to assess the sustainability of companies’ financial models, the sustainability of their business practices, and the sustainability of their business models.

By looking at companies through each of these lenses, we are better able to identify those where the market is undervaluing their ability to generate sustainable excess economic returns in the future. This, we believe, enables us to capture the most attractive opportunities that will arise from the Sustainability Revolution.

Millennials on the rise

Consider, for example, demographic change, such as the ballooning middle class in China. In 2005, the upper middle class in China - defined by an income between 21,501 and 53,900 dollars - comprised around 53 million people. By 2025 it is expected to grow to 525 million. This rapidly growing class of consumers with a higher disposable income favours companies such as the Japanese premium cosmetics manufacturer Shiseido or its US counterpart Estée Lauder.

The current generational change in China will also have a profound impact. The Chinese millennials, i.e. the 20- to 35-year-olds, are likely to spend more than their parents' generation over the next few years. Prestige companies are already gearing their marketing strategies to address a younger, more technologically-savvy age group. Christian Dior, for example, became the first luxury brand with an official account in the Chinese social network Douyin last year.

Digitisation as a value driver

Digital technology is one of the driving forces behind prestige brands. Strategic partnerships such as "e-concessions", i.e. structured agreements between retailers and online marketplaces operated by third parties, are becoming increasingly widespread. As the growth of the luxury fashion online retailer Farfetch shows, these agreements are particularly efficient when it comes to reaching a larger customer base with an international brand. According to Goldman Sachs, the total market volume for online concessions is expected to grow from less than 500 million euros today to six billion euros in 2025.

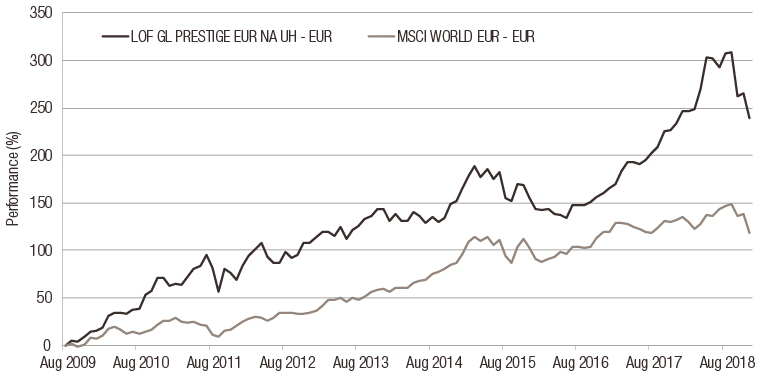

Based on our analysis, a diversified equity portfolio with investments in leading brands who have sustainable financial models and best-in-class business practices can outperform over economic cycles with similar volatility. The LO Funds - Global Prestige Fund outperformed the MSCI World since 31 December 2009. (see chart).

In view of the particular challenges presented by 2019, a defensive positioning with high-calibre prestige brands that can withstand an economic slowdown better than cyclical companies thanks to their leading position and financial strength as well as their global reach seems appropriate.

Performance since inception for the LO Funds – Global Prestige